After initially publishing our predictions for the EURO 2020 group stage, today we bring you our estimates on who will be successful in the first matches of the knockout phase.

And just to remind you that our predictions do carry some weight after all, in our first estimate we successfully predicted 13 out of the current 16 countries to compete in the knockout phase as well as 5 out of 6 group winners. To see what our initial estimates were, please click on the link.

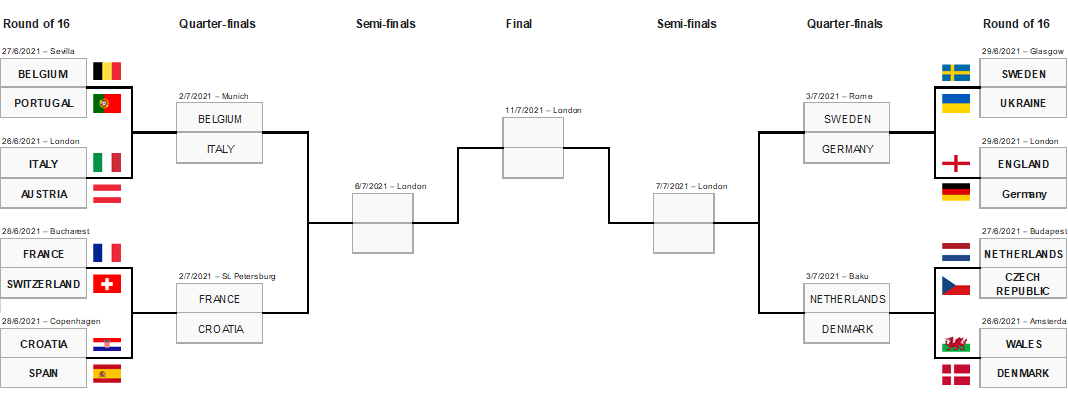

Below, you can find our new match predictions. We note that the stated predictions are a consensus of the InterCapital Group’s employees. We are by no means football experts, but there are definitely a couple football enthusiasts among us. Following the end of the first round of the knockout phase, we will be revisiting our estimates to see how accurate they were and will be giving another prediction on the quarter finals as well.

Knockout Stage & Quarterfinals– InterCapital Estimates

Today we bring you an overview of Fondul Proprietatea and other Romanian close-end funds’ current price to NAV discount.

Current Price To NAV Discount (%)

Among the observed funds, the highest discount was recorded by SIF Muntenia with a discount rate amounting to 64%, followed by SIF Oltenia (54%), SIF Banat (53%), SIF Muntentia (45%), SIF Transilvania (39%). Meanwhile Fondul Proprietatea managed to virtually completely eliminate their price to NAV discount which now stands at just 0.4%.

Although the discount to NAV is varies among the observed SIF it could be explained by the quality of assets that they hold. Namely, while SIF Muntenia holds more than 70% of their assets in listed shares, roughly half are listed on the BVB’s most demanding and premier segment, while the rest are in less quality segments. On the flip side, SIF Transilvania, who trades at the smallest discount to price among the observed SIFs has rather favourable asset class structure with listed equities accounting for 81% of the fund’s assets, while another 6% of assets is held in listed UCITS and non-UCITS equity securities.

Historic Price To NAV Discount (%)