First Republic Bank’s earnings report after the market close on Monday spurred the risk-off sentiment in the markets. The report showed bigger than expected decline in deposits as the fleeing deposits raised concerns of further problems in the banking system, especially in the small and mid-sized banks. Consequently, risky assets performed poorly this week as the uncertainty of financial stability is back in the spotlight.

Shortly after the Silicon Valley Bank collapse, yields began to rise again (last week’s blog) and the bond prices (US Treasury, Schatz, and Bund) kept falling as the risks of further contagion seemed to be contained. Deposit flight led to a slump of the FRB share price by 49.37% on Tuesday and an additional 29.88% drop on Wednesday. As it usually happens, a huge drop in share prices fuels further deposit flight which fuels additional sell-off in equity. One might call it a self-fulfilling prophecy. As problems due to the lower bond prices and higher short-term interest rates emerge across the financial sector, lending conditions are tightening even more and they may be considered as additional interest rate hikes, although the exact effect is difficult to quantify. The crux of the problem are banks’ HTM portfolios which need to be unwinded in case of deposit flight and the losses on those bonds become realized.

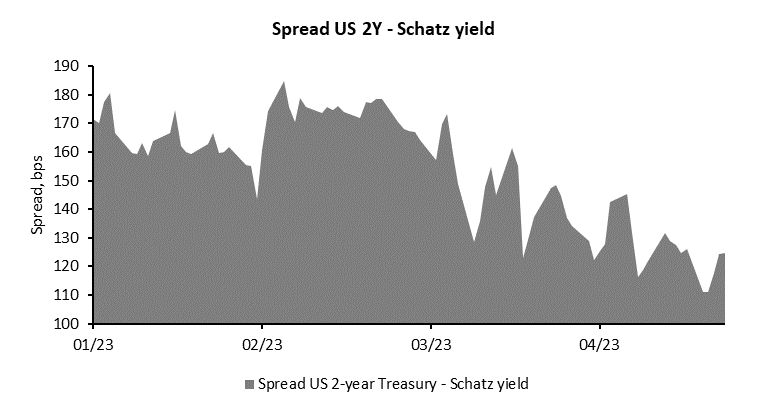

Over the course of the week, yields plummeted, Schatz yield fell by 20bps, and Bund by 10 bps. Across the Atlantic, US 10-year Treasury fell by 15 bps and the 2-year Treasury by 30bps. As can be seen from the mentioned difference in the yield change, the US bond market reacted stronger than the European bond market as the hawkishness of the ECB and the stability of the European banking system is still leading the way. Consequently, further tightening of US – German bond spreads should continue.

As risk-off sentiment is driving the markets, markets are preparing for the central bank meetings next week. Federal Reserve is holding a meeting on Wednesday the 3rd of May and the European Central Bank on Thursday, the 4th of May. Both of them will surely have to address financial stability, especially Fed which may need to soothe the markets. On the contrary, ECB might stay on the course of hiking rates as banks in Europe are stable and without significant deposit outflows due to the stricter regulations in Europe in comparison with the US. Change in the narrative may happen next week if ECB delivers a 25 bps hike and dovish rhetoric. However, it is likely that ECB stays on the current hawkish path as no major issue emerged in Eurozone. Furthermore, the Bank of Japan is holding a meeting today as the new governor Ueda took over the chair position and the consequences may be significant, especially in the case of slowly abandoning their ultra-loose monetary policy. In the next few days, policy adjustments both in the West and Far East will fuel volatility and investors should be ready for it.

InterCapital has successfully advised Tankerska plovidba in the acquisition of Turisthotel, a major tourist company in Croatia. On a 100% basis, this landmark transaction is valued at 224 EURm, making it the largest acquisition of a public company in Croatia in the past 5 years as well as one of the largest acquisitions in the history of Croatian tourism sector. Following the conclusion of the tender offer, Tankerska plovidba now controls 94.4% of voting shares.

