As of October 2020, Slovenian mutual funds manage EUR 2.939bn, representing a decrease 1.6% MoM and a decrease of -2.7% YTD.

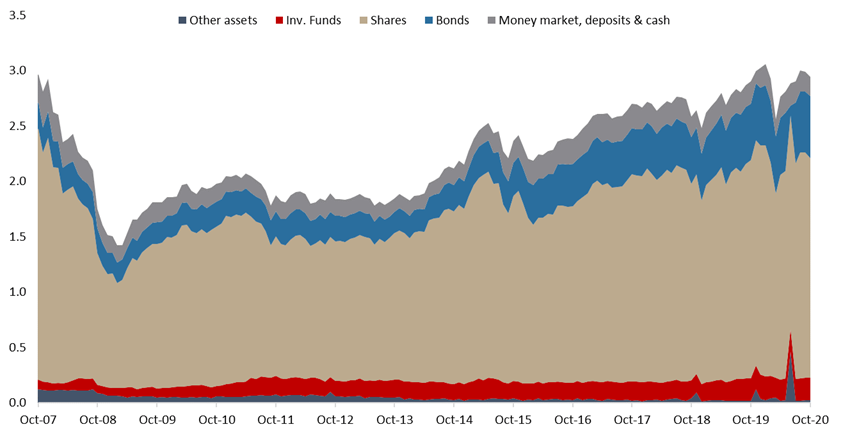

For today, we decided to present you with a short asset structure analysis of Slovenian mutual funds. When looking at the graph below, one can notice that the Slovenian mutual funds have not significantly changed their assets structure during COVID-19 crisis.

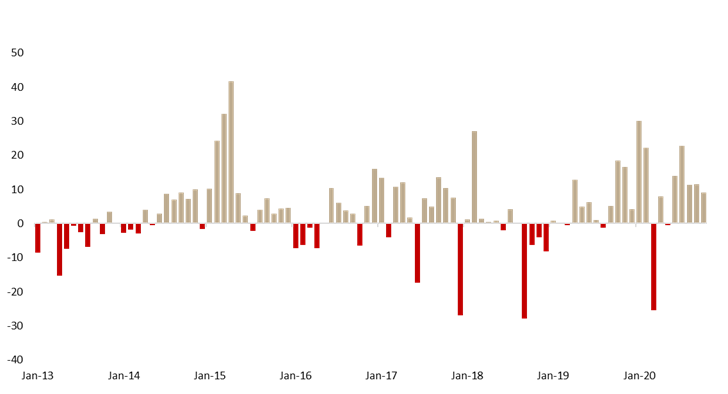

As of October 2020, Slovenian mutual funds manage EUR 2.39bn, recording a decrease of 1.6% MoM, which represents highest monthly decrease experienced since March, when mutual funds observed a sharp drop of 12.4%. It is also worth noting that mutual funds are experiencing a recovery after a considerable loss in March 2020 due to crisis caused by the Covid-19 pandemic. As a reminder, in April the AUM partially recovered with a 7.8% increase. Meanwhile, on a YTD basis, AUM is only 2.7% down, indicating that the investors were not withdrawing funds at a significant level during the Covid-19 outbreak, which was not the case in Croatia. To be specific, in March, net contribution to mutual funds amounted to EUR -25.5m. However, since than cumulative net contributions have significantly increased (by EUR 76.2m). Meanwhile, net contributions in October have amounted to EUR 9m.

Net contribution in the Slovenian mutual funds (EUR m)

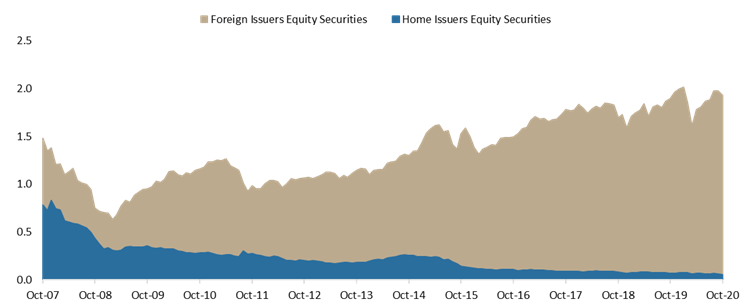

Turning our attention to the asset structure, as of October 2020, shares account for 67.4% of the total assets (or EUR 1.98bn). Shares observed a decrease of 2.5% MoM and were the main driver of the overall decrease. Note that the vast majority (97%) of equity holdings of Slovenian mutual funds come from the foreign market. Meanwhile, total equity holdings are down by 4.2% YTD. Domestic equity holdings, which amount to EUR 55.8m have witnessed a decrease of 6.3% MoM. Such a decrease is in line with SBITOP which dropped by as much as 6.2%, which notes the biggest decrease of the index since March (-19.17%). The aforementioned drop came on the back of a newly imposed “lockdown“ in Slovenia. To be specific, in order to prevent the spread of the virus, the Slovenian Government has imposed relatively harsh restrictions. Therefore, for the first time since WW2, a restriction on movement at night was introduced, meaning that Slovenians were not allowed to leave their homes from 9 pm until 6 am (with some exceptions).

On a YTD basis Slovenian mutual funds have observed a decrease in domestic equity holdings by 21.5%, while the current EUR 55.8m represents the lowest position in domestic equity since the inception of Regulator’s statistics.

Equity Holdings by Slovenian UCITS Funds (EUR bn)

Next come bonds, which make up for 19.1% of the total asset structure or EUR 560.5m. Of that, 93% come from the foreign market. Investment funds’ share in AUM amounts to 6.9% of total assets, while money market, deposits & cash account for 5.9%. In nominal terms, shares have observed the largest decrease of EUR 87.75m since the beginning of the year, while on the other hand, bond holdings are up by EUR 38.51m.

Total Assets of All Slovenian UCITS Funds (Sep 2007 – Sep 2020) (EUR bn)