With summer lull coming to an end, it’s worth our while to observe which sovereigns might be placing bonds in the coming weeks. Are you a money manager full of cash and you just became aware that in a world of negative short term rates cash really is trash? No fear, we’re here to the rescue – in the following brief research piece.

Beginning August German Bund was traded below -0.50% in nominal yield terms, the level recorded right after Georgia January runoff and right before the big bond slump of winter 2021. The -0.50% level recorded in August, coupled with US 5Y5Y inflation breakeven @ 2.36% and EA 5Y5Y inflation breakeven slightly below 1.70%, effectively meant that financial markets have completely bought the transitory inflation narrative. Even the skeptics camp had to give in to the FED claiming that in a regime like this depressed employment is more of a concern than elevated inflation – due to the negative real rates in the United States, the inflation skeptics called this regime „monetary repression“. What else do you call monetary policy where nominal rates are below expected inflation for the time being without using the word repression? (That was a rhetorical question, no answers needed, thank you very much.)

Well, that was in August and we’re in September right now, so the yields have been rising steadily and the move up has been slightly more pronounced in euro area than in the United States.

The reason? Well, not much other than some hawkish comments from Holtzmann (Austrian CB head) and Knot (Dutch CB head) regarding PEPP (nothing in particular) followed by Boštjan Vale‘s remarks that ECB is aware of the damage high inflation can cause. Our insight from the bond dealing rooms clarified that some of the desks were a bit worried about the supply coming up in the months ahead. Just yesterday Germany placed 5.5bn EUR on 30 year tenure @ 0.159% YTM, followed by Greek dual tranche of 1.5bn 5Y @ 0.02% YTM (wow! it’s positive) and 1bn EUR tap of 31y @ 1.675% YTM.

More will come. Slovenia announced yesterday a tender offer to buy shorter paper and replace them with longer dated maturities, so it wouldn’t surprise us if Slovenia decides to place one more 30Y paper (or tap the existing paper) in the weeks ahead.

Apart from Slovenia, focus of CEE fixed income investors would most likely be on countries such as Poland, Romania and Bulgaria. Croatian investors, mainly UCITS funds, are on their toes for any possible news on new ROMANI placement. Based on the information available, it’s quite likely that Romanian Ministry of Finance would circumvent local investors who demand higher nominal ROMGB yields to compensate for higher inflation rates at home, and instead tap the deep US market.

Why would they place USD paper instead of EUR-denominated? The reason lies in the tighter Z-spreads in dollar space compared to euros: for instance, ROMANI 3 02/14/2031$ traded at 122bps z-spread, so compare this to ROMANI 2.124 07/16/2031€ traded @ 185bps! It’s like this all along the yield/spread curve. At the longer part of the curve ROMANI 6.125 01/22/2044$ trades @ 214bps z-spread, while ROMANI 2.875 04/13/2042€ stands close to 266bps. Wide z-spreads in euroland likely reflect the expected supply in the coming four months when both sovereigns and corporates would tap the bond market to get the funding they need. Alas, Romania is likely to collect 1bn-2bn USD, while Serbia might also be next in line to get the funding for the infrastructure projects expected in 2022.

