As July 31st approaches, markets are on their toes to get any additional information about the first interest rate cut since the Great Recession in the world’s largest economy. The conviction to cut rates seems to be firm, but the action plan is still missing. On the Old Continent, the European Commission updated the 2019/20 GDP forecast and most of the SEE countries received a tap on the back. Find out what this all means in this brief article.

Yesterday’s testimony delivered by the FED Chairman Jerome Powell before the Congress enforced conviction that the first rate cut since 2008 is still coming and there’s very little doubt about that. The big question that had to be answered yesterday was did a strong NFP number alter in any way the resolution of US central bank to cut rates – and the answer was a big, confident NO. The source of this resolution comes from weak global macroeconomic backdrop which is characterized by tit-for-tat trade wars and an apparent growth slowdown (visible in high frequency data such as manufacturing orders, PMIs, and investment).

It’s also worth mentioning that minutes from the June FOMC meeting were released yesterday and there is one sentence that underscores the high probability of a rate cut in July: „Several participants noted that a near-term cut in the target range for the federal funds rate could help cushion the effects of possible future adverse shocks to the economy and, hence, was appropriate policy from a risk-management perspective“ (page 10 of the report). It’s curious to note that August 2019 FED fund futures currently price a 2.10% implied FED fund rate – meaning that one July cut is certainly expected, but the market aren’t really sure whether it’s going to be a 25bps or 50bps cut. In the aftermath of Bullard’s comments and strong NFP, it’s obvious that market participants aren’t putting their blue chips on the 50bps cut (nevertheless, it’s still in the realm of possible).

On this side of the Atlantic it’s worth mentioning that the European Commission published its Summer 2019 Economic Forecast. As usual, not much has changed and the Commission still expects the euro area economy to expand by +1.2% YoY in both 2019 and 2020. It’s worth mentioning that Barleymont economic forecasters expect German economy to expand by +0.5% YoY in 2019, however last week’s factory orders data point out that the risk of 2019 recession appear to be elevated. If You’re planning a vacation in August, watch out for August 14th when German GDP data come out – this might give European bond markets a proper shake up.