Turisthotel is a prominent hospitality company in the Dalmatia region of Croatia, with a flagship property, the Zaton holiday resort, an open-air family resort located north of Zadar that can accommodate up to 8,000 guests. For the year 2022, Turisthotel reported a consolidated revenue of 43 EURm and an EBITDA of 18 EURm.

This acquisition marks the entry of Tankerska plovidba, a renowned Croatian tanker operator, into the thriving Croatian tourism market and represents a significant milestone for both companies. We are confident that this acquisition will unlock tremendous value for both Tankerska plovidba and Turisthotel’s stakeholders, and we look forward to witnessing the continued growth and success of our client in the years to come.

We are proud to have played an important role in the success of this deal, which further attests to the robustness of InterCapital’s tourism practice.

At the share price before the announcement, this would imply a DY of 1.92%. The ex-date is set for 4 May 2023, while the payment date is due on 16 May 2023.

Yesterday, Arena Hospitality Group published the OGSM resolutions, including the resolution on the distribution of profit, or rather, the dividend payment. According to the document, Arena’s shareholders approved EUR 0.7 DPS, which at the share price before the announcement would amount to a DY of 1.92%.

As a reminder, after the initial proposal, the Company received a counterproposal for the dividend (EUR 1.37 DPS, DY of 3.6%) more on which you can read here. As the initial dividend proposal was approved at the meeting, this would in effect mean that the counterproposal was rejected.

The ex-date for the dividend is set for 4 May 2023, while the payment date is set for 16 May 2023.

Below you can see the historical dividends per share and dividend yields of the Company.

Arena Hospitality Group dividend per share (EUR) and dividend yield (%) (2019 – 2023)

Source: Arena Hospitality Group, InterCapital Research

At the share price before the announcement, the DY amounted to 7.61%. The ex-date is set for 12 May 2023.

OMV Petrom has published the resolutions from its OGSM meeting, including the details on the dividend payment. According to the Company, a gross dividend of EUR 0.0375 DPS has been approved, which at the share price before the initial announcement would imply a DY of 7.61%.

The ex-date for this dividend is set for 12 May 2023, while the payment date is set for 7 June 2023. Below we provide you with the historical dividends per share, as well as the dividend yields of the Company.

OMV Petrom dividend per share (left, RON) and dividend yield (right, %) (2013 – 2023)

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 49 | 28.4.2023 | TTS | Transport Trade Services General Assembly Meeting | Romania |

| 50 | 28.4.2023 | TTS | Transport Trade Services 2022 Annual Report | Romania |

| 51 | 28.4.2023 | EL | Electrica 2022 Annual Report | Romania |

| 52 | 28.4.2023 | M | MedLife 2022 Annual Report | Romania |

| 53 | 28.4.2023 | TEL | Transelectrica 2022 Annual Report | Romania |

| 54 | 28.4.2023 | AQ | Aquila 2022 Annual Report | Romania |

| 55 | 28.4.2023 | AQ | Aquila General Assembly Meeting | Romania |

| 56 | 28.4.2023 | WINE | Purcari 2022 Annual Report | Romania |

| 57 | 28.4.2023 | TRP | Teraplast General Assembly Meeting | Romania |

| 58 | 28.4.2023 | TRP | Teraplast 2022 Annual Report | Romania |

| 59 | 28.4.2023 | SNP | OMV Petrom Q1 2023 Results, Conference Call | Romania |

| 60 | 28.4.2023 | COTE | Conpet 2022 Annual Report | Romania |

| 61 | 28.4.2023 | RIVP | Valamar Riviera Q1 2023 Results | Croatia |

| 62 | 28.4.2023 | PODR | Podravka Q1 2023 Results | Croatia |

| 63 | 28.4.2023 | HT | Hrvatski Telekom Q1 2023 results, Conference Call for analysts and investors | Croatia |

| 64 | 28.4.2023 | ATPL | Atlantska Plovidba Audited 2022 Annual Report, Q1 2023 Results | Croatia |

| 65 | 28.4.2023 | TLSG | Telekom Slovenije 2022 Annual Report | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).