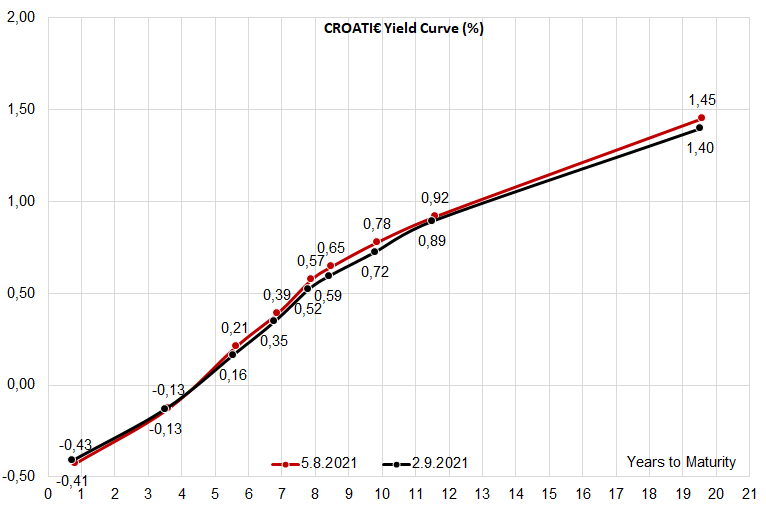

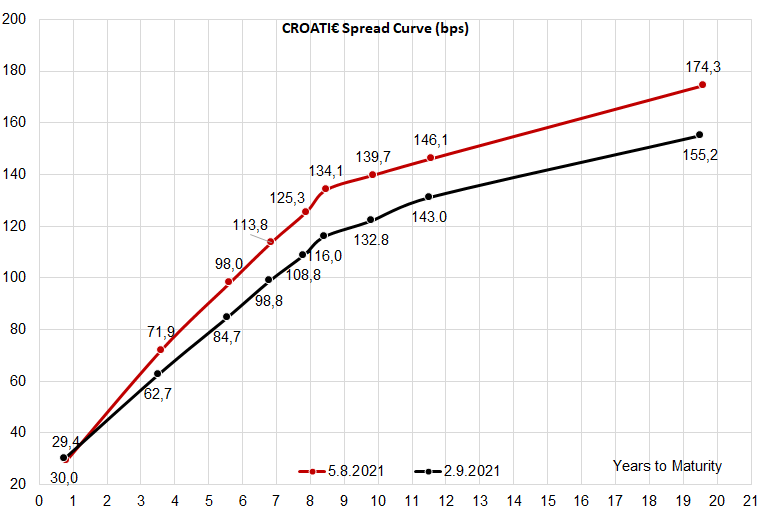

How are Croatian Eurobonds doing in the midst of the rising Bund yields? As indicated on the two charts submitted above (yield curve) and below (spread to Germany curve), the prices are intransigent due to poor trading, meaning that the spreads have tightened significantly. What we see Croatian investors doing right now, especially LDIs such as insurance companies, is switching away from long CROATI and into longer CROATE. Here’s what LDIs have been doing (at least the more active ones): a couple of days ago it was still possible to sell CROATI 1.5 06/17/2031 @ 107.50 clean (0.70% YTM) and move into CROATE 1 11/27/2034 @ 99.80 clean (1.02% YTM), pocketing some 32bps of extra return for 3.5 years of extra duration. Not bad, especially if you can put CROATE 1 11/27/2034 in HTC and keep price volatility at bay. Apart from that, we have seen significant buying interest on the longer dated bonds (2040 and 2041 maturities) and the buying interest is equally distributed among local and foreign clients. It’s also worth mentioning that there won’t be another bond placement before 2022, so the scramble for assets (bonds) would likely continue into year end.

The Group’s Croatian operations showed very strong results during the summer season, with August 2021 revenues being in line with August 2019 revenues.

Arena Hospitality Group published an announcement on the ZSE stating that its Croatian operations during July and August has exceeded the Management Board’s expectations, with the aggregate unaudited revenue for these two months reaching approximately 90% of the aggregate revenue for the same period in 2019. In addition, August 2021 revenue was in line with August 2019.

The company adds that these results were achieved without the usual gradual build up to the season, in a time when vaccination passports and testing are still in place and certain source countries retaining travel restrictions for Croatia.

The Group’s other operating region, consisting of Germany, Hungary and Serbia, has shown signs of recovery too, however the pace of such recovery varies by market and is slower than experienced in the leisure driven Croatian segment. The unaudited aggregate revenue for this region for July and August represents 39% of the aggregate revenue for the same period in 2019. However, with markets reopening and vaccination programs continuing to advance, the company expects a continued recovery.

As a reminder, back in Q3 of 2019, Arena Hospitality Group’s operating revenues stood at HRK 423.14m, while 9M revenues amounted to HRK 688.9m. Of that, HRK 501.3m (or c.73%) related to the Croatian operations, while HRK 182.2m related to German and Hungarian operations.

Cinkarna Celje published their H1 2021 results, recording an increase of 12.1% YoY in net sales revenue, 50% YoY increase in EBITDA and a net profit raise of 60% YoY.

In the first half of 2021, Cinkarna Celje noted net sales revenue of EUR 99.4m, which represents a growth of 12.10% YoY. Also, the result exceeded by 13% the plan for the period. The increase in sales is mostly driven by a surge in sales of their main product – titanium dioxide pigment which has a share of 80.9% in net sales revenue, as well as a result of increased optimism and further growth in construction sector and automotive industry. Furthermore, sales of the pigment increased by 9.4% YoY (or EUR 6.9m) caused by higher average price and an increase in quantities of pigment sold.

EBITDA witnessed an increase of 50% (or EUR 10.7m), driven by both growth in sales revenue by 12.1% (or EUR 10.7m), and decrease of operating expenses by 1.4% (or EUR 1m). Cost of material and services were same as in the same period last year. This is due to the fact that purchase prices of titanium-bearing raw materials are at similar levels as last year. the largest part of production costs included raw materials/material for production (87.3%), followed by energy (10.8%) and packaging (1.9%). Labour costs were down 4% YoY. The largest share of labour costs (76%), gross wages, decreased by 8% YoY. Therefore, EBITDA margin recorded a value of 26.8%, which sums to a 6.8 p.p. increase from H1 2020. Operating profit amounted to EUR 19.6m, up 68% YoY (vs. 1H 2020 of EUR 11.7 million). The operating performance in the first half of 2021 was objectively better than in the same period last year as a result of the postponement of the overhaul to autumn 2021, the record sales volumes in the first quarter and favourable selling process of the main product.

Cinkarna Celje documented a net profit of EUR 15.8m, which corresponded to an increase of 60% YoY (or EUR 5.9m). Net profit margin increased by 4.7 p.p. when comparing to the same period in 2020, which amounted to 15.9%.

Cinkarna Celje Key Financials (EUR)

Trading statistics for August 2021 demonstrate an average daily turnover of EUR 1.08m (+12.18% MoM). Meanwhile, SBITOP ended the month with an increase of 2.17%, concluding the month at 1,193.89 points.

The Ljubljana Stock Exchange (LJSE) published their trading statistics for August 2021, recording an equity turnover of EUR 23.7m. This converts into an average daily turnover of EUR 1.08m (+12.18% MoM).

Of the total value traded in the period (excluding block turnovers), Krka generated 45.24%, followed by NLB with 12.11%. Next comes Petrol with 10.46% and Luka Koper with 8.44%. Sava Re follows with 8.15%. These 5 shares generated 84.4% of the turnover recorded by the entire (equity) market excluding block turnovers.

Focusing on the total equity market capitalization, it witnessed a 2.51% MoM increase (or EUR 220m), and currently totals to EUR 9bn.

Concentrating on the SBITOP constituents, Cinkarna Celje leads with an increase of 6.44%, NLB follows with a growth of 5.78%, putting their share price at the end of the month at EUR 69.60 per share. Both Luka Koper and Sava Re follow closely with an increase of 4.84% and 4.73% to EUR 26.00 and EUR 28.80 per share, respectively.

On the other hand, Telekom Slovenije witnesses the biggest decrease out of SBITOP companies at 4.03%, placing price per share at EUR 57.20.

Performance of SBITOP Constituents (August 2021)