Core bond yields dropped by some 40bps in the last 40 days. An early Thanksgiving gift for the buy side? Or is it just a technical rally that’s going to be killed off by central bank hawkish rhetoric? Read in this brief research piece.

Without looking at the Bloomberg terminal and just from the top of your head, would you be able to tell where the 10Y German yield stood at the beginning of the year? It was at roughly 2.55%. This morning the figure opened at 2.63%, or merely 8bps higher. On a year-to-date basis, the 10Y yield barely moved, but why is that so important? Well, to understand that, take a look at what markets were expecting on the last day of December for the current year based on €STR swaps:

Notice that financial markets were expecting rate hikes to be continued in 2023, raising the €STR rate from 2.00% to around 3.50% by end-July. What actually happened was that the ECB got to 3.50% in June and delivered one more 50bps hike in September to end gradually higher than the markets were expecting. These additional 50bps are not expected to stay here for longer, at least according to the most recent WIRP reading:

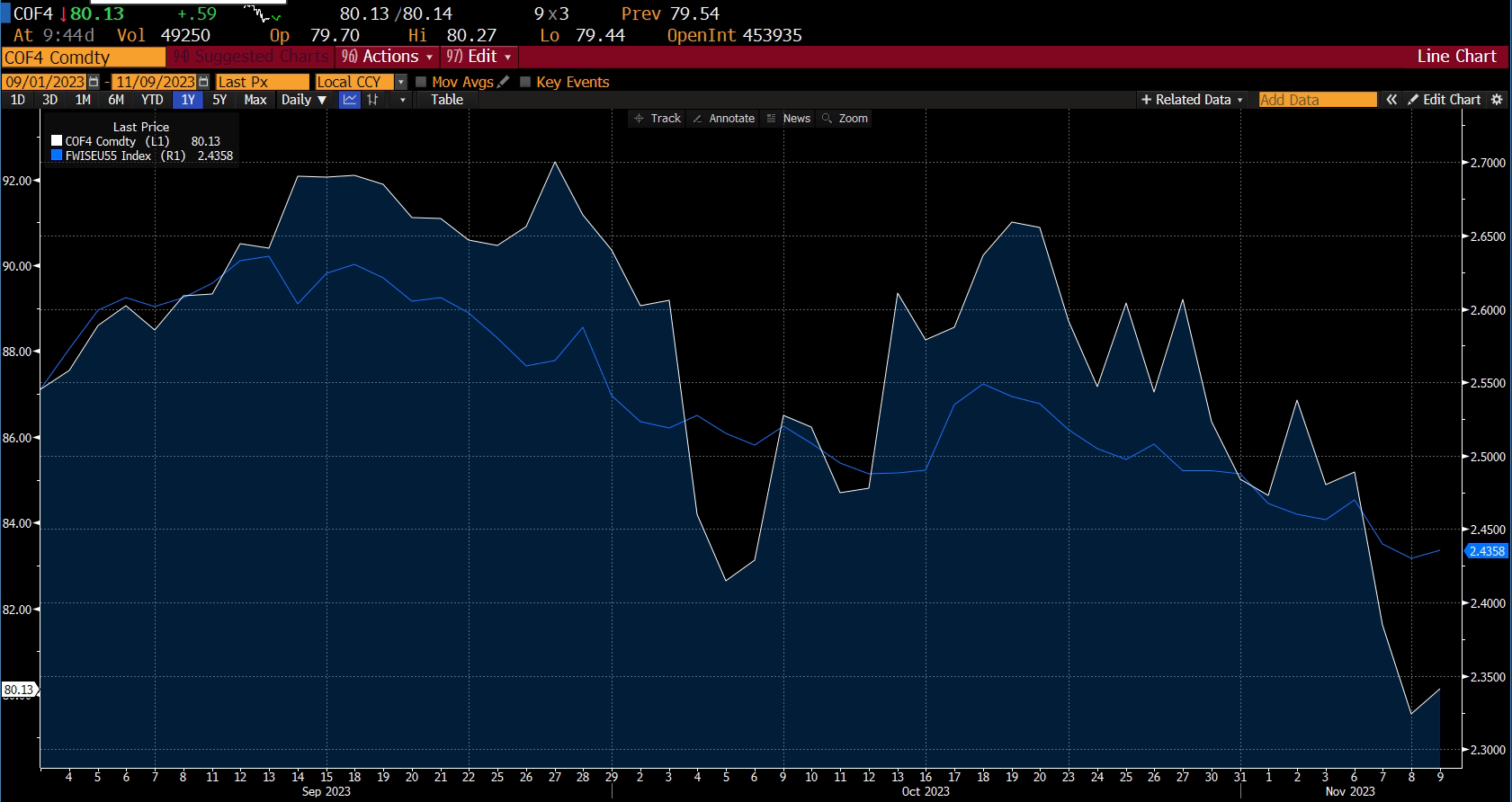

Now here’s where things get really interesting. Seasoned fixed income traders know that 10Y German yields came down by roughly 40bps (from 3.03% on October 04th to the current 2.634%), but very few understand the drivers of these yields. We opt for the most obvious solution, which is that the drop in oil prices caused European 5Y5Y inflation swaps to reprice lower, dragging long-term yields lower in the process:

However that is not the whole story because it’s obvious that inflation swaps came down by merely 10bps.

Where are the remaining three quarters? On Tuesday BoE’s chief economist Huw Pill stated that market expectations for rate cuts next summer are not unreasonable. As a result 10-year gilt yields dropped by 11bps and have still not retraced the Pill they swallowed, holding to the gains in gilt futures. Yesterday Mario Draghi expressed his expectations about the euro area entering a recession by year’s end. Finally, yesterday’s 40bn USD heavy 10Y UST auction went by with a really small tail (4.519% versus 4.511%), while indirect bidders took 69.7%. This was not a flop. Additionally, any bond you might have purchased on primary placement this week, regardless of whether it’S BGARIA€, MAEXIM€ or something else, it’s up compared to reoffer price.

Our explanation about the sharp drop in yields is based on narratives circling around, however, JP Morgan’s Nikolaos Panigirtzoglou has a different angle to it. Analyzing CTA flows, it seems that momentum traders were caught off guard by the beginning of this month and about half of the extreme short positions recorded on October 25th were unwound in about a week. That’s nice, but the yields have been sliding since the beginning of October, so there might be more than one explanation for the current chain of events.

