CEE finally got interesting on Wednesday when Poland and Romania placed brand new international bonds. So far we didn’t manage to find any decent analysis on the placements and received the explanation from one investment bank that a lot of their fixed income research staff is on a study break for this week’s CFA exams. Luckily, our team finished the CFA journey and is fully able to deliver a substantiated analysis of last week’s bond placements. Enjoy your reading.

At first glance the Wednesday’s ROMANI$ syndicate looks relatively bad from the owner’s perspective (the issuer would subscribe to the opposite view).

Romanian Ministry of Finance decided to place a dual USD tranche and went to the markets with IPTs at T+250bps/T+320bps for 5.5Y/12.0Y maturities. These IPTs raised a couple of eyebrows since it indicated 60bps-80bps NIP, depending upon whom you ask to price the curve. In our view, calculating the NIP (new issuance premium) was a pointless task indeed since ROMANI$ cash prices were marked quite low and it was difficult to find a buyer for the existing bonds. The risk off environment was getting worse by the day and asset managers were asking themselves how much juice would Romania have to give in order to make the deal float.

It’s worth bearing in mind that Romanian Ministry of Finance planned to raise as much as 10bn EUR this year on international markets and with Wednesday’s syndicate they managed to get close to 6.75bn USD in existing deals. This was third Romanian syndicate this year, following a 2.4bn USD 5Y/17Y USD placement and 2.5bn EUR dual tranche, both transactions happening in January. In a nutshell, close to half Romanian funding needs were closed in January and the situation looked quite good for the sovereign. Then the environment got a bit colder.

First of all, the IPTs contracted by some 10bps and some of the asset managers were seeing the ROMANI 6 05/25/2034$ at NIPs as wide as 70bps! Wow! On the other hand, some of the asset owners claimed it was irresponsible to place 1.75bn USD of new paper on a 3.00bn USD orderbook (implying a 1.7x bid-to-cover). To make things worse, SPX went down from 4.100 to 3.900 on the day of the bond placement. According to one of the bondholders: “It was like the Supreme Court upheld Murphy’s Law – you had an outsized print, by a twin deficit SEE country, in the midst of the risk off environment!” Truth be told, on the following day both bonds were marked lower and we did see some sellers, but the clips were measured in hundreds of thousands. The bond flipping aristocracy sat through this time, possibly learning a lesson on previous CEE/SEE syndicates that without the central banks as marginal bond buyers all of this is a losing game. A bit less smart money was attracted to cheap valuations and was cut in the process – luckily there was a handful of UK HF’s shorting it on the syndication day and closing the deals on the following morning. This at least gave the FM accounts some source of bids. Finally, ROMANI 5.25 11/25/2027$ was placed at 5.3% YTM (ref 99.764, T+240bps), while ROMANI 6 05/25/2034$ was placed at 6.02% YTM (ref 99.839, T+310bps).

There are some silver linings as well in the CEE space. Poland placed a EUR syndicate on Wednesday as well, 2bn EUR worth of 10Y paper on a 4.1bn EUR book (implying a 2.05x bid-to-cover). IPTs came early at MS+125bps and managed to close at MS+110bps, putting the end yield to maturity at 2.85%.

