As of the end of September, the total financial institution’s loans amounted to HRK 278.5bn, which represents a 2.56% increase YoY and 0.18% decrease MoM.

Croatian National Bank (HNB) published its monthly statistical report on loan placement of other monetary financial institutions. According to the monthly statistical report, as of the end of September, total financial institution’s loans amounted to HRK 278.5bn, a rise of 2.56% YoY and a decrease of 0.18% MoM.

The largest segment, the household loans recorded a growth of 4.1% YoY and 0.4% MoM. At the same time, the corporate loans witnessed a 0.78% decrease MoM and a 0.84% decrease YoY. This continues the negative trend that the corporate loans had for the last few months, making this the 7th consecutive month the corporate loans decreased. Focusing on the YTD basis, household loans increased by 3.6%, while corporate loans are down by 2.9%.

Corporate and Household Loans Growth Rates (YoY)

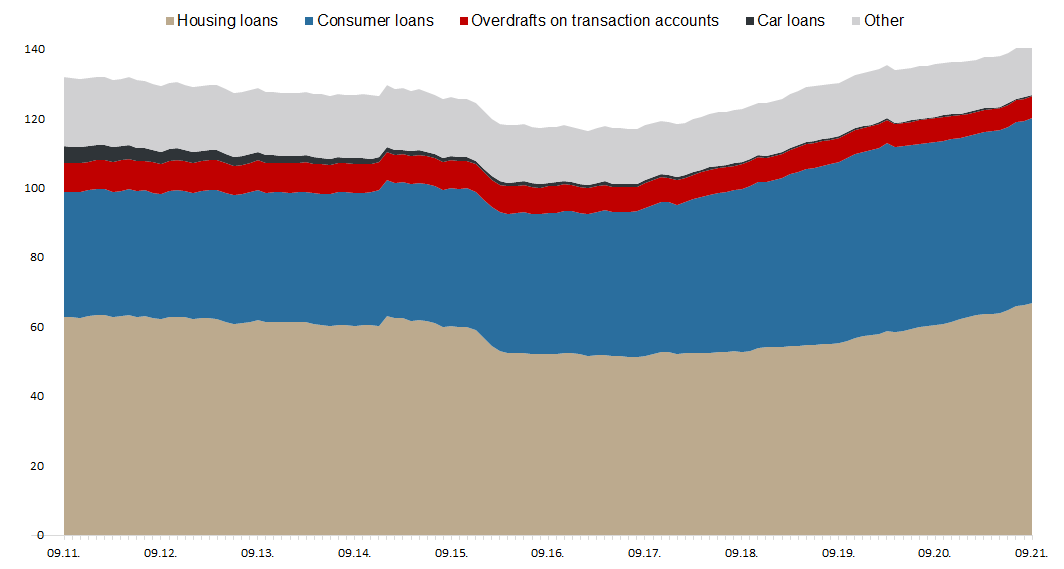

Total loans issued to households amounted to HRK 141.06bn, representing a 4.1% growth YoY (or HRK 5.49bn). Such an increase was mainly due to the rise in housing loans (10.5% YoY or HRK 6.37bn). At the same time, the government’s subsidizing program influenced the growth of housing loans which amounted to HRK 454.5m MoM (or 0.7%). Consumer loans, which remained at the level of 37.7% (or HRK 53.19bn) of all household loans, witnessed a 0.8% growth YoY (or HRK 411.8m).

Household loans growth was partially offset by a lower result of overdrafts on transaction accounts loans (-6.7% YoY or HRK -461.4m) and other loans (-4.8% YoY or HRK -445.5m). The reviewed segments represent 95.8% of total household loans. Looking over to credit card loans and car loans, the negative trend continues as both segments decreased by -1.2% and -2.2% MoM respectively.

Loans to Households (HRK bn)