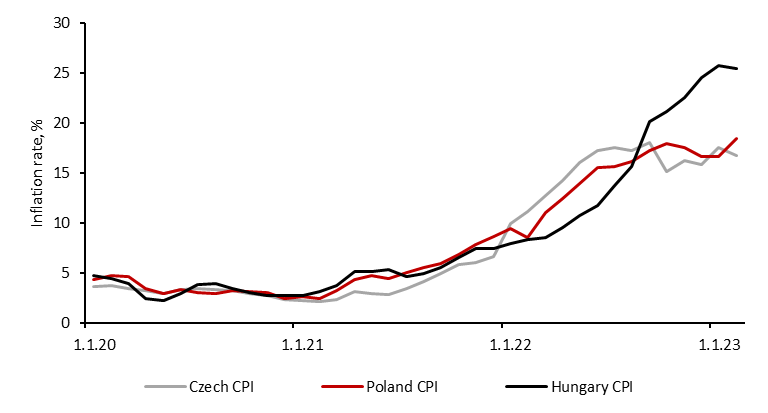

As high inflation is still a problem in Eastern Europe countries, central banks decided to hold rates high until inflation drops to more acceptable levels. Loosening monetary policy should not be on the table for double-digit inflation in Poland, Hungary, and the Czech Republic with inflation at 18.4%, 25.4%, and 16.7%, respectively. The Czech Republic certainly reached the peak of inflation and the downtrend is clear, however, Hungary and Poland are still keeping up with their battle with their stratospheric inflation. How long tight monetary policy is going to last will be seen later in the year.

Growth slowing across the world as a result of tightening monetary policy led to money market pricing rate cuts as central banks might try to evade recession or at least soften it up. Unfortunately, growth concerns proved to be exaggerated as the growth outlook improved this year. Consequently, this is the case for delaying rate cuts in CEE countries. As central banks’ rhetoric developed over the first quarter of 2023, it is clear that the rate cuts this year are unthinkable as inflation is sky high and the severe recession should not be the scenario for this year.

Firstly, yesterday the Czech National Bank left the interest rate at the level of 7.00%. Recently, Czech central banker Zamrazilova strongly ruled out the rate cuts at least until the inflation returns to the single digits. In addition to that, she pointed out the importance of strong koruna as it is helping to curb inflation. However, wage growth is a matter of concern and further rate hikes are not unthinkable in case of the labor market tightening even more.

Secondly, the National Bank of Poland holds the current interest rate at 6.75% and at this level of inflation, there is no incentive to cut them anytime soon. As the Polish monetary council pointed out, further rate hikes are not ruled out. It was expected at the last meeting (8th of March) that Governor Glapinski will formally end the tightening cycle, however, there was little guidance for that. The positive news is related to the downward revision of the inflation for 2023 and 2024 and the upward revision for the growth in this year. The monetary council was united about this decision as only two members wanted to raise rates by 0.25% and a single member was in favor of a 1.00% rate hike.

Thirdly, on Tuesday the 28th of March, Hungary’s central bank decided to leave its interest rate on hold at 13.00% as inflation is the highest among the mentioned countries. Thus, there is little scope to cut rates this year. In addition to holding rates stable, other currency stabilization tools which are used to support the forint are in place longer than previously expected. In the case of phasing out, this could lead to renewed volatility in EURHUF as it was in 2022 until it stabilized at the sub-400 level.

To conclude, according to the central banks of the three mentioned countries, there is little scope for rate cuts as high wage growth supports inflation in the future. Thus, the idea of rates higher for longer in these countries is the most likely scenario. One thing is certain, getting back to 2% inflation is not in the cards for this year.

Inflation rates in CEE economies (2020-2023 YTD, %)

Source: Bloomberg, InterCapital

At the share price before the announcement, this would amount to a DY of 2.91%. The ex-date is yet to be announced, while the payment date is set for 17 July 2023.

At the meeting of the Management Board held yesterday, 29 March 2023, the distribution of the profit from the financial year 2022 was discussed. According to the press release published by Podravka, in 2023 a dividend of EUR 2.65 per share should be paid out, implying a dividend yield of 2.91%. Compared to last year, the EUR 2.65 DPS is 53.5% higher (2022 dividend: EUR 1.73 DPS).

