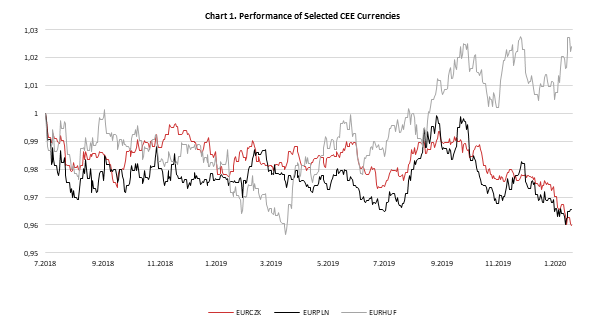

2019 was a stellar year for most of the asset classes, with equities, bonds and commodities posting double-digit performances. However, CEE currencies’ results were mixed. CZK and PLN posted modest positive gains against EUR which, when including for carry, amounted to a total return of close to 3.0%. On the other side Hungarian forint depreciated against EUR by 3.0% in 2019 while Romanian Leu dropped by 2.3%. In the first three weeks of 2020, we are witnessing similar pattern and in this short article we are trying to explain main forces behind CEE currencies and what to expect next.

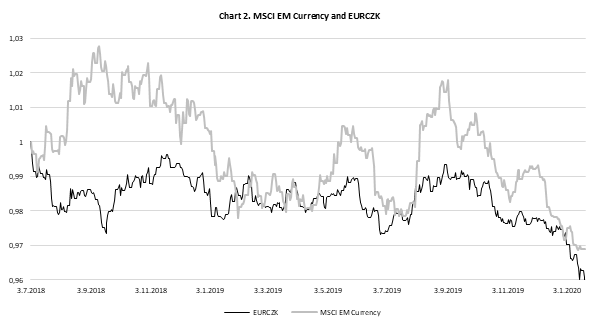

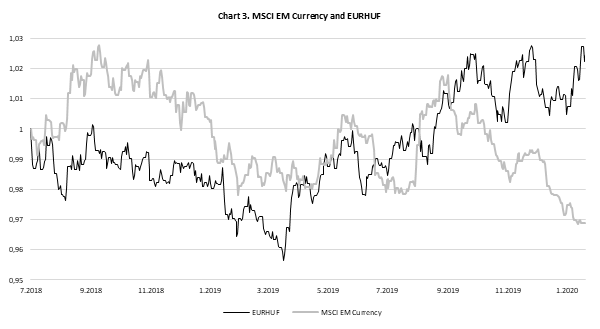

Let’s start this short analysis of currencies in CEE universe by looking at broader environment in which they operate. To start with, our selected CEE currencies (CZK, PLN, HUF and RON) all have positive correlation with euro and with several EM currency indices (this is obvious as our CEE currencies are included in these indices and ETFs). Furthermore, all these currencies post positive correlation with world equity as well, meaning that they appreciate in risk-on periods and vice versa. Regarding economic condition, these 4 selected CEE countries all have similar patterns: they all grow above EU average, their labor markets are very tight while inflation is running on the upper side of the tolerate bands of central banks. Reference rates are above ECB’s, implying they are used as carry currencies, except HUF. Reference rate is the lowest in Hungary at 0.90% and looking at the bid side of EURHUF forward points, there’s only modest 0.50% interest differential to obtain for a one-year period. For both CZK and PLN investor can expect interest differential around 2.0% while Romanian Leu carries almost 4.0%. There are also some idiosyncrasies that needs to be considered. For example, there were some risks in Poland due to CHF loans, while in Romania there were and still are substantial risks connected with overheating of the economy and widening of twin deficits. Also, all these countries were under risk of messy Brexit and lower world trade driven by trade war between US, China and EU.

Source: Bloomberg, InterCapital

Now let’s have a look at what happened in 2019. Last year’s total return was positive among 3 out of 4 countries. Namely, CZK and PLN posted spot positive returns which coupled with solid carry totals almost 3.0%, while Romanian Leu posted negative spot performance, but substantial carry more than compensated for that. On the other side HUF’s modest carry wasn’t enough to cover solid depreciation over single currency. What was the biggest driver of such a divergence compared to PLN and CZK? Most likely, the most real negative interest rates in the whole world. Namely, inflation in Hungary stood at 3.4% in December while reference rate was almost 3.0% lower. Also, due to low interest rates, investors started to short Hungarian forint and use it as a funding currency to go long into richer EM currencies such as Turkish lira, Romanian Leu and so on.

