First Republic Bank’s earnings report after the market close on Monday spurred the risk-off sentiment in the markets. The report showed bigger than expected decline in deposits as the fleeing deposits raised concerns of further problems in the banking system, especially in the small and mid-sized banks. Consequently, risky assets performed poorly this week as the uncertainty of financial stability is back in the spotlight.

Shortly after the Silicon Valley Bank collapse, yields began to rise again (last week’s blog) and the bond prices (US Treasury, Schatz, and Bund) kept falling as the risks of further contagion seemed to be contained. Deposit flight led to a slump of the FRB share price by 49.37% on Tuesday and an additional 29.88% drop on Wednesday. As it usually happens, a huge drop in share prices fuels further deposit flight which fuels additional sell-off in equity. One might call it a self-fulfilling prophecy. As problems due to the lower bond prices and higher short-term interest rates emerge across the financial sector, lending conditions are tightening even more and they may be considered as additional interest rate hikes, although the exact effect is difficult to quantify. The crux of the problem are banks’ HTM portfolios which need to be unwinded in case of deposit flight and the losses on those bonds become realized.

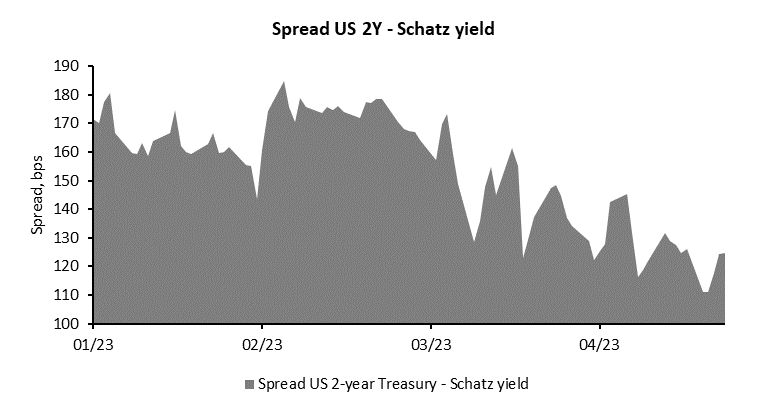

Over the course of the week, yields plummeted, Schatz yield fell by 20bps, and Bund by 10 bps. Across the Atlantic, US 10-year Treasury fell by 15 bps and the 2-year Treasury by 30bps. As can be seen from the mentioned difference in the yield change, the US bond market reacted stronger than the European bond market as the hawkishness of the ECB and the stability of the European banking system is still leading the way. Consequently, further tightening of US – German bond spreads should continue.

As risk-off sentiment is driving the markets, markets are preparing for the central bank meetings next week. Federal Reserve is holding a meeting on Wednesday the 3rd of May and the European Central Bank on Thursday, the 4th of May. Both of them will surely have to address financial stability, especially Fed which may need to soothe the markets. On the contrary, ECB might stay on the course of hiking rates as banks in Europe are stable and without significant deposit outflows due to the stricter regulations in Europe in comparison with the US. Change in the narrative may happen next week if ECB delivers a 25 bps hike and dovish rhetoric. However, it is likely that ECB stays on the current hawkish path as no major issue emerged in Eurozone. Furthermore, the Bank of Japan is holding a meeting today as the new governor Ueda took over the chair position and the consequences may be significant, especially in the case of slowly abandoning their ultra-loose monetary policy. In the next few days, policy adjustments both in the West and Far East will fuel volatility and investors should be ready for it.