Telekom Slovenije published their key strategic objectives which can be found here.

- Leader in the user experience

The leading user experience will be based on the best fiber optic network and the most advanced 4G/5G network for B2C, business verticals and critical infrastructure, and will be created in line with the latest trends, needs and demands of their users.

- Digitalization of operations

Telekom Slovenije Group will continue to accelerate its digitalization of business operations through optimization and automation of business processes in order to ensure efficient operations.

- Growth of ICT services

Growth of ICT services for their users will be based on their existing state-of-the-art LTE/4G network, the development of the internet of things, smart infrastructure (smart cities, smart communities, industry 4.0, etc.), ensuring cyber security, artificial intelligence, and the opportunities ushered in by the fifth generation of mobile networks (5G). This will be the foundation for Telekom Slovenije to become the leading partner of the digital development of Slovenia. They will achieve the growth through organic growth and the consolidation of the Slovenian ICT market.

- Retaining revenue levels from core activity in Slovenia

Telekom Slovenije will retain the market share and revenue from the telecommunication activities in Slovenia through digitalization (including the development of e-commerce, e-identity and other digital services), by offering comprehensive services, developing a unique, customer-oriented user experience, and through continued digitalization and constant development of networks and services.

- Consolidation in individual markets

On the one hand, the telecommunications market is undergoing intense consolidation of the industry and mergers of operators, with a change in the portfolio of services, while new competition is entering the ICT services market, which will additionally affect the operators’ business models. The consolidation activities will be focused on obtaining new competencies and entering new markets and areas.

- Optimal HR structure

Achieving the goals they set is only possible through carefully planned management of the reputation and employer brand, an optimum human resources structure, with an effective system of rewards, by helping their employees develop new know-how and competencies, and through proper organization and classification of job positions.

- Financial stability

Telekom Slovenije Group is executing activities that ensure effective management of liquidity and financial stability. They will ensure the optimum level of debt over the long term, maximizing the company’s value.

- Social responsibility

The Group actively identifies and will continue to identify the opportunities where they can contribute to the development of the social and economic environment in which they operate through their expertise, financial and other resources.

Note that the agreed purchase price is EUR 5m.

Yesterday, Telekom Slovenije signed a share purchase agreement with TV2 MEDIA CSOPORT ZRT for the sale of all business shares in Planet TV, televizijska dejavnost, which together represent 100% nominal value of company’s share capital.

Note that the agreed purchase price is EUR 5m. The entire transaction will be completed after the fulfilment of all the conditions precedent agreed in the SPA and buyer’s acquisition of the consent of the competent authorities. The transaction is expected to be completed by the end of September 2020.

For today, we decided to present you with an updated asset structure analysis of Croatian UCITS funds.

Since the asset managers play a very significant role in the Croatian capital market, it is particularly interesting to see how they have been affected by the ongoing Covid-19 situation. Given that the global financial markets observed a partial recovery in April as well as May, it is worth seeing how Croatian UCITS funds performed during that period.

According to the report, NAV of all funds in May 2020 experienced a slight increase of 1.3% MoM (or HRK 205m), amounting to HRK 16.08bn. This also represents a decrease of 16.7% YoY and a decrease of 28.8% YTD. As a reminder, in late February until late March UCITS funds recorded the majority of the yearly decrease in their NAV. HANFA noted earlier this year that since 21 February until 24 March, 86.1% of the decrease could be attributed to withdrawals from the funds, while the rest 13.9% can be attributed to a change in value of assets in which the funds invest. As turmoil on financial market subsided withdrawals from funds were halted, but the value of most financial instruments has not yet returned to pre-crisis levels.

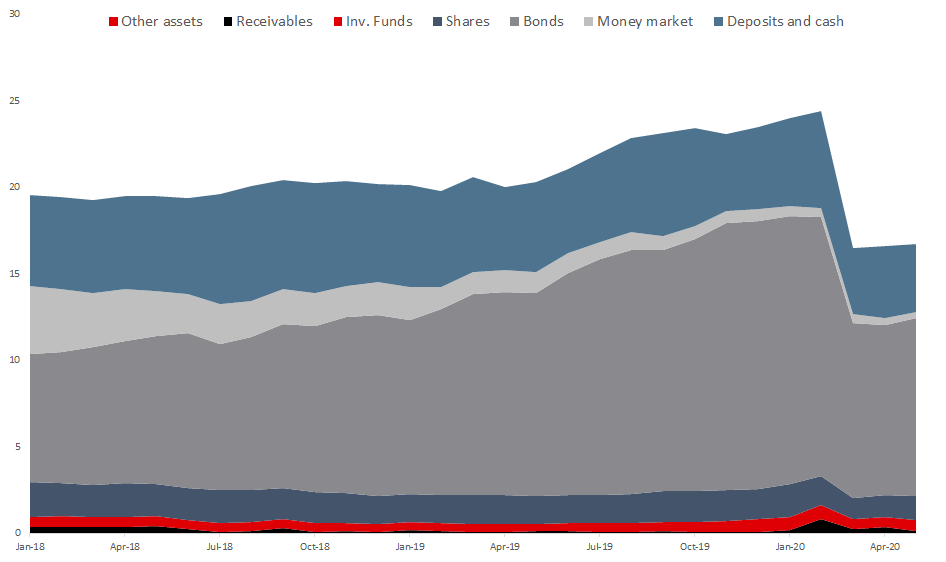

Asset Structure of UCITS funds (May 2020)