Looking at the current year, Hungarian forint already lost some 2.0% and almost breached all- time highs. This week we saw BBG article saying that short position on HUF started to build in the last several months due to low interest rates that made forint a funding currency versus some “real” EM currencies. So, seems like correlations for Hungarian forint could currently be changed, as risk-off event could lead to buying of forint as investors will try to close their carry trade positions. Nevertheless, Hungarian forint is also part of EM currency baskets which often moves CEE currencies in the same direction meaning that we could see some mixed signals going further. Another important thing is that this Monday Hungarian central bank decided not to maintain its regular FX swap auction, most likely due to forint weakness. Nevertheless, it is not expected from bank to make a U turn in its monetary policy and to turn hawkish.

Source: Bloomberg, InterCapital

Source: Bloomberg, InterCapital

CZK and PLN on the other side continue with their appreciation trend in 2020, following major EM indices and rise of equity since the start of the year. However, there are some signs of economic weakening in Czech Republic which could force central bank to start easing again this year so one should have an eye on CNB. Going further, Romanian Leu stayed close to 4.78 versus single currency and continued moving in very tight band, most likely controlled by central bank. As twin deficits widen and with “government” not being able to deliver smaller wage and pension increases, risks mount which was also marked by governor Isarescu on their last meeting.

To conclude, as equities continue their rally, CZK and PLN are performing great this year, but question is how long this trend can last. On the other hand, Hungarian forint has seen some bad days which should come to an end in case central bank decides to draw the line in the sand as it did this Monday. In Romania there is great carry but also great risk which could be decreased in case new government finds enough political capital to stop wage and pension boosts that do not follow any productivity growth. In case new government stops at least some of the announced hikes, that could be RON positive in the end.

Croatian government budget to GDP ratio in 3Q 2019 increased 0.8 p.p. YoY and has amounted to 5.5% of GDP. Slovenia has achieved somewhat lower budget surplus of 1.6% of GDP that increased even higher for 1.1 p.p. YoY. As a comparison, EU government budget was in deficit of 0.7% of GDP while in Eurozone deficit stood at 0.5%.

Croatian government budget in 3Q 2019 was in surplus, amounting to 5.5% of GDP. When looking at the last six years of data, this is the highest surplus of all third quarters and is in line with seasonality of public income. Revenues tend to peak around penultimate quarter supported by record tourist season which was reflected in higher tax revenue. On the annual level we expect public budget to be roughly balanced. Announced hikes of public wages and additional costs due to Croatia presiding over EU from January to June is expected to result in small general budget deficit in this year. Public debt in third quarter increased in local currency by HRK 12.6 bn YoY due to different dynamics of debt maturity but is on an annual level on a downward trajectory. In relative terms debt to GDP stayed basically flat YoY and has amounted to 74.9% of GDP. As we expect solid development of public revenues in 4Q and positive economic development, we see the public debt in relative terms to GDP to remain firmly on a decreasing path. We see it falling further in this year below 70% of GDP.

Croatia Public Debt & Public Deficit (% GDP)

On the other hand, Slovenia has in Q3 achieved somewhat lower budget surplus of 1.6% GDP, an increase of 110 bps YoY. This trend is expected to continue and on the annual level small budget surplus is expected. Public debt has decreased by 3.3 p.p. YoY to 68.1% GDP driven by higher economic activity while nominal amount of debt has increased slightly to EUR 32.4 bn. Public debt is expected to decrease further by the end of 2020 driven by favorable economic cycle and loose monetary policy.

Slovenia Public Debt & Public Deficit (% GDP)

Trading statistics for December 2019 show an average daily turnover of EUR 5.98m. Meanwhile, on a FY basis average daily turnover amounted to EUR 8.2m (-17.1% YoY).

Yesterday, the Bucharest Stock Exchange published their trading statistics for December 2019, showing an average daily turnover of EUR 5.98m. Meanwhile, on a FY basis average daily turnover amounted to EUR 8.2m (-17.1% YoY).

Average Daily Turnover on the BVB (EUR m)

When observing the top traded shares in December, one can notice that Banca Transilvania recorded the highest turnover of RON 125.9m. Fondul Proprietatea comes next with RON 94.89m. Romgaz and OMV Petrom follow with RON 60.1m and RON 54m, respectively.

Of the BET index components, Alro observed the highest share price increase in December of 9.85%. DIGI Communications follows with an increase of 4.7%. On the flip side, BVB and Transgaz observed the highest share price decrease of 3.4% and 2.57%, respectively.

In 2019, of the main index constituents, 12 witnessed a double-digit share price increase, with Nuclearelectrica leading the list (+74.8%). Romgaz and Banca Transilvania follow, with an increase of 49.5% and 40.2%, respectively. On the flip side, Alro recorded the highest share rpice decrease of 24%.

Share Price Performance of BET Constituents in 2019 (%)

Turning our attention to the main index of the BVB, BET observed an increase of 0.91%, ending the year at 9,977.30 points. Meanwhile in 2019, BET recorded a solid performance of +34%, which is the highest index increase among all regional indices.