This week, we will present you with detailed series – a decomposition of the Return on Equity (ROE) of selected Croatian companies, using 5-Step DuPont Analysis. DuPont analysis breaks down the underlying components of the ROE in order to analyze the contribution of each component to the return on equity. ROE is a measure of the profitability of a company in relation to its equity. The higher the ROE company achieves, the more efficient company is in generating profits from its equity financing. However, it is important that whether ROE is deemed good or bad depends on what is “normal” among a company’s peers. Therefore, we decided to present to you each of DuPont’s components affecting ROE and compared it to its peer’s median to get a meaningful picture.

ROE – Croatian Blue Chips [FY 2021]

Source: ZSE, InterCapital Research

5-Step DuPont Analysis

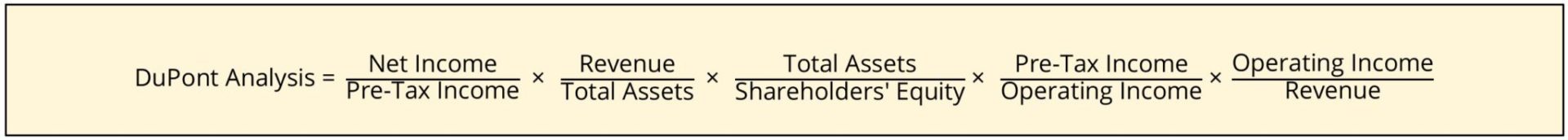

When decomposed in the 5-step formula, ROE looks like this. If the same variable from the numerator and denominators is „cut out“, the aftermath would just be net profit divided by equity – which is in fact, nothing but ROE. Also, it should be noted that each component is the most useful compared to companies within the same industry, as each industry has its own specific characteristics.

In other words, the company’s profitability ratio (ROE) is decomposed into five other ratios.

Operating margin gives us information on the company’s ability to generate profit from its operations and revenues. It calculates how much operating profit a company can make on a dollar of sales, after paying all production costs (COGS, wages..), but before paying interest or tax. Overall, the operating margin represents the company’s operating efficiency.

Financial leverage divides a company’s total assets with a company’s equity, giving us information on how leveraged the company is with debt. Financial leverage can be useful as it emphasizes the financial stability of a company. Financial leverage equal to 1 would indicate that the company has no debt – that company financed its total assets with equity. The higher the financial leverage goes, the more leveraged company

Asset turnover compares a company’s assets to its sales. This ratio helps us to determine how efficiently a company uses its assets to generate revenue. This ratio is crucial as every company has to utilize its assets. The higher the ratio is, the more efficiently company uses its assets to generate revenues. This means the company uses its equity and debt to produce higher revenues, compared to the company having a lower asset turnover ratio.

The last two components within DuPont are tax and interest burden. These components highlight how much do tax and interest weigh down a company’s net profitability. The tax burden gives us the proportion of profits retained after tax. This indicates how much tax impacts on company’s bottom line. Interest burden tells us the extent to which the interest expense of the company impacts its net profit.

Today, we will look at the Operating margin of a few Croatian Blue Chips, as a first DuPont component. Operating margin gives us insight into the company’s operating efficiency and ability to generate profit to equity from operating activities. The higher operating margin is a result of the company’s ability to generate more operating profit on each dollar of sales and it is a direct result of the company’s cost management efficiency.

Operating margin (%) – Croatian Blue Chips [FY 2022]

Source: ZSE, InterCapital Research

Tomorrow we will look into the second DuPont component of Croatian companies, Financial leverage, and compare them with peer companies operating within the same industry.