The last couple of weeks, if not months, could be described as nothing else than a rollercoaster ride. Big announcements, back-and-forth action, and a lot of volatility and uncertainty – it seems more has happened in the last 2 months than in many longer periods in history. In today’s blog, we take a look at all that occurred since the inauguration of President Trump, how it affected the markets, and maybe several lessons that can be taken away for the future.

First of all, a small disclaimer. The opinions expressed in this blog, especially the forward-looking statements, are based on how the situation has developed thus far, but also historically in similar situations of turbulence. This does not mean that it will develop as presented, and as such, it should not be taken as investment advice.

VIX index change (2020 – 2025 YTD, points)

Source: Bloomberg, InterCapital Research

At the moment that President Trump took office on 20 January 2025, the volatility index, VIX, stood at approximately. 15 points, as the new administration and its promises ushered a new wave of optimism for the US, but also the world. President Trump promised sweeping changes, and while many of them were announced, we will focus on the ones impacting the equity markets the most.

The Historical Background

President Trump’s agenda revolves around two core ideas: “America First” and “Make America Great Again.” Viewed through this lens, the recent turbulent events are not surprising despite the resulting uncertainty. Early on, Trump pledged unprecedented tariffs targeting countries he believes have economically exploited the U.S. Additionally, he vowed to revive American manufacturing, a sector weakened over decades as U.S. companies shifted production overseas, especially to fast-growing economies like China, attracted by lower costs.

Secondly, over the past several decades, the U.S. economy expanded significantly, achieving one of the highest GDP per capita levels globally – comparable even to smaller, wealthier nations. Unlike countries whose wealth primarily stemmed from commodities (e.g., Gulf countries, Norway), trade, position, finances (e.g., Singapore, Switzerland), or favorable tax policies (e.g., Ireland, small island nations), the U.S. grew mainly due to its robust services sector, consumer spending, and diversification into numerous industries. This economic growth led to higher wages, making domestic manufacturing comparatively less profitable, further accelerating the shift of production overseas.

Cheap labor – particularly in many Asian countries – has been a key driver behind the offshoring of U.S. manufacturing. As production shifted to lower-cost regions, companies continued selling goods back to the U.S., contributing to large trade deficits, especially in goods. While this is a broad generalization, it reflects the trend targeted by the current administration, which has focused heavily on goods trade. In contrast, the U.S. maintains a strong services trade surplus, exporting $1.1tn and importing $814bn in 2024 – a $293bn surplus. The U.S. leads globally, with services in sectors such as business, professional, and technical services, finance, travel, telecom, IT, and intellectual property (e.g., royalties and licensing). This was the (short) historical background of the US upon President Trump’s inauguration in January 2025.

The Opening Moves

Upon taking office in January, President Trump announced 25% tariffs on Canada and Mexico (starting February 1) and a 10% tariff on China, citing border security and the fentanyl crisis. Markets reacted mildly at first, as expectations of tax cuts and deregulation were seen as offsetting these early trade threats. Another brief episode involved a threatened 25% tariff on Colombia after it refused to accept deported migrants – a dispute resolved within hours.