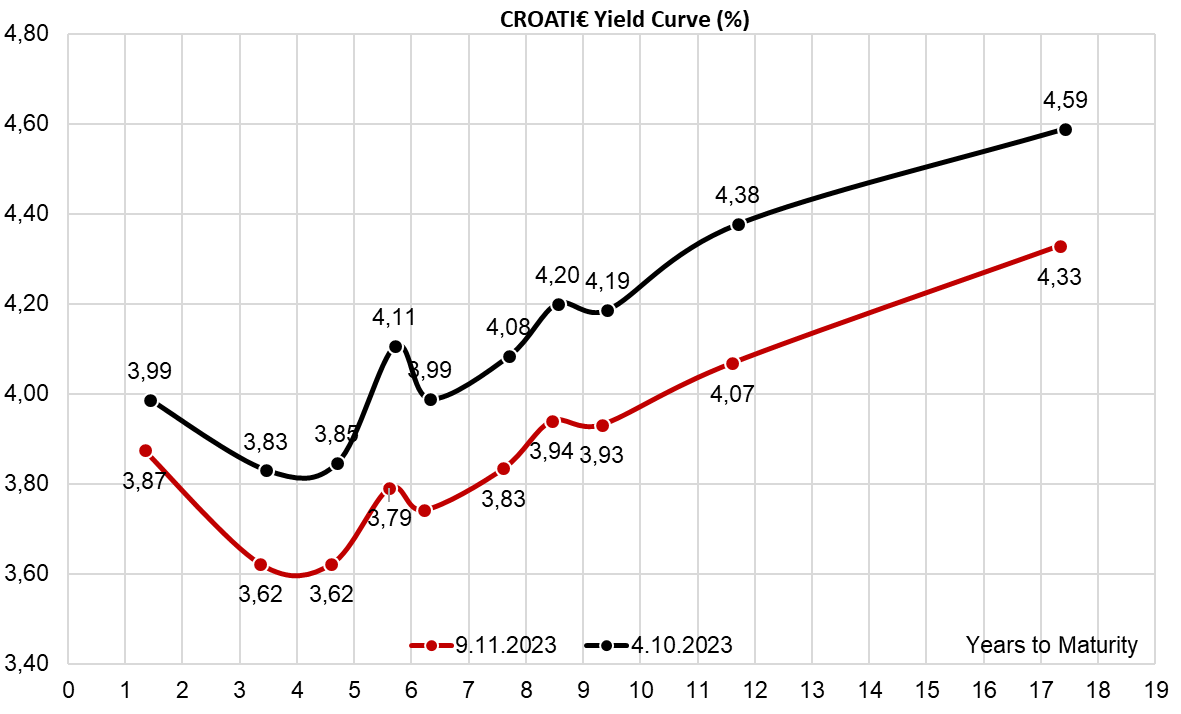

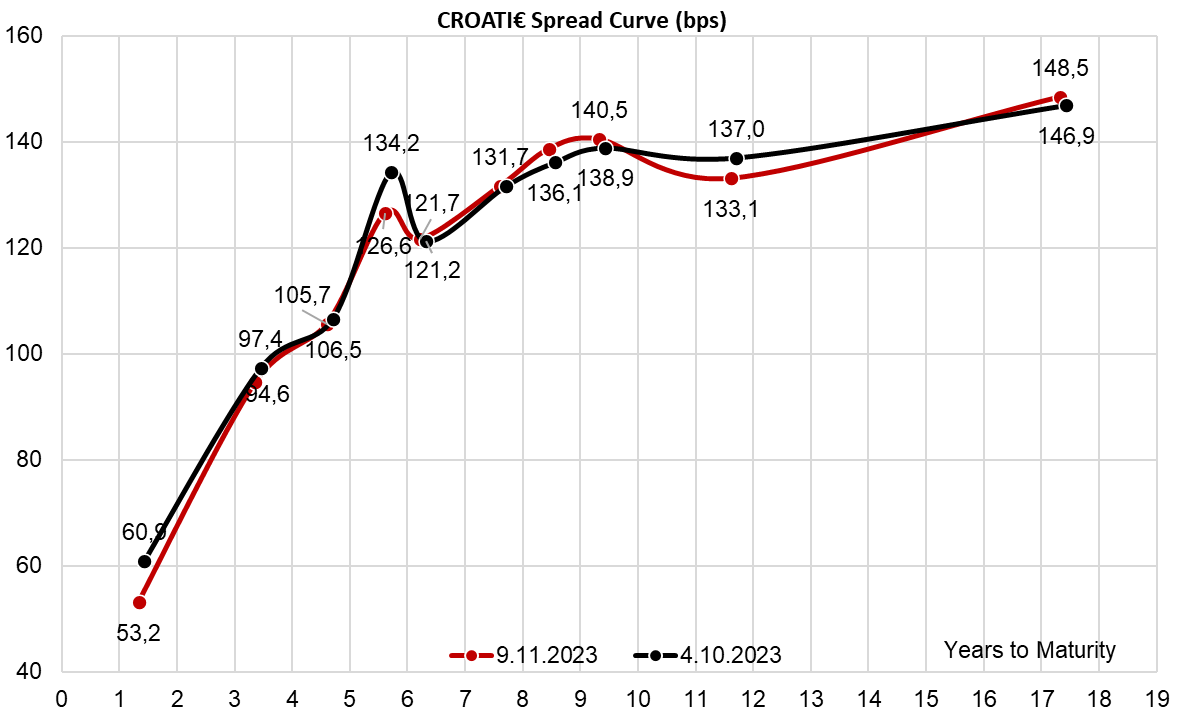

What do we make of Croatian international bonds? Obviously, CROATI€ prices went up with the bulk of demand being concentrated on CROATI 4 06/14/2035€. What we find really interesting is that the spreads to the German curve remained completely unchanged, strengthening the claim that Croatian paper is traded with a higher positive correlation to core countries. The time series is still too short to make a definite conclusion. Going forward we expect the attention of fixed income investors to be concentrated on the upcoming local bond auction taking place in the last full week of November. With 1.5bn EUR of CROATE 1.75 11/27/2023€, it’s still difficult to say which duration MinFin would pick for the new local paper, but based on the demand we see, some sort of RHMF-O-31BA might be in play. Time will tell.

