Since its bottom (23 March) CROBEX is up by 23.8%, while since the beginning of November the index is up by as much as 7.3%.

CROBEX breached 1,700 points during yesterday’s trading session for the first time since March when the index observed a sharp decrease. However, the index ended the day in red at 1,690.23 points, representing a slight decrease of 0.34%.

Since its bottom (23 March) CROBEX is up by 23.8%, while since the beginning of November the index is up by as much as 7.3%. Such a result is in line with many other European indices which have gained momentum on the back of positive vaccine progress.

As a reminder, Moderna announced that, in a preliminary analysis of a large late-stage clinical trial, its Covid-19 vaccine was 94.5% effective. To be specific, the company stated that preliminary analysis of data from more than 30,000 volunteers showed that Moderna’s vaccine prevented virtually all symptomatic cases of Covid-19. Such news, alongside Pfizer’s announcement this month, could be considered the furthest scientific progress so far in the efforts against the spread of the virus.

Of the index constituents, the share prices of Tourist companies seemed to have benefited the most from the aforementioned news. Since the beginning of the November, Valamar Riviera has observed the highest share price increase of 20.4% and is currently trading at HRK 27.7 per share. Further, Arena Hospitality Group has also witnessed a high share price increase of 15.8% and is currently traded at HRK 308 per share.

Share Price Performance of CROBEX Constituents in November

As of October 2020, Slovenian mutual funds manage EUR 2.939bn, representing a decrease 1.6% MoM and a decrease of -2.7% YTD.

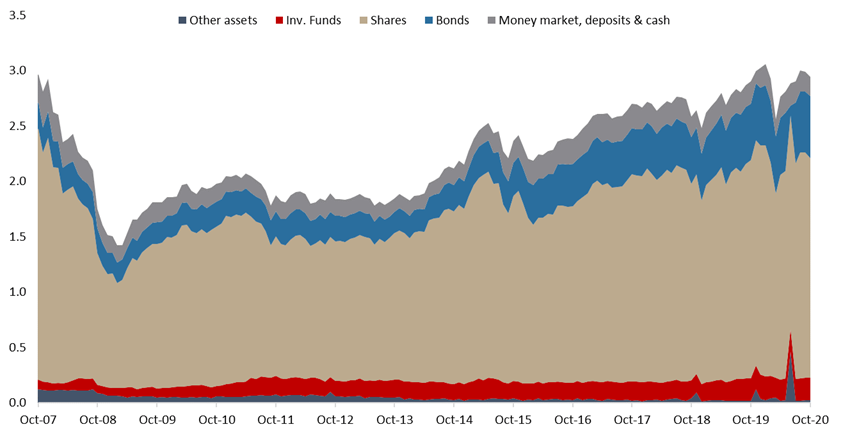

For today, we decided to present you with a short asset structure analysis of Slovenian mutual funds. When looking at the graph below, one can notice that the Slovenian mutual funds have not significantly changed their assets structure during COVID-19 crisis.

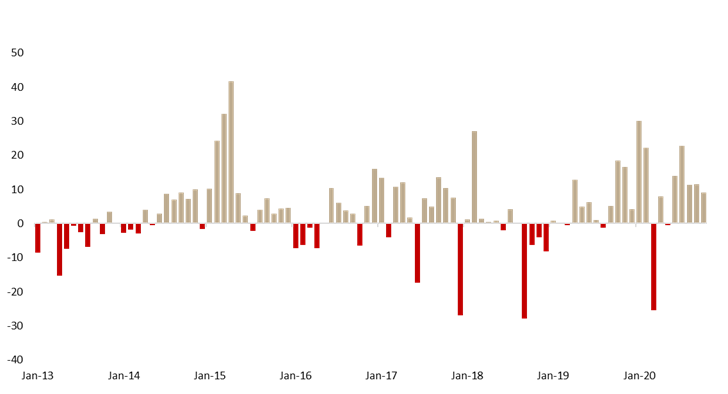

As of October 2020, Slovenian mutual funds manage EUR 2.39bn, recording a decrease of 1.6% MoM, which represents highest monthly decrease experienced since March, when mutual funds observed a sharp drop of 12.4%. It is also worth noting that mutual funds are experiencing a recovery after a considerable loss in March 2020 due to crisis caused by the Covid-19 pandemic. As a reminder, in April the AUM partially recovered with a 7.8% increase. Meanwhile, on a YTD basis, AUM is only 2.7% down, indicating that the investors were not withdrawing funds at a significant level during the Covid-19 outbreak, which was not the case in Croatia. To be specific, in March, net contribution to mutual funds amounted to EUR -25.5m. However, since than cumulative net contributions have significantly increased (by EUR 76.2m). Meanwhile, net contributions in October have amounted to EUR 9m.

Net contribution in the Slovenian mutual funds (EUR m)

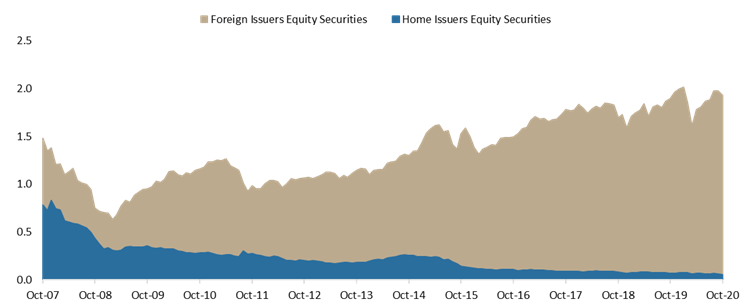

Turning our attention to the asset structure, as of October 2020, shares account for 67.4% of the total assets (or EUR 1.98bn). Shares observed a decrease of 2.5% MoM and were the main driver of the overall decrease. Note that the vast majority (97%) of equity holdings of Slovenian mutual funds come from the foreign market. Meanwhile, total equity holdings are down by 4.2% YTD. Domestic equity holdings, which amount to EUR 55.8m have witnessed a decrease of 6.3% MoM. Such a decrease is in line with SBITOP which dropped by as much as 6.2%, which notes the biggest decrease of the index since March (-19.17%). The aforementioned drop came on the back of a newly imposed “lockdown“ in Slovenia. To be specific, in order to prevent the spread of the virus, the Slovenian Government has imposed relatively harsh restrictions. Therefore, for the first time since WW2, a restriction on movement at night was introduced, meaning that Slovenians were not allowed to leave their homes from 9 pm until 6 am (with some exceptions).

On a YTD basis Slovenian mutual funds have observed a decrease in domestic equity holdings by 21.5%, while the current EUR 55.8m represents the lowest position in domestic equity since the inception of Regulator’s statistics.

Equity Holdings by Slovenian UCITS Funds (EUR bn)

Next come bonds, which make up for 19.1% of the total asset structure or EUR 560.5m. Of that, 93% come from the foreign market. Investment funds’ share in AUM amounts to 6.9% of total assets, while money market, deposits & cash account for 5.9%. In nominal terms, shares have observed the largest decrease of EUR 87.75m since the beginning of the year, while on the other hand, bond holdings are up by EUR 38.51m.

Total Assets of All Slovenian UCITS Funds (Sep 2007 – Sep 2020) (EUR bn)