As a week filled with significant developments and important data comes to a close, we can take a moment to analyze the numbers. While the uncertainty surrounding tariffs seems to be easing, the broader uncertainty about the future direction of the U.S. economy continues to grow. Will the Federal Reserve maintain its current interest rate regime? Will Jerome Powell’s successor alter the course of existing Fed policies? And is the U.S. economy truly heading toward a stagflationary spiral?

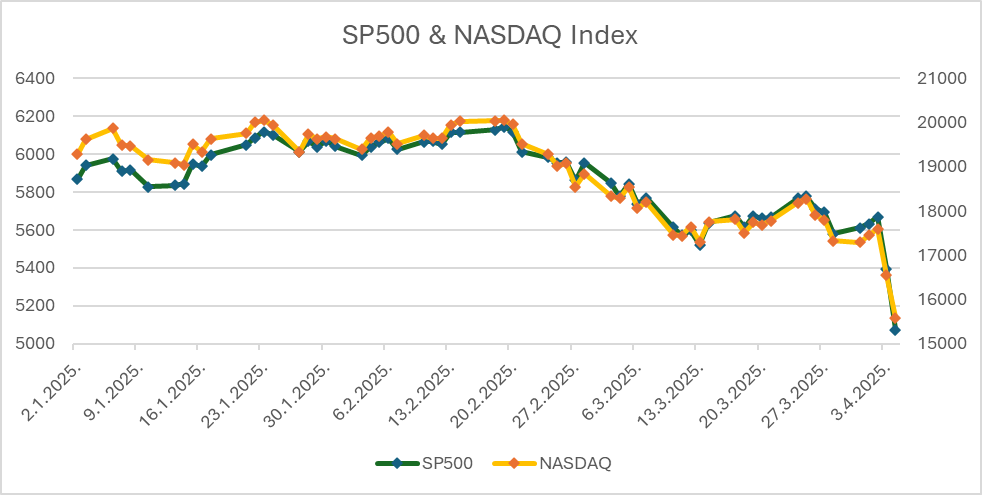

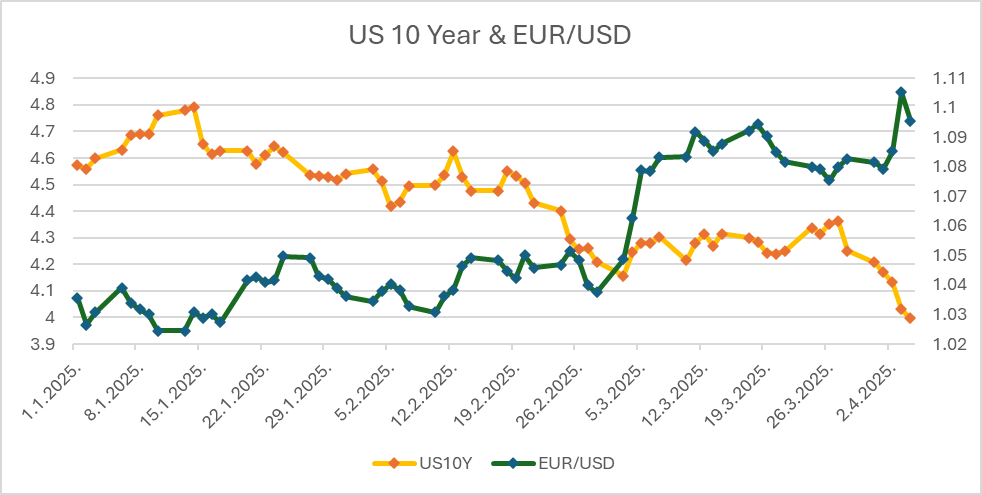

President Trump finally announced his long-awaited package of retaliatory tariffs last week. The basic 10% rate came into effect on April 5th, while the individual rates are set to take effect on April 9th. Among the more notable measures are 10% tariffs on imports from the United Kingdom, 20% on the European Union (with 25% tariffs being imposed on car and car part imports), and 24% on imports from Japan. China faces an additional 34% tariff on top of the already existing 20%. Canada and Mexico, however, are excluded from this tariff package. As a result, markets reacted sharply, with the S&P 500 dropping -9.08% for the week and the NASDAQ Composite Index falling -10.02%. In Europe, the STOXX 600 slid 8.44% for the week. The Euro strengthened against the U.S. dollar, with EUR/USD rising by 1.83% (-183 bps) the day after the tariff announcement, signaling heightened economic uncertainty in the U.S. As the dollar weakened and concerns about potential rate cuts grow, the U.S. yield curve steepened across the board. The day after the tariff announcement, the 10-year U.S. Treasury yield saw a decline of 2.49% (-249bps), while the 2-year Treasury yield fell by 4.61% (-461bps), reflecting growing concerns about the U.S. economy.

S&P 500 (left axis) & Nasdaq (right axis) Indices (2 January 2025 – last closing price, points)

Source: Bloomberg, InterCapital

US 10-year bond yield (left axis, %), EUR/USD exchange rate (right axis, units of dollars per 1 euro), (2 January 2025 – last closing price)

Source: Bloomberg, InterCapital

Turning to the labor market, last Thursday’s Initial Jobless Claims came in at 219K, slightly below expectations (forecast: 225K), signaling a positive trend in the labor market despite recent turbulent events. The Services PMI exceeded expectations, coming in at 54.4 (forecast: 54.3), indicating business optimism and suggesting increased demand in the services sector. Looking at Friday’s data, Non-Farm Payrolls (NFP) came in at 228K (forecast: 137K), and the Unemployment Rate stood at 4.2% (forecast: 4.1%), slightly above the consensus estimates. Overall, the positive macroeconomic indicators suggest a stable economic outlook, but the introduction of tariffs raises questions about the future of a “soft landing,” inflation, and the Federal Reserve’s subsequent policy decisions.

Despite President Trump’s assurances that the impact of the tariffs will be short-lived, the Federal Reserve will likely need to exercise increased caution in light of recent developments. In his speech last week, Jerome Powell highlighted positive macroeconomic data but emphasized that the Fed will await greater clarity before making further decisions. As a result, according to the Bloomberg analyst consensus, market expectations for rate cuts are steadily rising, even though the Fed is likely to adopt a more cautious and restrictive stance in the near future. Investors will remain on edge, as it remains uncertain whether the effects of the tariffs will be truly transitory or could potentially lead to a recession.