Two weeks ago, Fed’s governor Jerome Powell announced that FED will shift to average inflation targeting which did not surprise investors although curves bear steepened as some investors started to calculate higher inflation once it reaches past targets. Today, ECB will announce their newest decisions but there should not be much news. However, we expect questions on inflation targeting on this side of Atlantic and is there more PEPP increases in the following months.

In its speech in Jackson Hole, Mr Jerome Powell announced several changes to FOMC’s Statement on Longer-Run Goals and Monetary Policy Strategy. On maximum employment, the FOMC emphasized that maximum employment is a broad-based and inclusive goal and reports that its policy decision will be informed by its “assessment of the shortfalls of employment from its maximum level” while previous document referred to “deviations from its maximum level”. Second, and main change was on the price stability as FOMC adjusted its strategy for achieving its longer-run inflation goal of 2% by noting that it “seeks to achieve inflation that averages 2% over time” meaning that it could leave rates unchanged even if inflation reaches 2.0% in the future. However, this shows that FED does not expect inflation to reach its targeted level for some time but also that it could tolerate higher inflation for some time. Change towards average inflation targeting did not surprise investors although market’s reaction was quite interesting. Namely, yields on US 10Y first went down but then yield curve bear steepened as some investors now calculate fatter tail on right part of inflation probability curve. In the meantime, markets had few days of risk-off which has driven rates once again a bit South. Now, the main question is whether central banks around the world will copy FED’s move?

ECB’s strategy review is expected to be delivered by mid-2021 so we do not expect ECB to change its target so soon, especially today. However, ECB has similar problem as FED as inflation in eurozone did not reach its target for several years now, except few months in the end of 2017. Although 5Y5Y inflation swap index rose from March’s low of 0.7% to 1.20%, it still shows that market does not expect inflation to reach ECB target in the next 10 years, not even close.

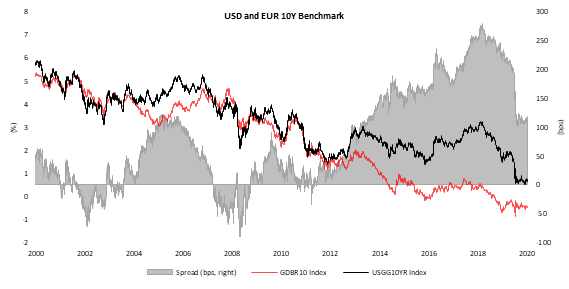

So, what to expect from today’s meeting? Rates and QE will stay unchanged and there could be some speech on enlargement of one of the QE packages. PEPP would be the most logical case as it is the most flexible in terms of assets that ECB can buy. Market now expects PEPP envelope to be increased once again, but around end of this year or sooner in case supply starts accelerating more than expected. Expectations go from EUR 400bn to some 700bn. Furthermore, there could be discussion on AIT and YCC but rather in philosophical manner. Bund is currently trading at the middle of its negative 0.40% – 0.60% range while spreads seem to be under control and some of them even tighter compared to February 2020 so there is not any obvious reason why should ECB be too dovish at this moment. However, there is wall of debt coming soon from sovereign governments and supranationals to finance deep deficits and New Generation package, meaning that some precaution in wording should be in place today.

Source: Bloomberg, InterCapital