Yesterday, the Fitch Ratings Agency affirmed a BBB- rating for Nuclealectrica, with a stable outlook. In this brief research piece, we bring you the main highlights that led to this decision.

According to Fitch, this rating reflects Nuclearelectrica’s (SNN) strong market position as the sole producer of electricity from low-cost nuclear power plants in Romania, its solid position in the merit order, and the low net leverage at least until 2025. However, a large CAPEX plan, in particular the refurbishment of nuclear unit 1, which will not be operational in 2027-2029, will considerably increase net leverage from 2027. This might lead to a negative rating action depending on the 2027-2030 financial profile, potential support measures from the Romania state as the majority shareholder, changes in revenue visibility due to possible contracts for difference (CfD), and progress with other projects, among other things.

In terms of the key rating drivers, Fitch noted a solid business profile, healthy profitability, a large investment plan, rising leverage, rating pressure, medium-term projects, GRE linkage, relationship with sovereign rating, and electricity price cap as the main points.

In terms of the business profile, it is supported by SNN’s strong market position as the sole producer of electricity based on nuclear technology, covering 20% of total electricity demand and 35% of electricity produced without greenhouse gas emissions in Romania. In terms of profitability, in 2022 EBITDA grew by more than 2x YoY due to high electricity prices in contracts and on the spot market. Fitch expects this to remain healthy in the 2023-2026 period, with an avg. annual EBITDA of around EUR 1.9bn.

In terms of the investment plan, Fitch expects high CAPEX, on average at around RON 1.8bn per year in the 2023-2027 period, mainly related to the refurbishment of unit 1 and the heavy water detritylation project. Rising leverage is expected due to this CAPEX and the shutdown of unit 1. As such, FFO (funds from operations) to net leverage is expected to rise sharply in the 2027-2029 period. This might also lead to a negative rating action, but the decision will depend on the projected financial profile in the 2027-2030 period.

Moving on to medium-term projects, for the construction of units 3 and 4, the state support agreement signed in 2023 assumes state guarantees for the new debt to be incurred by the vehicle that will implement the capex and CfD mechanism. In terms of the GRE linkage, the Romanian state has 82.5% majority ownership in SNN, and Fitch expects that the State will continue supporting SNN as it is seen as of strategic importance.

Due to the linkage between the State and the Company, changes in one’s rating could influence the other, with of course the State’s rating influencing SNN more than the other way around. Finally, in terms of the electricity price cap, a new regulation adopted at the end of 2022 requires generators to sell up to 80% of generated volumes between January 2023 and March 2025 through a centralized electricity purchase mechanism (MACEE), at a fixed price of RON 450/MWh. In 2023, SNN will sell about 50% of electricity through MACEE, due to bilateral contracts concluded before the regulation was introduced.

The entire report can be accessed here.

Nuclearelectrica and other select Romanian energy companies’ performance* (2023 YTD, %)

Source: Bloomberg, InterCapital Research

*Hidroelectrica’s share price as of IPO in July 2023, and as such the value represented before that is 0.

In 9M 2023, OMV Petrom recorded a revenue decline of 36% YoY, an EBITDA decrease of 40%, and a net income to majority of RON 3.5bn, a 68% decline YoY. Furthermore, during Q3 2023, the Company recorded a revenue decrease of 43% YoY, an EBITDA decline of 45%, and a net income to majority of RON 1.97bn, a 63% decrease YoY.

