As of end July, total financial institution’s loans amounted to HRK 279.8bn, which represents a 3.2% increase YoY.

According to the monthly statistical report published monthly by Croatian National Bank (HNB), as of end July, total financial institution’s loans amounted to HRK 279.8bn, which represents a rise of 3.2% YoY and a 0.5% increase MoM. Pick-up in July is evidenced compared to previous months as annual growth in July stood at 2.3% YoY, and in May and April at 0.7% YoY.

Its largest segments household loans recorded a significant growth of 4% YoY and 1% MoM. Meanwhile, corporate loans witnessed a decrease of 0.3% YoY. It’s also worth noting that corporate loans documented a negative trend for the fifth consecutive month, both on YoY and MoM (-0.3% YoY and -0.19% MoM). Focusing on a YTD basis, household loans rose by 3%, while corporate loans are down by 1.1%.

Corporate and Household Loans Growth Rates (YoY)

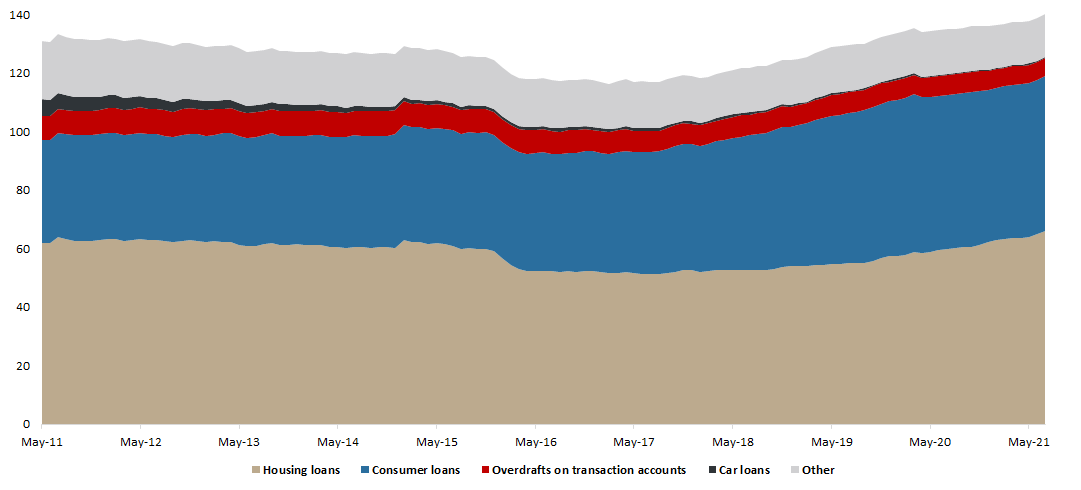

Total loans issued to households amounted to HRK 140.33bn, representing an increase of 4% YoY (or HRK 5.36bn). Such an increase was mainly a consequence of a rise in housing loans (+10.4% YoY or HRK 6.23bn). Furthermore, the government’s subsidizing program influenced the growth of housing loans which amounted to HRK 1.14bn MoM (or 1.8%). Consumer loans, which maintained the level of 37.7% (or HRK 52.89bn) of all household loans, witnessed a minor growth of 0.1% YoY (or HRK 71.6m).

Household loans growth was partially offset by a lower result of overdrafts on transaction accounts loans (-5.1% YoY or HRK -342.7m) and other loans (-3.6% YoY or HRK -341.1m). The mentioned segments account for 95.8% of total household loans. Turning our attention to specific purpose loans and car loans, a negative trend continues as both segments decreased by 1.8% MoM.

Loans to Households (HRK bn)

In August CROBEX increased by 0.99%, ending the month at 1,967.54 points.

The total equity turnover in August the turnover reached EUR 15.84m (HRK 118.7m), indicating an average daily turnover of EUR 754k.

Out of the total value traded (excluding block transactions) in August, Atlantska Plovidba generated 12.8% of the total equity traded on ZSE. Valamar Riviera comes next with a 10.7%, while HT and Podravka follow with 8.1% and 7.5%, respectively. Meanwhile, Ericsson NT accounted for 6%. These top five traded companies accounted for 45.2% of the total value traded.

Among the CROBEX constituents, 8 ended the month in green with IGH (+24.5%) and Atlantska Plovidba (+11.9%) being the best performers. Valamar Riviera and Podravka come next, with an increase of 3.1%, respectively. On the flip side, Dalekovod found its way among the losers, decreasing by 24.8% and ending the month at HRK 79 per share. To read more about the recent news on the company, click here.

As a result of all of the above, the main index of ZSE, CROBEX noted a slight increase of 0.99%, thus ending the month at 1,967.54 points. CROBEX10 was up 0.80% ending the month in green.

Performance of CROBEX 10 Constituents (August 2021)

Total ETF turnover amounted to HRK 1.8m. 7CRO market capitalization at the end of August was at HRK 30.4m and 7SLO at HRK 28.2m. NAV of 7CRO noted a slight decrease of 0.34%, while NAV of 7SLO was up 3.16%.

Trading statistics for August 2021 exhibit an average daily turnover of EUR 221k (+289.44% MoM). Meanwhile, BELEX15 ended the month with an increase of 2.17%, closing the month at 805.01 points.

The Belgrade Stock Exchange (BELEX) published their trading statistics for August 2021, recording an equity turnover of EUR 4.86m. This converts into an average daily turnover of EUR 221k (+289.44% MoM).

Omoljica was the front-runner by generating 75.51% of the total turnover recorded in August. Followed by NIS with 7.54% and Vojvodina with 3.36%. Next came Tehnohemija with 2.93% and Komercijalna banka with 2.40%. Previously mentioned top five traded shares generated 91.74% of the total value traded in the period.

Turning our attention to BELEX15 constituents, Alfa Plam, which has the lowest weight within the index at 1.83%, witnesses the biggest increase of 53.62% putting their share price to RSD 31,800. Komercijalna banka comes next with an increase of 38.39%. Messer Tehnogas and Jedinstvo follow with a raise of 13.79% and 5.88%, respectively.

On the other hand, Metalac records the biggest decrease out of BELEX15 constituents at 2.11% which puts their price per share at RSD 1,860. It’s also worth noting that BELEX15 observed a decrease of 95.32% MoM (or EUR 3.61m).