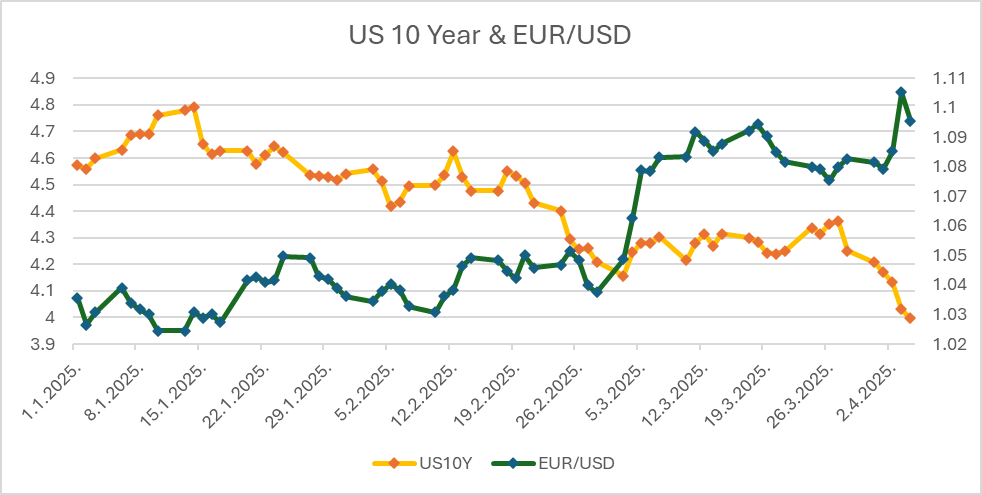

At the month’s end, the Federal Reserve held rates steady at 4.25% to 4.50%. Chair Jerome Powell maintained a cautious tone, noting solid economic growth but elevated inflation. While tariff details were still unfolding, Powell acknowledged they could temporarily raise inflation and slow growth, though his comments didn’t surprise the market.

Meanwhile, Q4 2024’s GDP grew at an annualized 2.3%, driven by consumer spending, which rose at its fastest pace in nearly two years. Many businesses reported a spike in demand from Americans preemptively buying goods ahead of the expected tariffs. The market welcomed the data, but uncertainty lingered. Still, volatility remained contained, with the VIX holding in the mid-teens.

In early February, the U.S. delayed its 25% tariffs on Canada and Mexico by 30 days to allow room for negotiations, but the 10% tariff on Chinese imports took effect on February 4. China responded swiftly, imposing 15% tariffs on LNG, coal, and certain vehicles, and launching an anti-trust investigation into Google. These measures were set to begin February 10. This marked the first major spike in market volatility – widely seen as the formal restart of the U.S. – China trade war. Companies with significant China exposure, particularly in the tech and industrial sectors, declined in value, and the VIX surged into the mid-to-high 20s, reflecting mounting investor anxiety.

Furthermore, the January jobs report showed fewer jobs added than expected, and inflation came in higher than forecast, prompting speculation that the Fed might keep interest rates elevated for longer. This fueled trading activity and helped keep the VIX at elevated levels. On February 10, the U.S. expanded its tariff regime, removing steel import exemptions and raising aluminum tariffs from 10% to 25%, effective in March.

Just days later, on February 13, President Trump introduced his plan for reciprocal tariffs, pledging to match foreign tariff rates with equivalent U.S. measures. Although Q4 earnings were generally strong, the combination of rising trade tensions and monetary policy uncertainty weighed on sentiment. The S&P 500 moved sideways while volatility increased, reflecting investors’ unease about the unfolding policy landscape.

Despite mounting trade tensions, the S&P 500 reached an all-time high on February 19, supported by solid earnings and continued optimism around Trump’s business-friendly policies. Volatility remained moderate, with the VIX hovering in the mid-teens, as domestic policy hopes helped offset rising external risks.

Investors largely viewed Trump’s aggressive trade stance as a negotiation tactic rather than a lasting shift, especially as tariffs on Canada and Mexico were extended beyond early February. Still, the market began showing signs of caution – defensive sectors like consumer staples and utilities outperformed while high-growth sectors started to lag, signaling early positioning for potential volatility ahead.