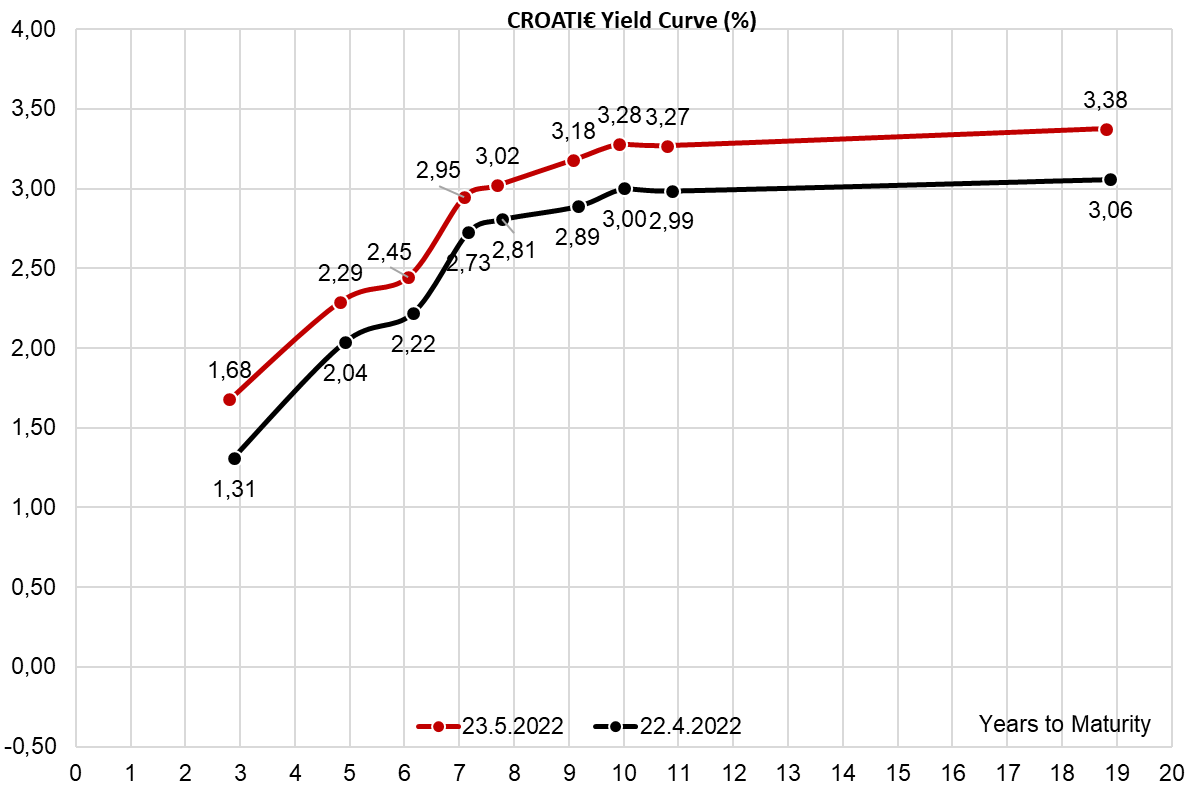

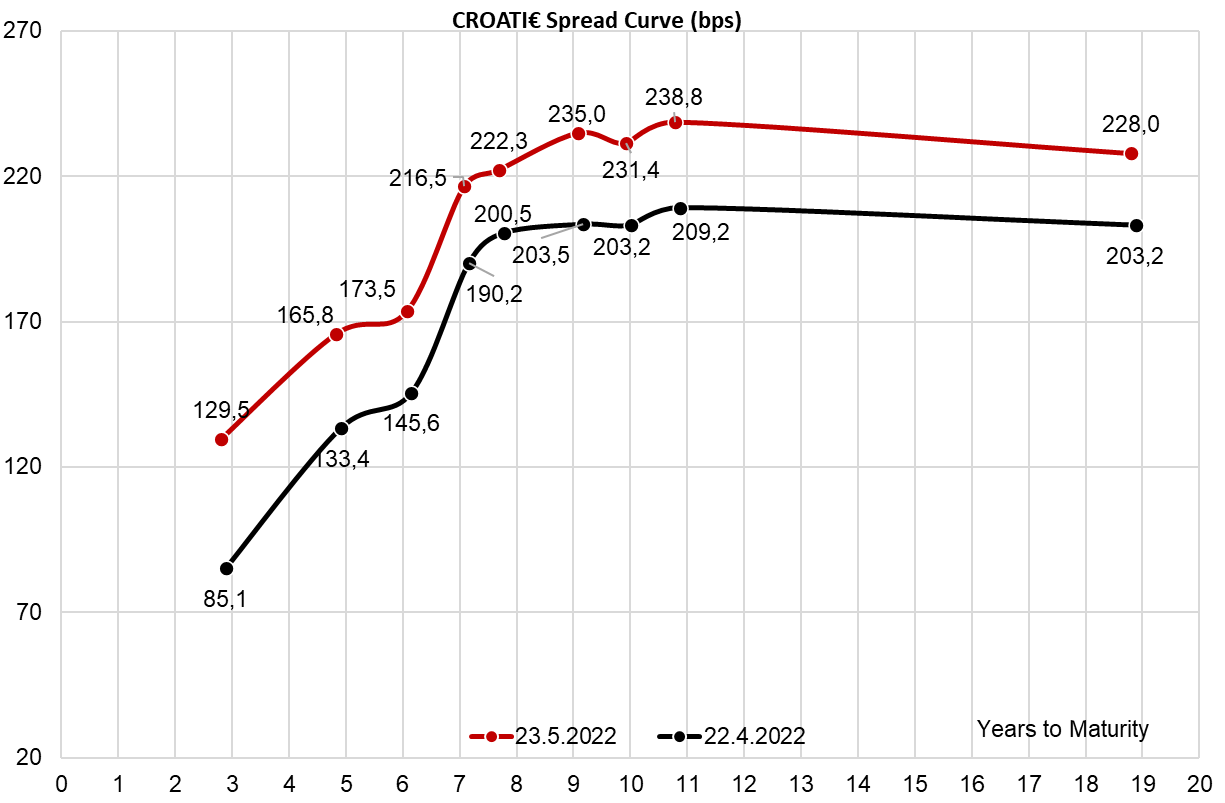

A bit of a context is needed here. Remember when Croatia placed 10Y paper exactly a month ago and the paper was quoted at B+205bps/B+203bps (bid/ask) on the following day? How could you not remember our research piece on the following day titled “The Eagle Has Hatched, but When Will It Fly?“. Well, this morning POLAND 2.75 05/25/2032€ is quoted at B+178bps/B+175bps (bid/ask). Oh and don’t forget that Poland is A2/A-/A-, compared to Croatia’s Ba1/BBB-/BBB. This morning CROATI 2.875 04/22/2032€ is priced at B+232.5bps/B+230.0bps, which is some 50bps wider than Poland. We would argue that it’s more likely that CROATI€ is rich instead of POLAND€ being cheap, but on a market like this nobody can guarantee anything.

