In today’s blog, we’re bringing you an overview of the EUR/USD exchange rate and why the current situation is unlike what one would expect given the macroeconomic situation. In particular, we take a look at why we, despite the interest rates set by the ECB, which are significantly lower than those set by the Fed, end up with a “stronger” euro as compared to the dollar.

In the last couple of decades, the euro/dollar exchange rate changed dramatically in favor of the US dollar. Faster growth in the US, sluggish growth in the EU, combined with the inability of Europe to agree on a singular direction on many issues, has meant that investors have always looked at the US dollar as a “safe haven” option.

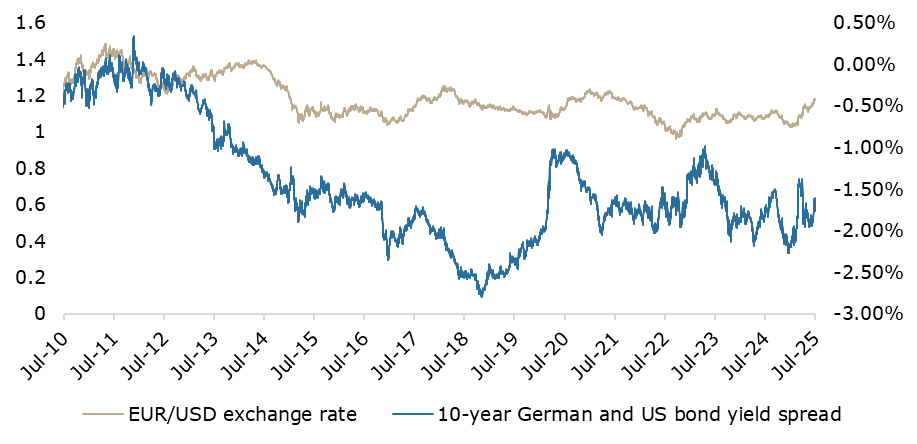

EUR/USD (points, left) exchange rate, 10-year German bond & 10-year US bond yield spread (%, right) (2010 – 2025)

Source: Bloomberg, InterCapital Research

The dollar’s strength is also influenced by the fact that it is a de facto world reserve currency, used in transactions outside the US, between countries that do not even use the dollar as official tender. Many of the commodities, such as oil, gas, wheat, coffee, etc., are also quoted in dollars.

Back when the euro was introduced, it was seen as a lot “stronger” currency, on the back of the strength of the EU economy, which was still expanding rapidly at that point. However, this all changed in the 2010s and 2020s, especially during which period the USD appreciated strongly as compared to the euro. Many factors could be attributed to this, including the slowdown in the EU economy, the widening of the gap between the size of the two blocks’ economies, increased investments from not just Europe, but around the world into American stocks and bonds, but also the “negative” connotation that the EU had, at least for investors. This mostly pertains to innovation, opening new companies, especially in emerging sectors, and, of course, the ever-present overregulation, which only got worse and worse during this period in the EU.

However, since the start of 2025, and especially since the start of the presidency of Donald Trump, an inverse trend has started to happen. The euro, which is nominally “weaker” due to the weaker performance of the European economy, started to appreciate, growing from app. 1.03 USD/EUR to 1.18 USD/EUR, implying a 14% depreciation of the dollar as compared to the euro. We would like to note that a depreciation of the USD to other developed countries’ currencies also occurred during this period, but as the US/EU are one of the largest trading partners in the world, their fates are usually more linked, and that’s what we’re focused on in this blog.

What’s even more interesting is the fact that the dollar, which should be seen as a “stronger” currency, especially for investors, continued to depreciate despite the fact that the Fed was quite dovish in its approach to interest rate reductions, lagging far behind the ECB.

Fed & ECB key interest rate comparison (September 2019 – June 2025, %)

Source: Fed, ECB, InterCapital Research

In fact, when the ECB reduced the rates from its high value of 4% in September 2023, all the way down to 2% currently, the Fed only reduced its key interest rates from a range of 5.25% – 5.50%, first implemented in July 2023, down to 4.25% – 4.50% range today. Normally, these two central banks follow each other closely due to the amount of trade being done between them and the strong connection between these two economies. While inflation, which was the underlying reason for the rate hikes and the subsequent cuts, has been driven by different factors on both sides of the Atlantic. In the US, this was due to heavy money printing, supply chain disruptions leading to higher costs, and wage inflation, which later spilled to other sectors of the economy. In the EU, a similar situation was present, with heavy money printing, supply chain disruptions, wage inflation to a smaller extent, but also strong growth in the energy sector following the start of the war in Ukraine, which has also translated to other sectors as it remained high for a long time. However, inflation largely cooled off in the EU in 2024 and especially 2025, and while it did decline in the US, it still remains above the 2% target, influencing the Fed’s decisions not to cut rates at this time.