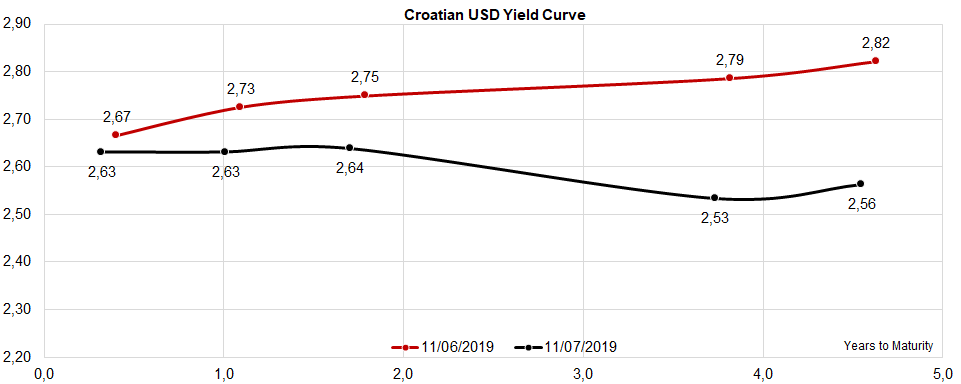

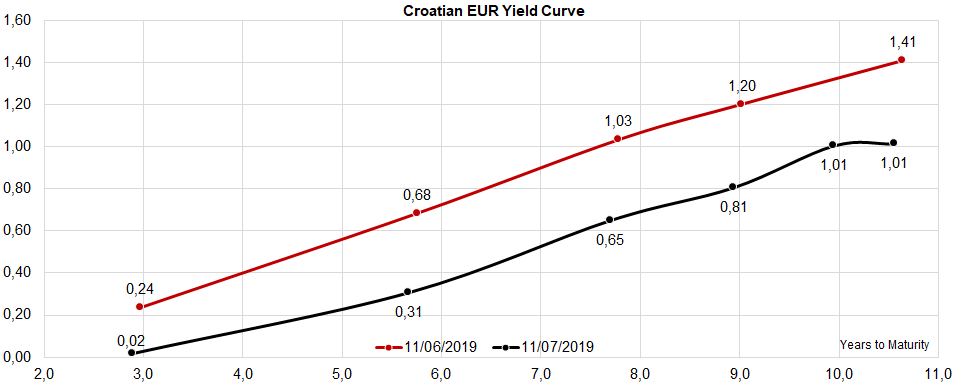

Speaking about the SEE region, the Commission upgraded it’s forecast of Croatian GDP growth in both 2019 and 2020 – in summer projection these figures stand at +3.1% YoY (versus +2.6% YoY in spring forecast) and at +2.7% YoY (versus 2.5% YoY), respectively. The explanation behind these upgrades is quite comprehensive – in a nutshell, personal consumption growth and investment would offset a slowdown in services export (a.k.a tourism). For this purpose, watch out for the August 28th flash data on Croatian GDP data which would be completed two days later (August 30th) by final data. Upbeat economic data and now secular trend of public debt contraction on a %GDP basis set the stage for continued reduction in yields, depicted on the charts submitted.

Slovenian economic growth also received a minor upgrade and Commission currently harbours a +3.2% YoY (versus +3.1% YoY in spring forecast) and +2.8% YoY (unchanged) for 2019 and 2020, respectively. In both cases of Croatia and Slovenia, it’s reasonable to assume that with major trading partners slowing down and with Mediterranean tourism competition getting stiffer, the bulk of the upgrade in expectations comes from domestic sources – higher wages, consumer credit etc. It’s also worth mentioning that yesterday Slovenian IMAD warned about wage growth decoupling from productivity growth in first quarter of 2019, something that hadn’t occurred in 2018. We’re still in expansion, but we’re obviously in the bottom of the ninth inning (if You watch baseball) or the overtime (if You fancy football).

In H1 2019, Luka Koper registered 11.9m tons of total maritime throughput (-1% YoY).

In H1 2019, Luka Koper registered 11.9m tons of total maritime throughput, representing a 1% decrease YoY. However, net sales revenues recorded a 6% YoY increase, amounting to EUR 118m. The increase could mostly be attributed to the better cargo structure and additional services on goods.

The company states that they registered a decrease of volumes on the car segment (-14%), mostly because of the global slowdown of sales of new cars. The general cargo segment amounted to 704,251 tons, representing a decrease of 9%. This segment (mostly timber and steel products) has been suffering from the unstable political situation in North Africa and the Middle East and volatility for a longer time. On the other hand, the trend of containerization is bringing positive effects, with conventional cargo transports decreasing in favor of container transports, resulting in a 5% increase in containers cargo.

The traffic of containers reached 497,891 TEU in the January – June period 2019, representing a 2% increase. The company adds that an increasingly important segment are the container freight station services, mostly stripping/stuffing of containers, with multiplicative effects on various terminals and bringing opportunities for higher value-added services.

Turning our attention to dry bulk volumes, Luka Koper registered a 9% decrease, amounting to 3.84m tons. Such a decrease can be mostly attributable to two factors: a technical failure at the facility of one of the customers, who uses the port of Koper as a supply point for coal, while the other factor is the delay of ships arrivals into July.

To put things into a perspective, new deals account for 39.3% of the company’s T12 operating revenue.

AD Plastik Group has sealed new deals worth EUR 71.4m for new vehicles of the Renault-Nissan Avto VAZ Alliance. Renault vehicles will be manufactured at the Avto VAZ factory in Togliatti. AD Plastik Group has sealed deals on development and manufacturing of more than 80 different exterior components, such as bumper components, rocker panels and under engine covers which will be produced in Togliatti factory. The start of serial production will likely begin in the second quarter of 2021, and the estimated duration of the project is eight years. New vehicles are expected to be sold in the amount of over 140,000 vehicles. To put things into a perspective, new deals account for 39.3% of the company’s T12 operating revenue.