The Start of the Escalation

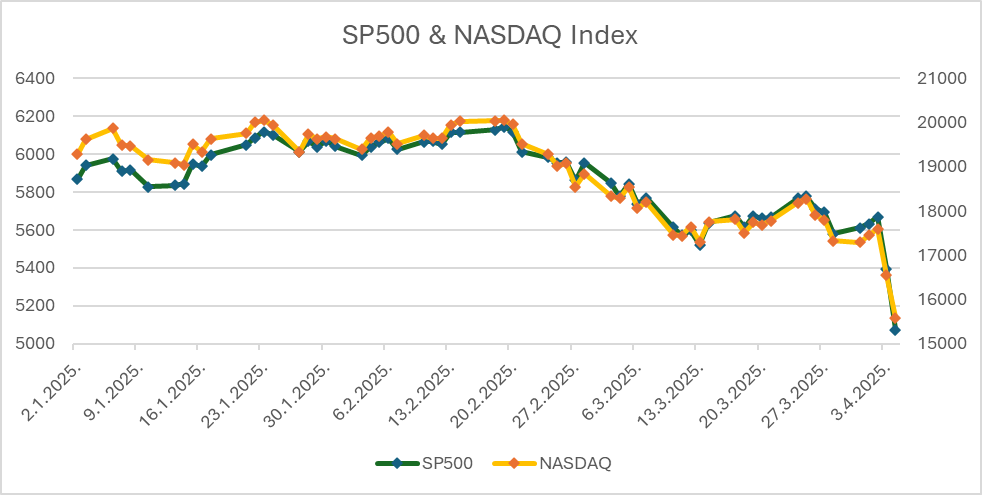

On February 27, President Trump announced that the 25% tariffs on Canada and Mexico would take effect on March 4, citing insufficient efforts to curb drug flows. He also stated that China’s tariff rate would double to 20%. This marked the turning point for markets, as hopes for productive negotiations were abruptly replaced by a hardline stance. Markets reacted sharply: the S&P 500 fell 1.6%, the Nasdaq dropped 2.8%, and the VIX jumped 10% to 21 points, signaling a spike in investor anxiety. That same day, Nvidia, despite strong Q4 results, issued a weaker-than-expected revenue forecast due to global demand uncertainty, sending its stock down 8.5% and adding to the broader sell-off.

The late February sell-off wiped out approximately $3tn in market value in just over a week. The VIX rose by 40% from the start of the month, settling in the low 20s as volatility became more entrenched. On March 4, the U.S. imposed 25% tariffs on Canada and Mexico, though Canadian energy exports were capped at 10%. Canada had already prepared retaliatory tariffs on over $100bn of US goods, while Mexico issued warnings of a similar response, though it left the door open for negotiations.

China reacted to the 20% U.S. tariff hike by imposing 15% duties on U.S. agricultural products, expanding export controls on critical minerals, and blacklisting dozens of American firms. The European Union, alarmed by U.S. moves on steel, aluminum, and reciprocal tariffs, drafted countermeasures targeting $28bn worth of U.S. goods, though implementation was delayed until mid-April in hopes of de-escalation.

While markets initially reacted negatively, sentiment briefly stabilized on March 5-6 after President Trump granted 1-month exemptions for auto supply chains and delayed tariffs on Canada and Mexico for goods complying with USMCA rules of origin. These gestures, along with ongoing talks, led to a cautious rebound.

The Back-and-Forth Action

However, the calm was short-lived. On March 10, the S&P 500 dropped 2.7% and the Nasdaq 4%, pushing the S&P down 8.6% from its record high and erasing approximately $4tn in market value. The Nasdaq fell over 10% from its peak, while the VIX surged into the mid-20s. The constant policy swings and unpredictability unsettled both investors and consumers, reinforcing the sense of growing uncertainty.

Further developments followed as President Trump met with business leaders in an attempt to ease concerns, though he maintained a defiant tone. By then, the S&P 500 was down over 5% year-to-date, with the DJIA and Nasdaq falling even more. By this point, the VIX index had climbed nearly 85% since the inauguration.

A modest rally occurred on March 12 after February inflation data came in below expectations, offering temporary relief. Still, by this point, the tariff outlook had begun to overshadow macroeconomic data. On March 19, the Fed held interest rates steady, with Chair Jerome Powell acknowledging that the economy was leaning toward slower growth and temporarily higher inflation. He emphasized that the Fed wouldn’t overreact but stood ready to adjust policy if needed – offering some reassurance to jittery markets.

In late March, the administration announced new tariffs, including a 25% duty on any country purchasing oil or gas from Venezuela and a 25% tariff on imported cars and car parts, effective April 3, to protect U.S. manufacturers. Markets declined further in response: the S&P 500 was down 10% from its peak, the Dow about 10%, and the Nasdaq 14%. The VIX fluctuated between 20 and 30 as heightened volatility became the “new normal.” Numerous smaller policy shifts and retaliatory signals during this period only added to the growing uncertainty.

