With summer lull coming to an end, it’s worth our while to observe which sovereigns might be placing bonds in the coming weeks. Are you a money manager full of cash and you just became aware that in a world of negative short term rates cash really is trash? No fear, we’re here to the rescue – in the following brief research piece.

Beginning August German Bund was traded below -0.50% in nominal yield terms, the level recorded right after Georgia January runoff and right before the big bond slump of winter 2021. The -0.50% level recorded in August, coupled with US 5Y5Y inflation breakeven @ 2.36% and EA 5Y5Y inflation breakeven slightly below 1.70%, effectively meant that financial markets have completely bought the transitory inflation narrative. Even the skeptics camp had to give in to the FED claiming that in a regime like this depressed employment is more of a concern than elevated inflation – due to the negative real rates in the United States, the inflation skeptics called this regime „monetary repression“. What else do you call monetary policy where nominal rates are below expected inflation for the time being without using the word repression? (That was a rhetorical question, no answers needed, thank you very much.)

Well, that was in August and we’re in September right now, so the yields have been rising steadily and the move up has been slightly more pronounced in euro area than in the United States.

The reason? Well, not much other than some hawkish comments from Holtzmann (Austrian CB head) and Knot (Dutch CB head) regarding PEPP (nothing in particular) followed by Boštjan Vale‘s remarks that ECB is aware of the damage high inflation can cause. Our insight from the bond dealing rooms clarified that some of the desks were a bit worried about the supply coming up in the months ahead. Just yesterday Germany placed 5.5bn EUR on 30 year tenure @ 0.159% YTM, followed by Greek dual tranche of 1.5bn 5Y @ 0.02% YTM (wow! it’s positive) and 1bn EUR tap of 31y @ 1.675% YTM.

More will come. Slovenia announced yesterday a tender offer to buy shorter paper and replace them with longer dated maturities, so it wouldn’t surprise us if Slovenia decides to place one more 30Y paper (or tap the existing paper) in the weeks ahead.

Apart from Slovenia, focus of CEE fixed income investors would most likely be on countries such as Poland, Romania and Bulgaria. Croatian investors, mainly UCITS funds, are on their toes for any possible news on new ROMANI placement. Based on the information available, it’s quite likely that Romanian Ministry of Finance would circumvent local investors who demand higher nominal ROMGB yields to compensate for higher inflation rates at home, and instead tap the deep US market.

Why would they place USD paper instead of EUR-denominated? The reason lies in the tighter Z-spreads in dollar space compared to euros: for instance, ROMANI 3 02/14/2031$ traded at 122bps z-spread, so compare this to ROMANI 2.124 07/16/2031€ traded @ 185bps! It’s like this all along the yield/spread curve. At the longer part of the curve ROMANI 6.125 01/22/2044$ trades @ 214bps z-spread, while ROMANI 2.875 04/13/2042€ stands close to 266bps. Wide z-spreads in euroland likely reflect the expected supply in the coming four months when both sovereigns and corporates would tap the bond market to get the funding they need. Alas, Romania is likely to collect 1bn-2bn USD, while Serbia might also be next in line to get the funding for the infrastructure projects expected in 2022.

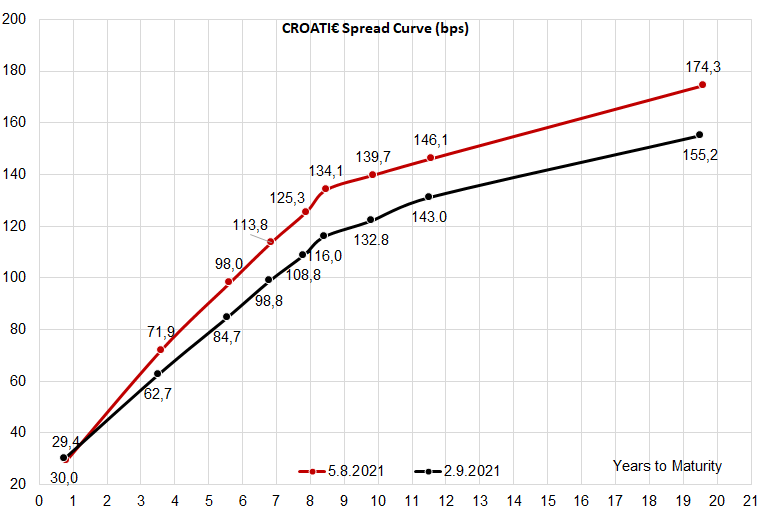

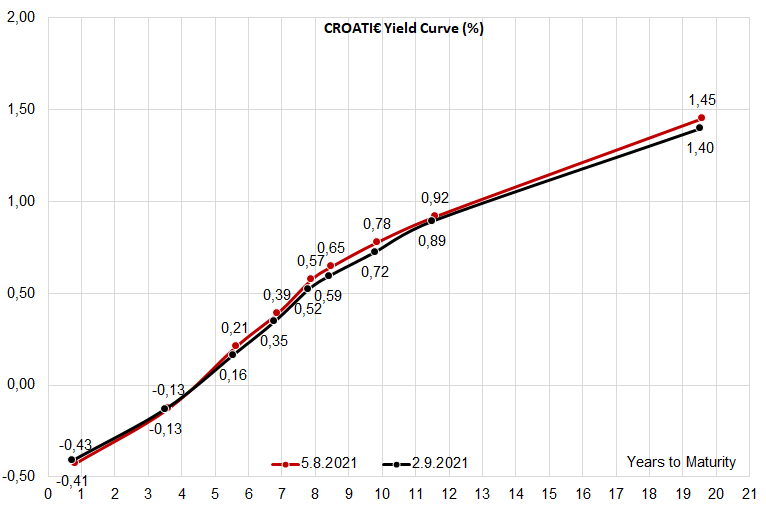

How are Croatian Eurobonds doing in the midst of the rising Bund yields? As indicated on the two charts submitted above (yield curve) and below (spread to Germany curve), the prices are intransigent due to poor trading, meaning that the spreads have tightened significantly. What we see Croatian investors doing right now, especially LDIs such as insurance companies, is switching away from long CROATI and into longer CROATE. Here’s what LDIs have been doing (at least the more active ones): a couple of days ago it was still possible to sell CROATI 1.5 06/17/2031 @ 107.50 clean (0.70% YTM) and move into CROATE 1 11/27/2034 @ 99.80 clean (1.02% YTM), pocketing some 32bps of extra return for 3.5 years of extra duration. Not bad, especially if you can put CROATE 1 11/27/2034 in HTC and keep price volatility at bay. Apart from that, we have seen significant buying interest on the longer dated bonds (2040 and 2041 maturities) and the buying interest is equally distributed among local and foreign clients. It’s also worth mentioning that there won’t be another bond placement before 2022, so the scramble for assets (bonds) would likely continue into year end.