OMV Petrom has published its 9M 2023 results, and in this brief analysis, we’re bringing you the most important points. During 9M 2023, OMV Petrom recorded a total sales revenue of RON 28.5bn, a 36% decrease YoY, while in Q3 2023, the revenue amounted to RON 10.7bn, a 43% decrease YoY. Revenue was negatively impacted by lower commodity prices and lower sales volume of electricity, which was only partially compensated by higher sales volumes of natural gas. In terms of segments, there are 2 most important ones, the “Refining and Marketing” segment, which accounts for 72%, and “Gas and Power”, which accounts for 28%. The Company notes that the 3rd segment, Exploration and Production, accounts for only 0.1% of the total sales, as this revenue is primarily intra-group revenue rather than 3rd party sales.

Inside the Refining and Marketing segment, the refining margin (measured in USD/bbl) declined by 6% YoY to USD 14.94 in 9M, and by 2% YoY to USD 16.81 in Q3. Total refined product sales decreased by 2%. On the other hand, in the Gas and Power segment, Gas sales volumes increased by 2% YoY to 33.6 TWh in 9M, and by 19% YoY to 11.67 TWh in Q3.

In terms of expenses, the net inventory variation, decreased by 36% YoY to RON 13.6bn in 9M 2023, and by 49% YoY to RON 4.9bn in Q3 2023, which is in line with the reduced demand. Due to the lower business volume, production, and op. expenses also decreased, by 19% to RON 3.17bn during 9M, and by 24% to RON 1.2bn during Q3. On the other hand, selling, distribution, and administrative expenses increased by 16% YoY to RON 1.9bn on a 9M basis, and by 13% YoY to RON 735m on a Q3 basis.

As such, EBITDA decreased by 40% YoY to RON 7.9bn during 9M, and by 45% YoY to RON 3.3bn during Q3. This would also mean that the EBITDA margin amounted to 27.8%, during 9M 2023, a 2.26 p.p. decline, while in Q3 2023, it declined by 1.33 p.p. to 30.7%. Moving on to the net financial result, it amounted to RON 234m during 9M 2023 (9M 2022: RON -66m), while in Q3, it equaled RON -77m (Q3 2022: RON 99m). On a 9M basis, the increase came as a result of higher interest income (+56% YoY) and slightly lower interest expenses (-4% YoY), while in Q3 the opposite happened, with a lower interest income (-42% YoY), and higher interest expenses (+37% YoY).

Besides all of this, OMV also recorded a solidarity contribution on refined crude oil, which adversely impacted 9M 2023’s net profit. This contribution pertains to companies that produce and refine crude oil. These companies have to pay a contribution of RON 350m per tonne of processed crude oil for 2022 and 2023. During 2023, OMV Petrom had to pay a total of RON 2.35bn for this contribution, of which RON 1,485bn is related to the 2022 obligation, while the remaining RON 870m is related to the 9M 2023 obligation. In Q3 2023, this contribution amounted to RON 372m. As such, OMV recorded a net income to majority of RON 3.46bn during 9M 2023, a 68% decrease YoY, and RON 1.97bn during Q3, a 63% decrease. This would imply a net income margin of 12.1% during 9M, a 12.4 p.p. decrease YoY, and 18.4% during Q3, a 9.96 p.p. decrease.

OMV Petrom key financials (9M 2023 vs. 9M 2022, RONm)

Source: OMV Petrom, InterCapital Research

OMV Petrom key financials (Q3 2023 vs. Q3 2022, RONm)

Source: OMV Petrom, InterCapital Research

OMV also provided an outlook for FY 2023. They expect the average Brent oil price to be above USD 80/bbl (vs. between USD 75/bbl and USD 80/bbl previously). The refining margin is expected between USD 12-14/bbl (vs. above USD 10/bbl previously). In Romania, the demand for oil products in retail is expected to be slightly above the 2022 level, while demand for gas and power is expected to be significantly lower than in 2022. The aforementioned legislative measures (solidarity contribution) are expected to remain in place until the end of March 2025. The 2023 contribution payment is due by the end of June 2024.

In terms of CAPEX, they anticipate it at app. RON 5.5bn, with investments focused on the Neptun Deep project, low and zero carbon projects, and the Petrobrazi refinery. They also expect a positive free cash flow before dividends, but lower YoY, due to higher investments and payment of solidarity contribution.

For a deeper look at the Company’s 9M 2023 results, you can access the report here.