“Liberation Day” and Its Effects

Then, the big bazooka was finally announced. On April 2nd, President Trump announced baseline tariffs of 10% on all imports to the U.S., along with even higher country-specific rates. Asian countries were hit especially hard – China received a 34% tariff (on top of the existing 20%, now totaling 54%), 20% on EU imports, 24% on Japan, 25% on South Korea, and 32% on Taiwan, among others. Canada and Mexico were also included, each facing 25% tariffs.

The size of these tariffs exceeded even the most bearish forecasts, and as such, a stock market plunge followed. On April 3rd, the S&P 500 dropped 4.8% and the Nasdaq by 6% – the biggest single-day losses since June 2020 and March 2020, respectively. S&P 500 companies lost a staggering $2.4 trillion in value in just one day, while the VIX spiked above 40, briefly touching 60 points intraday.

Gold prices surged, along with other safe-haven assets like Treasuries and the Japanese yen. The U.S. dollar, however, fell against most other currencies. The tech sector was hit especially hard – Apple lost over 9%, and Nvidia lost 8%. And the selloff wasn’t limited to the U.S.; markets across Asia and Europe posted steep losses. Even typically steadier local markets like Slovenia and Croatia recorded drops on par with broader European declines.

It didn’t take long to see responses. China imposed 34% tariffs on U.S. exports, prompting Trump to counter with an additional 50% on top of existing tariffs, leading to app. 104% tariff rate on China. Other countries reacted in mixed fashion – some began planning retaliatory tariffs, while others held out hope for renewed talks.

After the latest round of U.S. tariffs on China, Beijing raised total tariffs on U.S. goods to 84%, introduced more export controls on rare earth elements, blacklisted additional US companies, and initiated regulatory investigations into US companies operating in China. As a result of this, President Trump increased the overall China tariff to 125%.

Relief to the Market

On April 9, President Trump announced a 90-day pause on all tariffs above 10%, giving time for negotiations. He noted that many affected countries had already sent teams to work on new trade deals. However, he remained firm on China, even increasing the levies on China to 145%.

The move triggered the biggest market rally in recent memory: the DJIA jumped 7.9%, the S&P 500 rose 9.5%, and the Nasdaq Composite surged 12.2%. Just hours before the announcement, Trump posted on Truth Social: “BE COOL! Everything is going to work out well. The USA will be bigger and better than ever before!” followed by “THIS IS A GREAT TIME TO BUY!!! DJT”.

The latest news includes the exemption of certain electronic products, such as smartphones, laptops, etc., from the tariffs, even from countries such as China, but this, the US Commerce Secretary said, was only temporary.

S&P 500, Dow Jones Industrial Average, Nasdaq Composite performance (2020 – 2025, January 2020=0, %)

Source: Bloomberg, InterCapital Research

Going Forward

Without trying to predict the future, maybe several lessons could be learned from this.

Firstly, the markets do not like uncertainty, especially when it comes to things that could, in a very short period of time have a strong effect on everyone, from businesses and consumers to entire countries and their outlook.

Secondly, as stated several times about the President by his close aides, the moves made by the President are not random and are a calculated strategy, even if we do not have a direct view of how that strategy is formulated. What we can look at, however, is the overall goal from the lens mentioned at the beginning of this blog. The moves, while hugely disruptive, did put the US in a better negotiating position. Furthermore, it is likely that other countries will take what the President says more seriously, which could lead to less back-and-forth and more negotiation moving forward.

Thirdly, short-term uncertainty and volatility cannot be ruled out going forward, but as the last couple of weeks have shown us, while the markets react swiftly, this was more due to uncertainty related to the actions taken, and maybe in part because of their expectations that all these threats would not materialize in the end. However, the President did say throughout his years, during the election, as well as after being elected, that choosing actions that best suit the US is his course of action. The US economy has many issues that it needs to fix, and thus, radical moves could be expected. Maybe it’s a matter of perspective then – many politicians make a lot of promises, many of which do not get done, especially after facing backlash. This is the truth across all the democratic countries. As such, maybe the best advice that can be given is to take note of what the President says, especially when it aligns with some long-term goal, and in particular, “Make America Great Again”, and then position accordingly.