As of May 2020, Slovenian mutual funds manage EUR 2.81bn, representing an increase of 1.7% MoM and of 4.6% YoY.

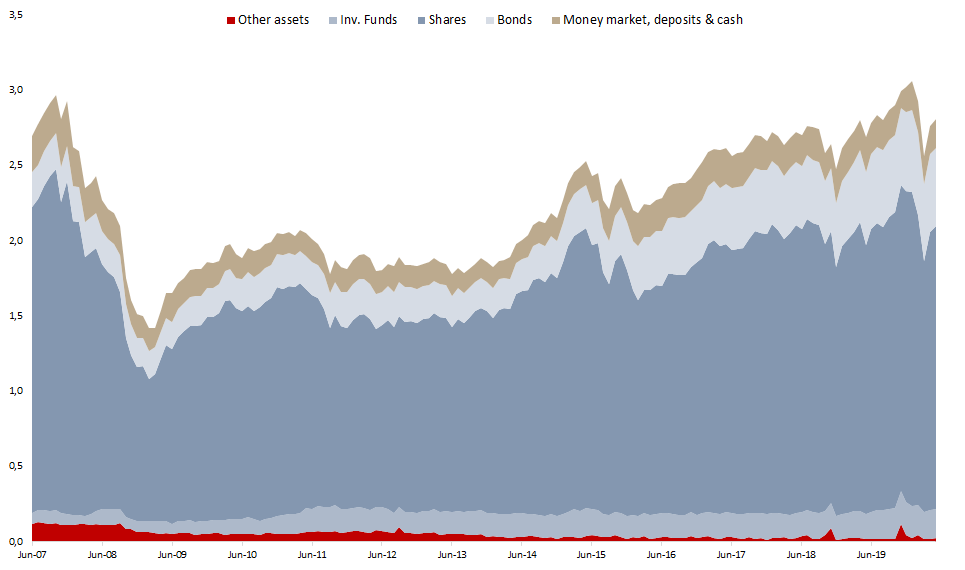

For today, we decided to present you with a short asset structure analysis of Slovenian mutual funds. When looking at the graph below, one can notice that the Slovenian mutual funds have not significantly changed their assets structure during COVID-19 crisis.

As of May 2020, Slovenian mutual funds manage EUR 2.81bn, observing a solid increase of 4.6% YoY and +1.7% MoM. It is worth noting that mutual funds are experiencing a recovery after a considerable loss in March 2020 (-12.4% MoM) due to crisis caused by the Covid-19 pandemic. As a reminder, in April the AUM partially recovered with a 7.8% increase. Meanwhile, on a YTD basis, AUM is 7% down, indicating that the investors were not withdrawing funds at a significant level during the Covid-19 outbreak.

Turning our attention to the asset structure, as of May 2020, shares account for 66.8% of the total assets, which is below the historic average of 70% (in the observed period). Note that the vast majority (96.5%) of equity holdings of Slovenian mutual funds come from the foreign market. Next come bonds, which make up for 18.6% of the total asset structure or EUR 522.7m. Of that, 92.3% come from the foreign market. Investment funds’ share in AUM amounts to 6.9% of total assets, while money market, deposits & cash account for 6.8%.

Total Assets of All Slovenian UCITS Funds (2007 – May 2020) (EUR bn)

Source: Securities Market Agency, InterCapital Research