After the final member of the Romanian BET index published their H1 2021 results we bring you an overview of the top line, EBITDA and bottom-line performance of all index components.

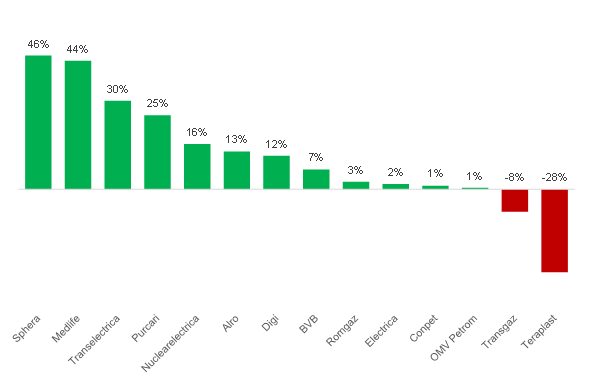

Top Line Development of BET Components in H1 2021 (%)

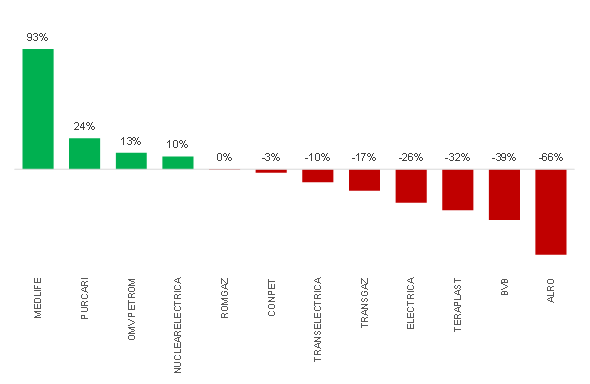

When observing the top line performance of BET components, the two clear leaders are Sphera and Medlife with sales in H1 increasing by more than 40%. Sphera’s strong sales growth came because of relaxing epidemiological measures which made restaurant operations easier to conduct. Note that this also translated to a higher EBITDA which, in Sphera’s case soared 39-fold. Meanwhile, Medlife’s sales increased 44% YoY, led by a significant growth in all business lines, as well as by acquisitions completed by the group so far this year. Higher sales translated down the P&L, leading to a 93% YoY increase in EBITDA, and a nearly seven-fold jump in net profit.

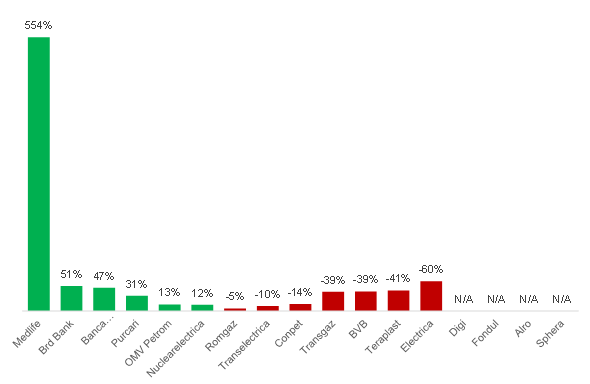

Electrica’s top lineincreased by 2% as higher revenues from the supply segment were somewhat offset by the decrease of the distribution segment’s revenues. EBITDA fell -26% YoY, amounting to RON 357.1m. The main reason behind the drop lies in the increase of electricity costs on the supply segment, coupled with an increase in the electricity costs needed to cover NL and in the GC purchase costs, the latter having no impact on the result. Net profit was down -60%, further hurt by a deteriorating net financial result.

EBITDA Development of BET Components in H1 2021 (%)

Transelectrica’s revenues increased by 30 % YoY mainly due to the increase in the amount of electricity delivered to consumers, the increase in the average transport tariff and the increase in revenues from the balancing market.

Purcari’s sales increased by 25% YoY fuelled by a strong performance in core markets. EBITDA was up due to higher sales, which were somewhat offset by higher G&A expenses (+34.6% YoY), mainly due to salaries increase. As a result, Purcari’s net profit amounted to RON 20.4m (+30.8% YoY).

