Today’s monetary policy meeting of ECB’s Governing Council should be classified as a non-event. However, market will be interested into Ms Lagarde’s speech and her comments on rising inflation and short-term rates expectations. Furthermore, market will look at any hints on how ECB plans to replace its PEPP program.

With their balance sheet being higher than ever and rates being lower than ever, every step by central bankers is watched with much scrutiny. Although market does not expect Ms Lagarde to announce any changes on today’s policy meeting, this event is still the main dish of the investors’ week as Ms Lagarde has several tasks today. First, she should push back market’s expectations that EUR interest rates will be lifted already in 2022 as Euribor futures show. After BOE’s governor stated that central bank will have to act against inflation, markets started to price larger rates in UK but there were some spillovers into EUR and USD, i.e., 3M Euribor maturing in December 2022 decreased by more than 10ps. Several ECB officials led by chief economist Lane already commented on the topic saying that markets did not “fully absorb rate forward guidance”.

Next, Ms Lagarde could slowly start introducing new program that should replace PEPP once it ends in March 2022. PEPP’s envelope of EUR 1.85bn will most likely be used in full until March 2022 and the latest data show that ECB did not slow down purchases after September’s meeting although they announced slower purchases compared to Q2 and Q3. Market expects ECB to announce new program in December 2021 which would ensure smooth transition from PEPP and favorable financial conditions for eurozone beyond March 2022. However, the main question is how much flexibility ECB wants to leave for the new package. Capital key, monthly pace, Greece, just to name a few. We expect ECB to include Greek bonds into purchase programs going further and to leave capital key flexibility like PEPP. However, new package could be only ad-hoc rather than having projected monthly purchases. More on that most likely only in December. Talking about ECB’s tools, we should mention TLTRO also, as ECB will have to prepare new tranches of the program to avoid any liquidity issues.

In the end, market will look at Lagarde’s comments on inflation risks, as last time she said that risks were broadly balanced. After the last meeting, energy prices continued rising strongly, while CPI growth did not show any signs of decelerating. Nevertheless, ECB’s stance is that most of the inflationary shocks were only temporary, and it sees inflation to drop below 2.0% already next year. Their forward guidance on rates stated that rates will remain at current levels or lower until inflation reaches 2.0% well ahead of the end of projection horizon which could be forever. Their guidance leaves room for ECB to keep saying inflation is transitory for few years if they see it applicable.

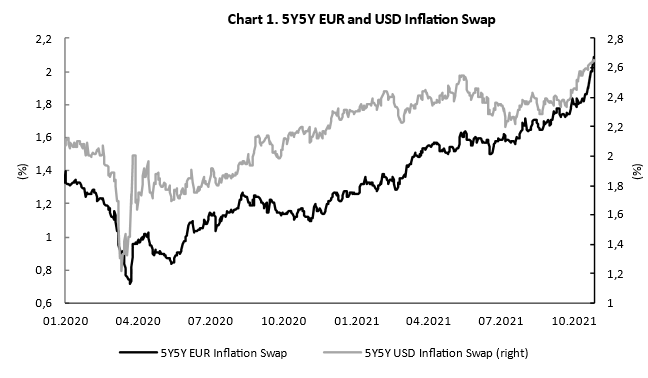

However, looking at 5Y5Y inflation swap that looks at 5Y average inflation beyond 2026 which is above 2.0%, it seems market does not believe ECB. Lagarde could leave inflation expectations to increase unlimited as financial conditions are still under loose and control, but we think that would be mistake as increased expectations would lead to self-fulfilling prophecy. So, ECB’s governor will most likely try to ensure market that slower wage growth, normalization of supply chains and energy costs will leave CPI below 2.0% in 2022 and curb inflation expectations.

Source: Bloomberg, InterCapital

ADPL ended the day in red yesterday, noting a decrease of 9.1%.

AD Plastik published yesterday their 9M 2021 results, according to which the Group noted a decrease in sales of 1% YoY, a decrease in EBITDA of 10.3% and a decrease in net profit of 3.4%. However, when looking at solely Q3, sales decreased by 29% YoY, EBITDA decreased by 55% while the company also reported a net loss of HRK -9.5m. We note that a detailed overview of the 9M results are available to our Research subscribers.

Following the results investors unloaded the share, which led a sharp decrease in ADPL price by as much as 9.1%, erasing all gains made in 2021. We note that such a high daily decrease was the last time seen during the outbreak of the pandemic (18 March 2020) when the share decreased by 14.8%.

The share price ended the day at HRK 154 per share, which puts the company at a trailing 12m P/E of 13.8x and EV/EBITDA of 6.2x.

AD Plastik ended up being the second most traded share on ZSE, with a turnover of HRK 1.9m.

YTD Share Price performance of ADPL

In the first 9m of 2021, sales increased by 6.2% YoY, EBITDA increased by 47.8% and net profit increased by 70.9%.

In the first 9 months of 2021, Ericsson Nikola Tesla reported an increase in sales of 6.2% YoY, amounting to HRK 1.53bn.

Market-wise, in the domestic market, sales amounted to HRK 729.8m up by 9.8 YoY. In cooperation with HT, they have enabled the commercial use of 5G technology in the existing spectrum significantly before 5G frequencies were allocated. In export markets (excluding services to Ericsson) sales amounted to HRK 157m, noting an increase of 7.7% YoY. In addition to the negative impact of COVID-19 pandemic, the political and economic crisis in certain markets, primarily in Belarus and Bosnia and Herzegovina, additionally aggravates business performance. In Ericsson market, sales amounted to HRK 646.2m, up by 2.1% YoY.

On the operating expenses side, one can note an increase of 2.7% YoY reaching HRK 1.42bn. The above-mentioned results led to a significantly higher EBITDA (+47.8% YoY) of HRK 175.3m. Such a result also led to an improvement of EBITDA margin by 3.2 p.p. YoY (to 11.3%). Going further down the P&L, operating profit reached HRK 132.16m (+73.3%).

In the first 9 months, net financial result amounted to HRK 3.2m (vs HRK -1.11m). The better outcome could be mostly attributed to relatively favorable FX result.

Meanwhile, the Group reported a strong increase in net profit of as much as 70.9%, amounting to HRK 114.73m. Such a result puts the profit margin at 7.4% (+2.8 p.p. YoY).

The closing of the transaction is envisaged by 31 March 2022.

NLB published an announcement on the LJSE stating that Komercijalna banka Beograd and Banka Poštanska štedionica signed a sale and purchase agreement relating to 100% ordinary shares of Komercijalna Banka Banja Luka.

The closing of the transaction is envisaged by 31 March 2022 at the latest, subject to receipt of requisite regulatory approvals, while the effect of the transaction on the consolidated financial statements is not material.

As of end 2020, Komercijalna banka Banja Luka operated with 10 branches, 9 agencies and had 163 employees. The intention to divest from KB’s subsidiaries was already communicated by the company and does therefore come as no surprise.