For today, we decided to present you with an updated asset structure analysis of Croatian Mandatory Pension funds.

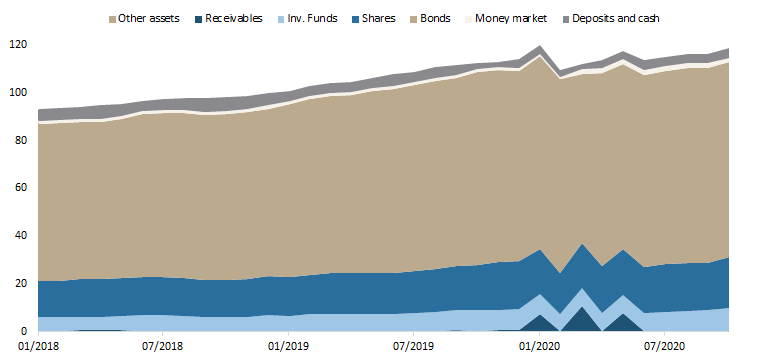

Pension funds could be seen as the key player on the Croatian capital market, as their current domestic equity holdings account for more than 40% of the free float market cap of ZSE. NAV of pension funds has witnessed a steady increase for each consecutive month since April, and as of end November stood at HRK 118.18bn (+2.1% MoM or HRK 2.44bn). Such an increase represents the best monthly performance in 2020. This also represents an increase of 5.1% YTD. As a reminder, in March (the worst performing month for almost all asset classes) the pension funds recorded a decrease of 3.3% MoM or HRK 3.76bn.

It is also worth adding that in November net contribution payments amounted to HRK 586.6m, remaining flat compared to the previous month.

Asset Structure of Croatian Mandatory Pension Funds (November 2020)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research

Looking at the asset composition of pension funds, asset managers have not changed significantly their composition, which can be seen in the graph above. Bonds account for the vast majority of total assets (68.7%) which as of November amounted to HRK 81.47bn (decrease of HRK 206m MoM or 0.3%). Shares come next, with 18% or HRK 21.47bn, representing an increase of as much as 8.4% MoM (or HR 1.67bn). Such a high increase could be attributed to the positive sentiment on both domestic and foreign markets amid encouraging vaccine development.

Unlike Croatian UCITS funds whose majority of equity holdings are foreign, mandatory pension funds have 57.2% (or HRK 12.3bn) of their equity holdings allocated in domestic shares. We note that shares turned green on a YTD basis, with an increase of 8.1%. Of that, domestic shares are slightly down by 0.5% YTD, while foreign shares are up by 22.2% YTD.

Total Assets of Croatian Mandatory Pension Funds (2018 – November 2020) (HRK bn)

Subject to fulfilment of other conditions for completion of the transaction, the transaction is expected to be completed by the end of 2020.

NLB Group announced yesterday that they have obtained the required regulatory approvals contemplated by the SPA in relation to the acquisition of Komercijalna Banka. Subject to fulfilment of other conditions for completion of the transaction, the transaction is expected to be completed by the end of 2020.

As a reminder, in late February NLB announced that they have entered into a share purchase agreement with the Republic of Serbia for the acquisition of an 83.23% ordinary shareholding in Komercijalna Banka.

NLB acquired the 83.23% shareholding for the amount of EUR 387m, which will be payable in cash on completion. Such a price puts the transaction multiple at P/B 0.77 and P/E 6, while it implies a valuation of EUR 465m for the 100% stake in Komercijalna Banka. Note that in accordance with Serbian bank privatisation regulations, NLB is not required to launch a mandatory tender offer for minorities’ shareholdings in Komercijalna Banka.

Following the completion of the acquisition, Serbia would become NLB’s second largest market accounting for roughly 24% of the Group’s assets (compared to current 4%). Meanwhile, the Group’s assets in core foreign markets would increase from 34% to roughly 49%.

To read more about NLB click here.

As of November 2020, Slovenian mutual funds manage EUR 3.15bn, representing a sharp increase of 7.2% MoM and an increase of 4.3% YTD.