In total, this would mean EUR 18.6m will be paid out as dividends, implying a payout ratio of 70.7% on the Company level, and 37.9% on the Group level. The ex-date for the dividend is yet to be announced, while the payment date has been proposed for 17 July 2023. Of course, the dividend payment is subject to approval at the General Shareholders Meeting, which will be held on 17 May 2023.

Below we provide you with the historical dividends and dividend yields of Podravka.

Podravka dividend per share* (EUR) and dividend yield (%) (2016 – 2023)

Source: Podravka

*converted using CNB’s EUR/HRK exchange rate at the time

Today, we present you with further DuPont decomposition of selected Croatian Blue Chips by looking into interest and tax burden and comparing it with their peers.

Since the beginning of the week, we looked at two components of the 5-step DuPont decomposition of ROE: operating margin, financial leverage and asset turnover. You can read about it here. Today, we present you with the last two components of DuPont decomposition of the selected Croatian Blue Chips. Today we will look at the interest burden and tax burden. These components highlight how much tax and interest weigh down a company’s net profitability. These two components, along with discussed operating margin, are just an extension of the net profit margin calculation to give us detailed information about the impact of operating activity, interest and tax effect on the net profit margin of the company.

We should note that both interest and tax burden is calculated using P&L operating level and under, meaning they can more often be under the impact of “one-offs”.

Interest burden tells us the extent to how much the net financial result of the company together with profit from associates (20-50% shareholding) and investments (<20% share) impact its profit. If a company pays more interest on its debt than what it receives as interest from its loans or profits from its investments into associates or joint venture, this ratio will fall below 1, meaning that net financial & investment result has impacted its profit negatively. It is calculated as EBT divided by EBIT.

Tax burden gives us a proportion of profits retained after tax. This indicates how much does tax impacts on company’s bottom line. It is calculated as a company’s bottom line, net profit, divided by EBT, pre-tax income. If a company has to pay taxes in the observed period, this ratio will naturally fall below 1, dragging a company’s profitability downwards.

Interest burden – Croatian Blue Chips [FY 2022]

Source: ZSE, Bloomberg, InterCapital Research

As can see from the graph above, the interest burden of all Croatian blue chips closely follows the industry mean, which should not surprise. This is just a result of a similar capital structure within the same industry. Within the valuation context, this leads to a similar weighted average cost of capital (WACC), due to more similar capital and debt weights. Also, the reported situation can be partly explained due to companies operating in the same region and generating sales from a similar region. This leads to similar FX gains/losses, which are also affected by the company’s risk management and hedging strategy.

Nevertheless, Končar reported an interest burden of 1.05 as its EBT (EUR 51.2m) was higher than EBIT (EUR 48.9m). The reported interest burden higher of 1, by itself, indicates a positive net financial & investment result. Končar reported a slightly positive net financial result of EUR 290k and a net investment result of EUR 2m, as Končar has a joint venture with Siemens, Končar-Power Transformers Ltd. (Končar – Energetski transformatori d.o.o., Zagreb).

Tax burden – Croatian Blue Chips [FY 2022]

Source: ZSE, Bloomberg, InterCapital Research

As can see from the graph above, the tax burden of all Croatian blue chips closely follows the industry mean, which, too, should not surprise an investor. Tax burden indicates how much does tax impacts on company’s bottom line. If any of the blue chips reported significant deviation from the industry means, it would probably be due to some “one-offs”, for example, a tax incentive. Last year, Valamar Riviera reported exactly the above-stated scenario, while Group paid taxes this year normally.

Tomorrow we will elaborate on the impact of all five decomposed components on Croatian Blue Chip’s Return on equity (ROE) and compare the whole picture given by DuPont within the industry context.

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 22 | 30.3.2023 | ATGR | Atlantic Grupa 2022 Annual Report | Croatia |

| 23 | 30.3.2023 | SFG | Sphera Franchise Group Ex-dividend date | Romania |

| 24 | 31.3.2023 | TLSG | Telekom Slovenije 2022 Annual Report | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).