Given that inflation has been a key topic of financial markets for quite some time now, it is interesting to see the real returns of Croatian and US equities. For this, we looked at the total (11 year) return of both CROBEX and S&P500 and deducted the reported average annual CPI (inflation).

For today we decided to present you with a brief analysis of the real return of two equity indices – CROBEX and S&P500 since 2010. Note that both indices are total return indices, meaning that they account for the reinvestment of dividends.

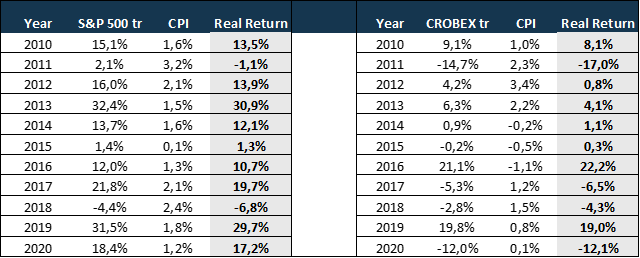

Annual Return of the Index vs. Annual Average CPI

Source: Bloomberg, InterCapital Research

As visible from the table above, the 2010s were depicted with relatively low inflation figures and solid performance of especially US equity market. Therefore, one can note that the S&P500 noted a positive annual real return in 9 observed years, while CROBEX noted a positive return in 7 observed years.

2011 was the only year in which the US market witnessed a negative real return, despite noting a positive nominal return. Meanwhile, in Croatia, CPI showed negative figures from 2014 – 2016, somewhat boosting the real return of CROBEX. Therefore, despite a slight decrease of CROBEX in 2015, the real return of the index remained positive.

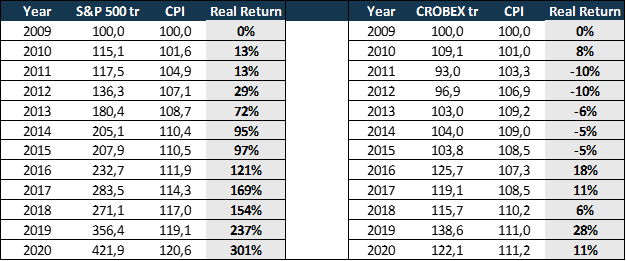

Additionally, it is interesting to see how the markets performed in real terms if an investor decided to invest in both indices in 2010. As visible from the table below, investing in CROBEX in 2010, resulted actually in a negative real return from 2011 to 2015. However, despite this in 2020 one would observe a real return of 11%. If we were to also take into consideration the YTD performance of CROBEX and adjust it for Jan – Sep 2021 CPI, one would note a total real return of 34%. Such a relatively better performance could be attributed to a strong YTD performance of CROBEX.

When looking at S&P 500, one could note that the index noted a significantly higher real return, which does not surprise given that the observed period refers to the longest bull run of US equities. Adjusting for inflation, S&P500 returned (total return) 301% from 2010 – 2020.

Real Return of Investing in S&P 500 & CROBEX (total return) (2010 – 2020)

Source: Bloomberg, InterCapital Research