After receiving the latest CPI print for the US the most natural question one would ask is are the ECB and the FOMC still going to move in sidestep or are they embarking on different paths when their cutting cycle begins which was widely expected to be from June meetings for both central banks. What does this CPI print mean for the ECB and what kind of posture will they take? – Here is our view:

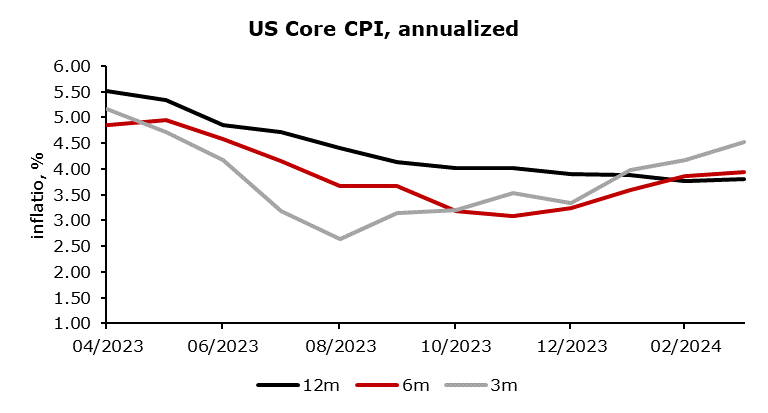

The US economy won’t be alleviated from the burden of higher inflation anytime soon as it was widely expected, at least that is what the newest CPI figures suggest. Consumer prices rose by 0.4% in March compared with the previous month and 3.5% on a year-on-year basis. When looking at the more significant core rate, excluding volatile energy and food prices, they were still up 0.4% month-over-month (which is the same number we received for January and February and not a very appropriate one if you decide to take 3m inflation and annualize it) and a whopping 3.8% year-on-year. Let’s look a bit more at specific drivers of inflation in the US. MoM core rate rounded to two decimal places was 0.36. Core goods are still experiencing an encouraging trend (-0.1% MoM) while core services don’t show any signs of flagging (+0.5%). Housing and OER (Owners’ equivalent rent) rates of growth remained high and some other components that experienced higher rates are car insurance, car repairs, and hospital & related services.

Source: Bloomberg, InterCapital

This US inflation print for March is likely to stir up views of FOMC members about rate cuts. At their latest meeting we received an update to their Summary of Economic Projections (SEP) which contains the popular dot plot in which members express their current assessment of the year-end Federal Fund Rate for this and following 3 years along with longer run projection. The median dot was expecting 3 cuts this year and it took only one person to lower their assessment so that the median dot would show only 2 cuts this year. Latest comments from chairman Powell assured the market that a cut in June would be imminent after receiving a couple more months of good data. The market has taken this CPI print as a bellwether suggesting that FOMC might have to shun the June meeting as the one for the first rate cut. Before receiving this CPI print, the market was pricing 2.65 cuts by the end of the year, and the June cut was priced in with a 60% probability. The situation is a little bit different today with the market pricing 1.65 cuts by the end of the year and a cut at the June meeting is now viewed as a 19% probability event.

Source: Bloomberg, InterCapital

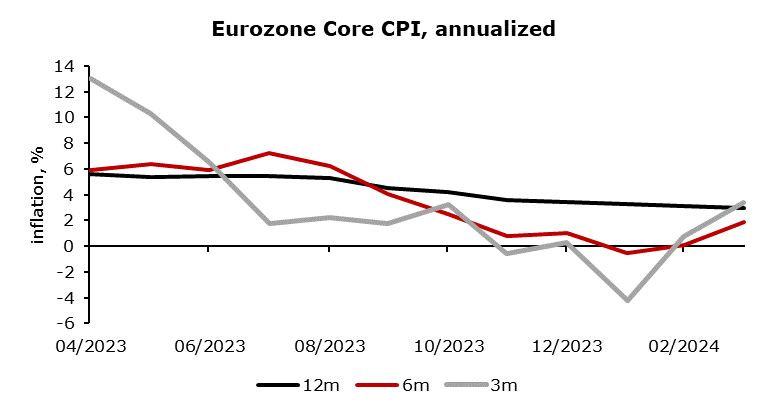

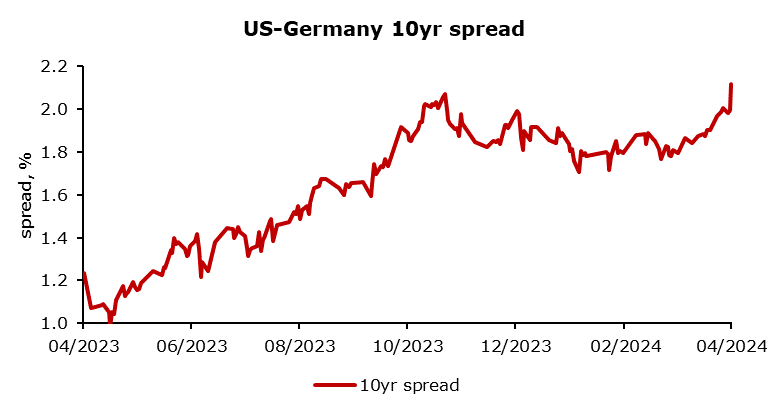

Pricing for ECB hasn’t changed a bit, June cut is still priced in with a probability of 81% and the market is still expecting 3 cuts this year. Inflation and growth figures for the US and the EU in the past couple of months show a clear disparity in trends which has led to a widening of the US-Germany 10yr spread. Some have questioned the willingness of the ECB to start their cutting cycle before the Fed because of fears of the EUR/USD foreign exchange rate sliding towards parity and aggravating EU terms of trade. In our opinion, angst about that is still premature with EUR/USD being currently at 1.075. We know what our afternoon pastime is going to be. – We are receiving another set of PPI figures which should clarify the picture regarding US inflation and 15 minutes later at CEST 14:45 ECB presser takes place in which President Lagarde should provide us with information solidifying ECB’s stance on rate cuts.

Source: Bloomberg, InterCapital