In the last few months we have seen modest recovery of the economic data in both US and euro area which was followed by rise of inflation. ECB acknowledged trend stating that risks are now almost in balance. However, there is this corona virus that could harm mentioned recovery while oil prices fell sharply in the last few weeks. What happened and what could we expect next read in this brief article.

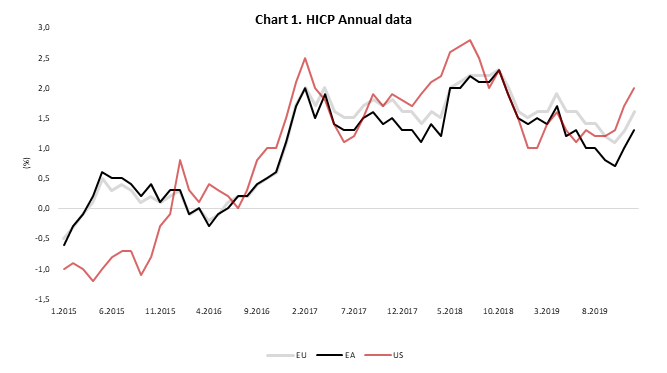

2019 was all about slower economic growth and possible recession in 2020 due to geo-political turbulences which had (among other reasons) driven industrial recession in several countries in EA including Germany. Despite house prices and wages rose by solid pace, inflation in euro area kept falling and reached bottom of 0.70% in October 2019. However, in September 2019 there were some signs that slowdown of economic data and leading indicators could see inflection point and could reverse. Last three months of the decade confirmed the trend although quite modestly which coupled with higher prices of oil set the stage for inflation to start rising once again. In December 2019 euro area’s HICP reached 1.3% (annual change) and Bloomberg’s survey now shows forecasters expecting it to rise to 1.4% in January.

Talking about expectations, last week ECB maintained monetary policy meeting which was mainly non-event as there weren’t any new policy signals due to start of strategic review which should be finished in the end of this year. After the announcement that ECB will continue to make net purchases and make core sovereign bonds even more ‘limited edition’, Mr Lagarde stated that some of the geo political risks receded since December and inflation picked-up which was in line with their expectations but seems that for ECB risks are still tilted to the downside. In case inflation keeps rising in the following months, we do not expect ECB to react rather to say inflation can overshoot for some period of time as it underdelivered for few years.

Source: Eurostat, InterCapital

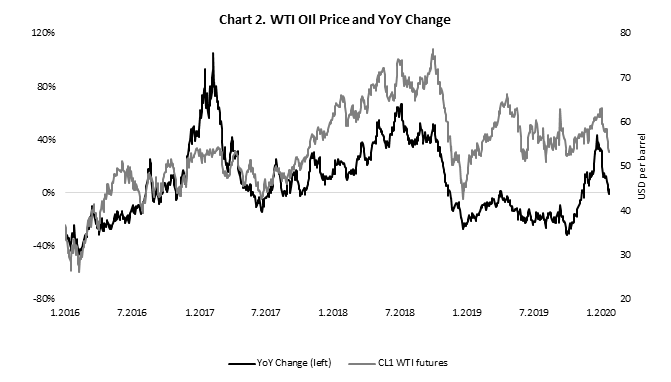

What could stop inflation from rising to ECB’s close but under 2.0%? First what we could think now is oil price which witnessed sharp drop in the last few weeks as concerns about increased global supply keep mounting and in case it stays close to these lower levels, inflation will inevitably go South. ECB’s most targeted measure is core inflation which excludes prices of oil but looking at the correlation between the two, it’s obvious that oil is still one of the main inflation drivers. Second, corona virus could show way more serious that market now thinks which would damage global trade and probably push inflation lower due to slower demand. Furthermore, ECB will most likely be on auto pilot for the whole year as they have to review the economy and they do not have more tools to fight slower growth or lower inflation. Also, US president in Davos said that he could impose tariffs on EU cars if they don’t reach some trade deal.

