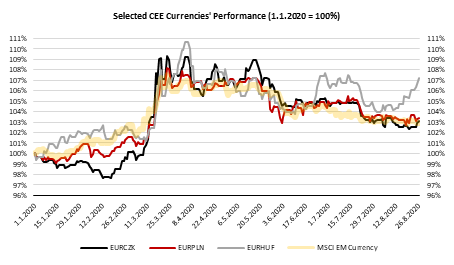

CEE currencies depreciated strongly after corona virus started and recovered after but are still far from the levels seen 6 months ago. Hungarian forint came closest to the levels seen before corona virus but is depreciating again due to macroeconomic data. The data from Q2 showed that economy witnessed the worst period on record (compared to same period last year and quarter before). What are the main drivers behind these moves and what to expect next read in this brief article.

Hungarian forint has seen depreciation trend in the last two weeks due to worse than expected GDP data for Q2 and jump of inflation above MNB’s target. Namely, its GDP plummeted by 13.6% YoY (-10.1% YoY expected by BBG consensus). Although detailed breakdown was not published yet, we assume that significant drop was seen in all parts of GDP while services suffered the most. On the other side, statistical office data showed that inflation jumped more than expected in July, i.e. it stood at 3.8% compared to June’s 2.9% making it more difficult for central bank to react as its mandate involved both price stability as well to support the Government’s economic policy.

Talking about central bank, this week they decided to leave reference rate at 0.6% after cutting by 15bps for the two consecutive months. However, they decided to increase its weekly QE purchases and will provide additional liquidity through repo operations. Central bank stated that they expect inflation to remain around its current level in the coming months before stabilizing close to its target of 3.0% although disinflationary effects of the coronavirus should become even stronger over the forecasting horizon, according to the bank. Regarding last month’s rise, central bank commented that faster rise was mainly caused by change of structure of aggregate supply and demand but also due to changes in indirect taxes and change in fuel and food prices. Also, one should consider that prices increased more than expected in almost all EU countries and one of the explanations was that summer sales were pushed to August meaning that in August inflation should fall back to June levels.

Bearing in mind central bank expects inflation to decelerate while economic recovery should take many more months, it is not excluded that central bank could increase QE even more if needed. In March, CB showed its willingness to fight with economic upheaval and managed to reduce long term yields while lifting short rates (widening the corridor between reference rates, i.e. between reference rate and overnight deposit and overnight collateralized lending rate) to curb depreciation trend of HUF.

Hungarian forint reached 344 for EUR last month but due to worse than expected macroeconomic data and increased QE depreciated above 355 yesterday. Although equity markets around the world are showing signs of prolonged recovery and some of them already being in green in YTD terms, buyers are still hesitating from going into emerging markets and HUF holders will have to wait for some time before risk-on comes in our region.

Looking at the region, CZK has also seen modest depreciation in the last two weeks while PLN, RON and HRK are trading water. CEE bond market is still in the summer mode but considering latest fall in bund prices we expect that to end abruptly. Furthermore, we expect bond supply to increase once again with issuance season reemerging already next week.