This brings us to the first point, that is, when one side has far higher interest rates, bond yields are also higher, attracting more investors. More investors wanting US debt would also increase the demand for dollars, leading to the currency strengthening, all other factors remaining equal. However, this hasn’t occurred. In fact, the opposite has occurred, with the dollar depreciating as compared to the euro and other currencies. In layman’s terms, while the EU offers lower returns than the US, its currency has appreciated in value, an inverse of what normally happens in the economy.

Of course, besides the raw economic data, there are other factors that influenced this. One of the main ones is the current uncertainty regarding tariffs by the US towards most of the world. While the country has announced some developments on this front, as of now, no deal has been reached with the EU. With this uncertainty, the demand for the US debt has also been subdued. And while countries outside the US do still use the dollar to make most of their trade transactions, the uncertainty in regard to the tariffs has left many countries wondering: maybe it would be better to diversify our trade, and focus more on other partners during this time.

Many deals could still be reached, and this might be a trend that would need more time to materialize, as even though the US is playing hardball to get its deficit under control with the rest of the world, unfortunately, there aren’t many other “better” options that would benefit countries in the long-term. One also has to take into account that this depreciation in the value of the dollar also means that hedging in the USD is becoming more and more expensive. Furthermore, any investments in the US are yielding losses this year due to the currency devaluation.

Take the S&P 500 index as an example; even though its standing close to 6.3k points at the moment, and having “recorded” a gain of 7% on a YTD basis, if a European investor held the index in his/hers portfolio from the start of the year, they would actually be in the negative due to the dollar’s depreciation.

The uncertainty is also visible in the difference between the US/German government bond yields, which have hovered at around a 1.5 – 2 p.p. difference for most of 2025, with fluctuations reflecting the volatility in regards to the US policy. Outflows from the US equity funds towards the EU equity funds were also recorded during the year.

This is not an issue just affecting equity, however, but bonds as well, especially from larger players such as China. China has continually reduced its debt holdings in the US since the 1st Trump presidency, but the rate of decline has accelerated, with the latest numbers in April 2025 showing USD 757bn in US bond holdings by China, the lowest level since 2009, and a 39% reduction from June 2016, just as the US Presidential elections were starting to be underway. Due to this, the UK has also surpassed China as the 2nd largest holder of US debt, just after Japan.

Chinese, Japanese, UK holdings of US bonds (January 2009 – April 2025, USDbn)

Source: Macromicro, InterCapital Research

On the other hand, Japanese holdings did somewhat decline from an all-time-high value of USD 1.3tn in November 2021, at the end of the President’s first term, to USD 1.06tn at the end of Biden’s term, and have picked up to USD 1.13tn as of April 2025. However, the fastest growth was recorded by the UK, whose holdings now stand at USD 807bn, having more than doubled from YE 2019.

The most recent increases can be seen as a preparation, as Japan is heavily exposed to the US through trade, and the UK, while having reached a deal with the US, is on shaky grounds as its economy is stagnant, and any changes in the US could be negative for the British pound.

Lastly, the sentiment in Europe, while still faced with sluggish growth, is positive, as both on the EU level and on the level of individual countries, higher spending was announced, especially towards defense and infrastructure. Furthermore, the political situation is stable if not predictable, meaning that even if there is slower growth, at least it’s to be expected.

The US, on the other hand, is only 6 months into President Trump’s 2nd term, and many changes that were promised are currently in the process of being carried out. However, opposition within the country, especially from the other side of the political spectrum, i.e., the democrats, remains. The recent passing of the “Big, Beautiful Bill”, which would, on top of continuing the tax cuts first implemented in 2017, go further with cuts in other areas. While this is positive for an average American, it is expected to raise the deficit by app. USD 400bn per year in the next 10 years. This is the opposite of what President Trump promised, i.e., getting the Government spending under control and decreasing the deficit. While the full impact of the tariffs is still unknown (some numbers were published indicating higher revenue from tariffs, but this remains to be seen if this is the new norm or just a one-off effect) and will not be known until more trade talks are finished (which could lead to the return of higher tariffs, or better deals for the US), it is hard to say to what extent the US will benefit from them.

While this uncertainty remains, and with all the possible moves that could still be made, one could expect that the US dollar could remain at this depreciated level or even depreciate further, especially compared to the euro. One also has to take into account that a depreciated currency, while negative for citizens as it reduces the value of their money, especially for import-related products, is positive for exporters, as it makes their goods cheaper abroad. Now, several questions remain. Firstly, after all the deals are done, and if tariffs remain in place at higher levels, will so many countries want to focus on the US market, or will they start focusing more on the trade between themselves? And secondly, if they focus more on trade between themselves, will this lead to the dollar losing more share as the preferred reserve currency? And if it does, what will it mean for its value in the short term, and for its place as this reserve in the long term? Only time will tell.