As of the end of September, the total financial institution’s loans amounted to HRK 278.5bn, which represents a 2.56% increase YoY and 0.18% decrease MoM.

Croatian National Bank (HNB) published its monthly statistical report on loan placement of other monetary financial institutions. According to the monthly statistical report, as of the end of September, total financial institution’s loans amounted to HRK 278.5bn, a rise of 2.56% YoY and a decrease of 0.18% MoM.

The largest segment, the household loans recorded a growth of 4.1% YoY and 0.4% MoM. At the same time, the corporate loans witnessed a 0.78% decrease MoM and a 0.84% decrease YoY. This continues the negative trend that the corporate loans had for the last few months, making this the 7th consecutive month the corporate loans decreased. Focusing on the YTD basis, household loans increased by 3.6%, while corporate loans are down by 2.9%.

Corporate and Household Loans Growth Rates (YoY)

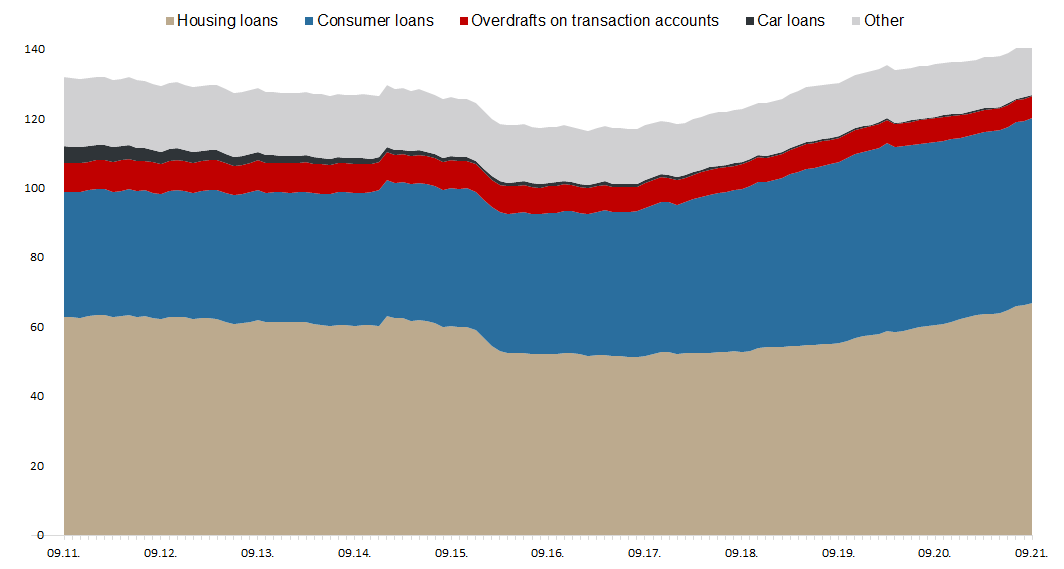

Total loans issued to households amounted to HRK 141.06bn, representing a 4.1% growth YoY (or HRK 5.49bn). Such an increase was mainly due to the rise in housing loans (10.5% YoY or HRK 6.37bn). At the same time, the government’s subsidizing program influenced the growth of housing loans which amounted to HRK 454.5m MoM (or 0.7%). Consumer loans, which remained at the level of 37.7% (or HRK 53.19bn) of all household loans, witnessed a 0.8% growth YoY (or HRK 411.8m).

Household loans growth was partially offset by a lower result of overdrafts on transaction accounts loans (-6.7% YoY or HRK -461.4m) and other loans (-4.8% YoY or HRK -445.5m). The reviewed segments represent 95.8% of total household loans. Looking over to credit card loans and car loans, the negative trend continues as both segments decreased by -1.2% and -2.2% MoM respectively.

Loans to Households (HRK bn)

Today, we bring you our updated overview of the indebtedness and capital structure of Croatian companies which comprise the CROBEX10 index using the 9M 2021 results.

As all the companies which are part of the CROBEX10 index have published their 9M 2021 results, we decided to take a look into how indebted these companies are by comparing net debt to EBITDA and % of debt financing. We also added how much additional debt could these companies take to reach a 3x EBITDA.

Among the observed companies, Končar, Ericsson Nikola Tesla, Adris Grupa, and HT operate at a negative net debt, meaning that their cash position (short-term financial assets + cash and cash equivalents) exceeds their financial debt. Because of this reason, they were excluded from the net debt/EBITDA graph.

Net Debt/EBITDA

Unsurprisingly, out of the 4 companies with the highest level of indebtedness (out of the observed companies), 2 of them operate in the tourism sector. Leading the way is Arena Hospitality Group, with a net debt/EBITDA ratio of 7.43x. In 2021, Arena Hospitality observed better sales (an increase of 82% YoY, but still not at 2019 levels), which contributed to realization of positive EBITDA of HRK 121m. TTM EBITDA improved as well to HRK 134m, from HRK -23m, while net debt of Arena amounted to HRK 995m at the end of Sep 2021. Next up we have Atlantska Plovidba, which has a net debt/EBITDA of 3x. With the shipping industry affected by the pandemic and subsequent restrictions, as well as the relatively high asset cost of the business, this comes as no surprise. The next two companies are Valamar Riviera with a net debt/EBITDA of 2.73x (for the same reasons as Arena Hospitality Group), and AD Plastik, which similarly to Atlantska Plovidba operates in an asset-heavy business, and thus, the higher levels of debt should be expected.

On the flipside, both Podravka and Atlantic Grupa operate with a net debt/EBITDA of 0.74x and 0.64x respectively. It should be noted that this is the lowest level of debt these companies have had in the last couple of years. Owing to the fact that both companies expressed interest in new acquisitions in the region, this reduction in the debt level comes as no surprise.

We also took a look into how much additional debt companies could take to reach 3x EBITDA which is in the region considered as a breaking point and red flag in terms of indebtedness.

Potential Additional Debt (HRK m) to Reach 3x EBITDA

Looking over the capital structure of the observed companies, 8 out of 10 companies are mostly equity funded. Of these, HT leads the way with 99% equity, followed by Adris Grupa, Končar, Podravka, Ericsson Nikola Tesla, and Atlantic Grupa with 96%, 90%, 86%, 79%, and 78% respectively.

Looking over to the other side, the companies with the highest amount of debt funding (of the observed companies) are Atlantska Plovidba and Valamar Riviera with 55% and 51% respectively.

Capital Structure of CROBEX10 Companies