On the flip side, leading the laggards in EBITDA was Alro whose result was greatly influenced by the rising electricity prices has a significant share in the company’s production costs.

Bottom Line Development of BET Components in H1 2021

Fondul Proprietatea managed to turn last year’s net loss of RON 848m into a net profit of RON 1,801m. The main contributor to the profit was the net unrealised gain from equity investments at fair value through profit or loss, generated by the rising price of OMV Petrom’s shares. Furthermore, Net profit was also boosted by an increase in the value of unlisted holdings in the fund’s portfolio following the valuation update process (this can mainly be attributed to Hidroelectrica).

Banca Transilvania’s net interest income amounted to RON 1,529m, representing a 5.2% YoY increase, driven by lower interest expense. Meanwhile net fees and commissions amounted to RON 446.9m (+27.0% YoY). Moving further down the P&L, operating expenses are down -4.2% YoY, standing at RON 1,245m. The drop in expenses came from lower impairments which were sliced in half to RON 113m (-50.7% YoY). As a result, net profit amounted to RON 1,015.5m (+47.2% YoY).

At the end of July 2021 total deposits in Croatia amounted to HRK 350.7bn, up by 9.8% YoY.

According to the consolidated statement of financial position for monetary financial institutions which is monthly published by the Croatian National Bank (HNB), total deposits as of end July 2021 amounted to HRK 350.7bn, representing an increase of 9.8% YoY, or +2.6% MoM. This amount represents once again an all-time high. The high level of deposits continued to see a positive trend despite the reopening of the economy and the relaxation of Covid-19 related measures.

The majority of the increase is channeled to demand deposits, reaching HRK 145.9bn, which now amounts to 42% of total deposits. As of the end of July, 2021 total savings deposits amounted to HRK 204.8bn, representing an increase of 2.1% YoY and +0.9% MoM. In the local currency savings deposits, one can note a decrease of as much as 5% MoM, reaching HRK 30.85bn.

Foreign currency savings amounted to HRK 173.96bn, a 2.4% increase YoY. To put things into a perspective, total saving deposits at the end of July 2021 were 15% in the local currency and 85% in foreign currency.

When observing solely households, they hold HRK 236.1bn or 67% of total deposits. Household deposits were up by 8.4% YoY in July, or up by 1.5% MoM.

According to the Croatian National Tourist Board, in the first 8 months of 2021 Croatia has witnessed 10.7m tourist arrivals and 67.94m tourist nights.

Croatia recorded 30.7m tourist nights in August 2021, which represent an increase of 46% YoY and is at as high as 93% of the result from August 2019. A total of 4.3m tourist arrivals were recorded in Croatia in August 2021, which is an increase of 59% YoY. To put things into a perspective, this represents 86% of the result from August 2019. Foreign tourists generated 26.7m bed nights and domestic tourists 4m.

The largest number of tourist nights (8.6m) was registered in Istria County, ahead of Split-Dalmatia County (5.8m). Meanwhile, the most popular destinations were Dubrovnik (164k tourist arrivals), Split (160k), Rovinj (149k), Medulin and Poreč (both 125k).

The above state figures could be seen as more than encouraging for Croatian tourism, given that tourist nights in the first 8 months account for 75.4% of the record 2019 level. To be specifc, according to the Croatian National Tourist Board Croatia has noted 10.7m tourist arrivals and 67.94m tourist nights (from Jan to Aug 2021). Such figures represent an increase of 56.4% YoY of arrivals and 42.8% YoY increase in tourist nights. Additionally, the average nights spen slightly decreased from 6.94 to 6.34 (in the first 8 months of 2021).

The largest number of tourist nights was registered in Istria County (27.9% of all nights), ahead of Split-Dalmatia County (18.4%).

In terms of accomodation, 16.48% of the total nights spent was recorded in hotels (11.2m, representing an increase of 89.6% YoY. Meanwhile, camps accounted for 20.7% of all nights or 14.1m (+72.7% YoY).

Such solid figures will definitely benefit the Croatian tourists in our coverage and, as a reminder, Arena Hospitality Group recently announced that the Group’s Croatian operations showed very strong results during the summer season, with August 2021 revenues being in line with August 2019 revenues. To read more about the aforementioned, click here.