Looking at the asset composition of Croatian UCITS funds, it seems that asset managers have not changed significantly their composition, which can be seen in the graph above. Since the beginning of 2020, we witnessed a considerable decrease of bonds in the assets structure which went from 65% in January 2020 to as low as 59% (April), while as of May 2020 bonds take up for 61.3% of the total assets. Such a decrease could mainly be attributed to withdrawals from funds which (predominantly) invest in the mentioned asset class, but also partially due to the decrease in value of bonds compared to the end of 2019.

Shares have observed a gradual increase in total assets since February, and currently account for 8.5% of the total assets. Note that domestic shares account for roughly a third of the total equity held by Croatian UCITS funds.

Total Assets of All Croatian UCITS Funds (2018 – May 2020) (HRK bn)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research

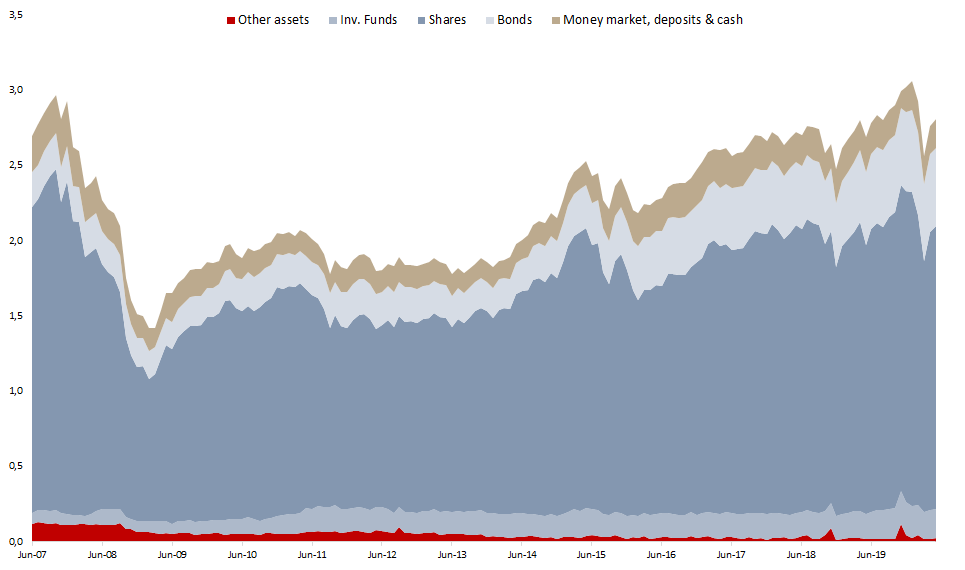

As of May 2020, Slovenian mutual funds manage EUR 2.81bn, representing an increase of 1.7% MoM and of 4.6% YoY.

For today, we decided to present you with a short asset structure analysis of Slovenian mutual funds. When looking at the graph below, one can notice that the Slovenian mutual funds have not significantly changed their assets structure during COVID-19 crisis.

As of May 2020, Slovenian mutual funds manage EUR 2.81bn, observing a solid increase of 4.6% YoY and +1.7% MoM. It is worth noting that mutual funds are experiencing a recovery after a considerable loss in March 2020 (-12.4% MoM) due to crisis caused by the Covid-19 pandemic. As a reminder, in April the AUM partially recovered with a 7.8% increase. Meanwhile, on a YTD basis, AUM is 7% down, indicating that the investors were not withdrawing funds at a significant level during the Covid-19 outbreak.

Turning our attention to the asset structure, as of May 2020, shares account for 66.8% of the total assets, which is below the historic average of 70% (in the observed period). Note that the vast majority (96.5%) of equity holdings of Slovenian mutual funds come from the foreign market. Next come bonds, which make up for 18.6% of the total asset structure or EUR 522.7m. Of that, 92.3% come from the foreign market. Investment funds’ share in AUM amounts to 6.9% of total assets, while money market, deposits & cash account for 6.8%.

Total Assets of All Slovenian UCITS Funds (2007 – May 2020) (EUR bn)

Source: Securities Market Agency, InterCapital Research