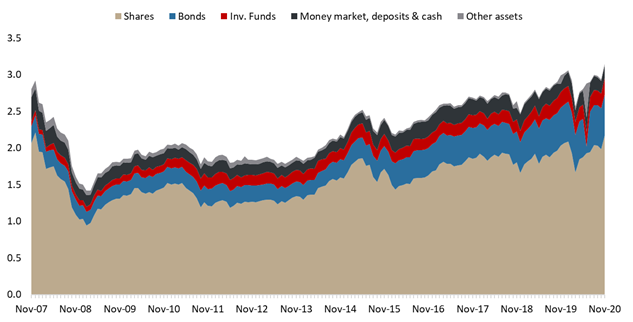

For today, we decided to present you with a short asset structure analysis of Slovenian mutual funds. When looking at the graph below, one can notice that the Slovenian mutual funds have not significantly changed their assets structure during COVID-19 crisis.

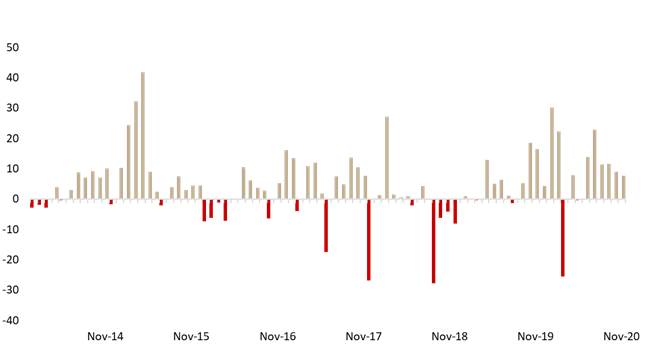

As of November 2020, Slovenian mutual funds manage EUR 3.15bn, recording a sharp increase of 7.2% MoM, which represents second highest monthly increase experienced since March, when mutual funds observed a sharp drop of 12.4%. Such a high monthly increase could almost exclusively be attributed to the positive sentiment observed on the financial markets in November, while net contributions to funds amounted to EUR 7.62m. It is also worth noting that mutual funds experienced a full recovery after a considerable loss in March 2020 due to crisis caused by the Covid-19 pandemic. As a reminder, in April the AUM partially recovered with a 7.8% increase. Meanwhile, on a YTD basis, AUM is up by 4.3% down, indicating that the investors were not withdrawing funds at a significant level during the Covid-19 outbreak, which was not the case in Croatia. To be specific, in March, net contribution to mutual funds amounted to EUR -25.5m. However, since than cumulative net contributions have significantly increased (by EUR 83.8m).

Net contribution in the Slovenian mutual funds (EUR m)

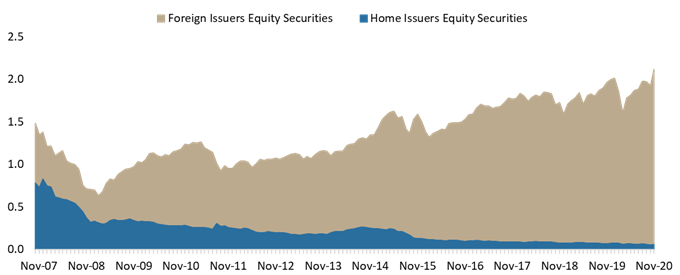

Turning our attention to the asset structure, as of November 2020, shares account for 68.9% of the total assets (or EUR 2.16bn). Shares observed an increase of 9.5% MoM and were the main driver of the overall increase. Note that the vast majority (97%) of equity holdings of Slovenian mutual funds come from the foreign market. Meanwhile, total equity holdings are up by 4.8% YTD. Domestic equity holdings, which amount to EUR 58.1m have witnessed an increase of 4.1% MoM. Such an increase indicates an underperformance relative to SBITOP which increased by as much as 12%, which notes its biggest increase in 2020. On a YTD basis Slovenian mutual funds have observed a decrease in domestic equity holdings by 18.3%, while the current EUR 58.1m represents the one of the lowest position in domestic equity since the inception of Regulator’s statistics.

Equity Holdings by Slovenian UCITS Funds (EUR bn)

Next come bonds, which make up for 17.9% of the total asset structure or EUR 563.8m. Of that, 94% come from the foreign market. Investment funds’ share in AUM amounts to 7% of total assets, while money market, deposits & cash account for 5.6%. In nominal terms, shares have observed the largest increase of EUR 99.6m since the beginning of the year, followed by bond holdings which are up by EUR 41.8m.

Total Assets of All Slovenian UCITS Funds (Nov 2007 – Nov 2020) (EUR bn)