Source: Bloomberg, InterCapital

On the other side, US seems to be in the right spot for growth acceleration due to phase one, Chinese growth being above expectations and FED’s last year’s easing. FED still has some room to react in case of slowdown or fall of inflation and at the moment market expects them to cut reference rate once again in September 2020. Also, one shouldn’t forget about Mr Trump who will try to keep economy rolling at list until the end of this year when he will most likely take another mandate as POTUS.

The interest on the principal of the subordinated notes will accrue at the interest rate of 3.40% per annum and the issue price will be equal to 100% of their nominal amount.

NLB announced on the Ljubljana Stock Exchange the collection of orders for initial sale of its subordinated notes, which have been offered to eligible counter parties and professional clients outside the United States of America, has been concluded successfully. The subordinated notes are expected to be issued on 5 February 2020 in the aggregate amount of EUR 120m. The interest on the principal of the subordinated notes will accrue at the interest rate of 3.40% per annum and the issue price will be equal to 100% of their nominal amount.

As a reminder, the company has on 17 September 2019 entered into a loan agreement relating to a EUR 45m of subordinated Tier 2 loan intended for the inclusion into additional capital to strengthen and optimize its capital structure. However, the company may only include the loan in calculation of additional capital according after obtaining an approval from the ECB. NLB noted that since such approval has not been granted by 23 December 2019 and it was not expected to be granted in the near future, the company decided to exercise the prepayment of the loan in January 2020.

To put things into a perspective, the deals account for roughly 16.5% of the company’s T12M 2019 consolidated sales.

AD Plastik published an announcement on the Zagreb Stock Exchange stating that they have concluded additional deals worth EUR 22.4m with the Renault-Nissan-AvtoVAZ Alliance in the Russian market as well as new deals with the PSA Group in the European market with a total value of EUR 9.4m.

In total, the new deals amount to EUR 31.8m, which accounts for roughly 16.5% of the company’s ttm 2019 consolidated sales.

Firstly, AD Plastik Togliatti factory will be producing absorbers and exterior pillar trims for the new model Lada Granta as well as front bumper lower grills for the new vehicle models Renault Logan and Sandero. The total value of the deals sealed for the vehicle Lada Granta amounts to EUR 15.2m, and for new Renault models – EUR 7.2m. The start of serial production is planned for the Q2 and Q3 of 2021, and the estimated duration of the projects is 8 years.

Secondly, AD Plastik Group factory in Mladenovac will be producing glass run channels for Opel Astra, with serial production scheduled to begin in the Q4 of 2021, and with an estimated project duration of 8 years. The total value of these deals amounts to EUR 5.8m.

Finally, exterior components for Fiat Ducato and Opel Vivaro commercial vehicles will be produced in Solin, and a total value of these deals amounts to EUR 2.2m. The start of serial production is also planned for the Q4 of 2021 with an estimated project duration of 2 years. Air extractors for the vehicles Peugeot 308 and Opel Astra will also be produced in Solin, with a project value of EUR 1.4m. Start of serial production is planned for the Q1 of 2021 with an estimated project duration of 7 years.

The project will take place in 2 stages. The first phase of the project will be financed mainly from MedLife own funds, coming from the company’s operational cash flow.

MedLife published a document on the Bucharest Stock Exchange announcing the acquisition of a land area of 9,500 square meters and of buildings with a built area of 5,000 square meters, while renting additional land area of 2,500 square meters, respectively buildings of 2,000 square meters.

There, MedLife will invests in the development of the largest private medical project in Romania – MedLife Medical Park. The project will take place in 2 stages. In the first stage, MedLife Medical Park will have a total built area of 19,000 square meters that will be put into operation in the next 18-24 months. In the second phase, within 3 to 5 years, the company will build MedLife Oncological Institute, following that the entire project, MedLife Medical Park, will reach a total built area of approximately 50,000 square meters.

The first phase of the project will be financed mainly from MedLife own funds, coming from the company’s operational cash flow. The company adds that currently, a feasibility study for MedLife Oncological Institute is carried on, following that the financing method, either through bank finance, issuance of shares, bonds or a combination thereof, will be decided according to the discussions with the shareholders and the partner financial institutions.