By the end of April 2022, the NAV of the Croatian mutual funds decreased by -2.9% MoM, amounting to HRK 17.6bn. This continues the declining trend that started in November, meaning that on a YoY basis, the decrease in NAV amounts to -10.8% YoY.

The Croatian Agency for the Supervision of Financial Institutions (HANFA) has published its latest monthly report on the developments in the financial markets. With the Croatian mutual funds being such key players in the financial market, we decided to bring you an updated overview of their performance. In April 2022, the NAV amounted to HRK 17.6bn, a decrease of -2.9% MoM, and -10.8% YoY. This is also the smallest MoM decline since the Russian invasion of Ukraine, as in February and March the NAV declined by -10% and 4.7% (on an MoM basis), respectively.

Looking at the types of holdings, the largest absolute decrease was experienced by deposits and cash, whose holdings were reduced by HRK -470.6m or -11% MoM, and HRK -1.25bn or -25% YoY. Considering the current uncertainty in the market, and the high inflation rates, different forms of investments are looked for which can „weather the storm“ better.

Next up, we have the bond holdings, whose holdings were reduced by HRK -227.2m (or -2.2% MoM), while on a YoY basis, they decreased by HRK -1.79bn, representing a decrease of -15%. Considering the current high inflation rates and the expected key rate increases, the sell-off is expected. Moving on, the 3rd largest decrease was recorded by share holdings, which lost -4% or HRK -95.6m of its value MoM but are still in the positive on a YoY basis, being higher by HRK 238.2m or 12%.

On the flip side, mutual funds increased their holdings in investment funds by HRK 243.4m (or 17.8% MoM), representing the highest increase of all the holdings. This is also true on a YoY basis, as holdings in inv. funds have increased by HRK 661.7m, or 69% YoY.

Meanwhile, looking at the securities and deposits, domestic securities decreased by -1.4% MoM (or HRK -133.8m), while foreign securities increased only slightly, by 0.15% (or HRK 9.1m). On a YoY basis, however, both the domestic and foreign securities and deposits decreased, with domestic ones losing -14% (or HRK -1.47bn), while foreign securities and deposits lost -4% (or HRK -248.4m) YoY.

Furthermore, taking a look at the asset structure of the mutual funds, bonds still remain the most prominent asset structure, at 55.2%, which represents an increase of 0.4 p.p. MoM, but also a decrease of -2.9 p.p. YoY. The slight increase on an MoM basis can be attributed to the entire NAV declining faster than the bond holdings. Moving on, deposits and cash are the 2nd largest asset holding, with 20.8% of the total, a decrease of -1.9 p.p. MoM and -4 p.p. YoY. Shares, the 3rd largest asset holding, lost -0.1 p.p. MoM, but still gained 2.5 p.p. YoY. Meanwhile, the most significant gain was experienced by the inv. funds, which gained 1.6 p.p. MoM, 4.2 p.p. YoY.

Croatian mutual funds AUM structure (April 2022, %)

It should also be noted that UCITS funds investments in domestic equity, which accounts for 27.3% of total equity holdings, were down by -14% YoY, while investments in foreign equity holdings, which account for the remaining 72.7%, are down by -26% YoY. Finally, net contributions decreased by HRK -256.6m during the month.

Total assets of all Croatian UCITS funds (2015 – April 2022, EURm)

While the decrease in value of equity can be attributed to the current uncertainty and volatility in the world (inflation, the geopolitical situation, etc.), if we look at the YoY data of some of the largest indices, we can see that the aforementioned net contributions decreases also had an influence on the funds, in some cases more some than the decrease of value. This is especially true for domestic equity, with CROBEX10 at the end of April increasing by 8.53% YoY, and 1.53% MoM. Meanwhile, if we looked at some of the largest international indices, FTSE 100 increased by 8.25% YoY, 0.38% MoM, while S&P500 decreased by -1.2% YoY, -8.8% MoM, and finally, DAX, which lost -6.9% of its value YoY, -2.2% MoM. What this can tell us is that the decrease in the value of foreign equity had a more significant influence on the decrease of investments in foreign equity holdings than was the case with domestic equity investments.

Performance of select indices in April 2022, YoY (%)