On 3rd of November the US will be holding their 59th quadrennial presidential election. The uncertainty of presidential elections is not a new worry for the investors and the relationship between elections and stock market has been widely studied. In today’s blog we are presenting you with some interesting findings with regards to this relationship.

In less than a month, on 3rd of November, the US will be holding their 59th quadrennial presidential election. The voters will be choosing between the Republican nominee (and the current president) Donald Trump and Joe Biden, the Democratic nominee. Although there are currently many uncertainties such as who will be the next president and what implications will it have on the US and global equity market, one thing is almost certain – whoever gets elected will be the oldest president ever to serve (Trump would become the oldest if he serves a full second term).

However, the uncertainty of presidential elections is not a new worry for the investors and the relationship between elections and stock market has been widely studied. Therefore, let’s start with the obvious.

How does the stock market react to elections?

A 2012 paper Political Climate, Optimism, and Investment Decisions argued that individuals become more optimistic and perceive the markets to be less risky and more undervalued when their own party is in power. Specifically, the paper shows that Democrats/Republicans become more optimistic about the stock market and the overall economy when Democrats/Republicans come to power and there is a decline in optimism when the opposite party comes to power. However, the downward shift in optimism is more pronounced among Democrats when the Republican party comes to power. This is quite insightful as it indicates that election results in general should not directly significantly affect the returns of the US equity market. However, we note that volatility on the stock market tends to increase in “too close to call” elections, such as this one. This could be attributed to the economic policy uncertainty that arises from such a tight election.

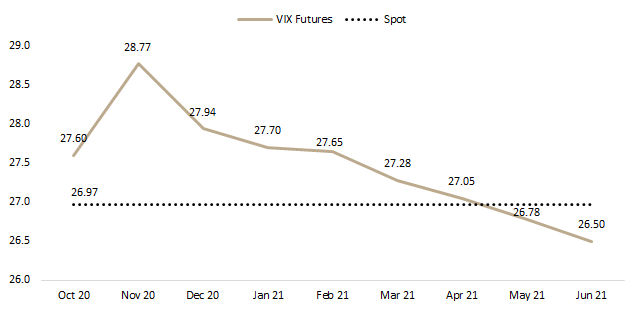

The worry behind how the election outcome could influence the equity market could be seen when observing the VIX futures term structure. As visible the graph below, the level of VIX futures contract maturing November (after elections) is currently at 28.77 points, quite higher than the “spot” level of VIX. As the futures expiring in November is based on S&P500 options maturing in mid-December, the market seems to be pricing a possibility that the results will not be known on the election date and that the election uncertainty will continue.

VIX Futures Term Structure

Source: Bloomberg, InterCapital Research

How does the party in power affect the stock market?

No matter which candidate or party resonates more with you, there will always be a debate running up to elections on weather Democrats or Republicans are better for the stock market. Therefore, if we were to look further from short term effect of the US elections on the equity market, we would benefit from knowing whether there is a positive correlation between the party in power and the performance on the stock market. The short answer is: The stock market does better under Democrats. But before we jump to any conclusions, let’s back up and look at historical performance of presidents and what explains the above mentioned.

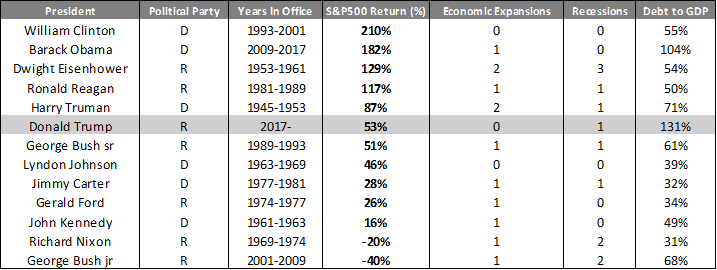

Presidential Performance (1945 – Today)

Sources: Forbes, NBER, Federal Reserve Bank of St. Louis¸ InterCapital Research

The table above showing the performance of S&P500 for each president since 1945 until today, clearly indicates that Democratic presidency has meant higher returns of the index. Bill Clinton (Democrat) leads the list, during whose presidency S&P500 increased by as much as 210%. Some argue that such a performance could partially be attributed to the fact that inflation was tamed during his presidency, however one should still be aware that Clinton’s presidency coincided with the tech bubble.

On the contrary, S&P500 recorded the worst performance during the presidency of Clinton’s successor, George Bush jr (Republican). Bush Junior’s presidency was definitely one of the most eventful presidencies in the recent history, as the former president had to cope with the aftermath of the tech bubble, the 9/11 terrorist attacks and the 2008 housing crisis.

Why does the US stock market perform better under Democrats?

If one was to conclude a causal effect between electing Democrats and better stock market performance, intuitively, one would have to also conclude that Democratic policies cause better performance. This would also have to infer a large amount of market irrationality as the investors would have to repeatedly misprice stocks by failing to anticipate such policy effects. This idea was further expanded on in a 2019 paper titled Political Cycles and Stock Returns which examined the effects of Democratic presidencies leading to higher returns.

Rather than arguing that the return gap is explained by what presidents do, the paper argues that the gap is explained by timing when presidents get elected. According to the paper, when risk aversion is high, such as during economic crises, voters are more likely to elect a Democratic president because they demand more social insurance. When risk aversion is low, such as during booms, voters are more likely to elect a Republican because they want to take more business risk.

Therefore, under Democrats risk aversion is higher, leading to a higher risk premium, and thus a higher average stock return. Likewise, Republicans do not cause low stock returns but they are rather associated with low returns simply because they tend to be elected when the risk premium is low.

There are more than a few examples from the recent history which seem to confirm the above mentioned. In 2008, Republican George W. Bush was replaced by Democrat Barack Obama. Further, Bill Clinton was elected shortly after the 1990-1991 recession, Jimmy Carter was elected shortly after the 1973-1975 recession, while JF Kennedy was elected during the 1960 – 1961 recession.