MSCI, the best known for its series of stock indices that provide a benchmark for many ETFs and mutual funds, has recently published its regular revision. The revision is favoring our region regarding its visibility for Croatia, Slovenian and Romania in the form of new representatives in MSCI’s Frontier Index.

MSCI, the largest provider of stock indices globally and best known for those series of stock indices being a benchmark for many ETFs and mutual funds, has recently published its regular revision. In a recent publication of its regular revision, MSCI has decidedly shed light upon our region and its potential for Croatia, Slovenia, and Romania (among others). This strategic move is manifested in the form of new entrants into MSCI’s esteemed indices, a recognition, which might bring an unlocking substantial value through recognition. The changes will take place as of the close of 31 August 2023.

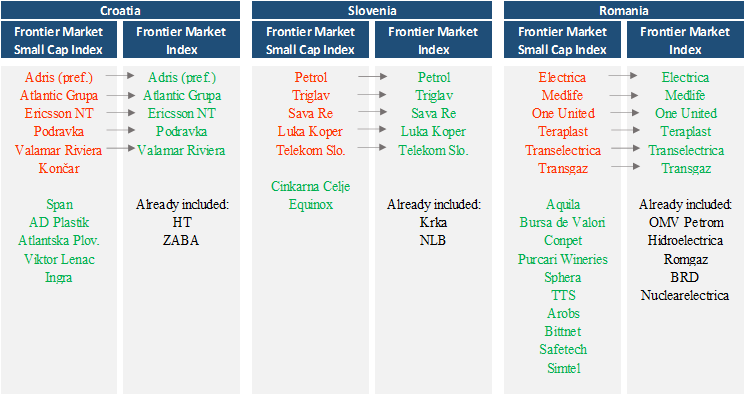

In short, MSCI divides frontier market into two main categories that enter the Frontier Market Index: Frontier Small Cap Index and Frontier Market Index, which is composed of companies with even higher market capitalization compared to Small Cap.

With that said, if a company is on any of these lists, it makes it „investable“ in the eyes of asset managers and investors. Additionally, special attention is paid to the companies listed on Frontier Market Index (read: not in Small Cap index). Companies like the aforementioned might be included in passive ETFs that track MSCI Frontier Market as its constituent. However, we note that this will also act as a catalyst for easier passing of investor’s screening when looking at region! The changes will take place as of the close of 31 August 2023.

Which companies are being included?

Let’s look at these changes with regard to the country as a whole. After the changes take place. Croatia will have 12 „investable“ companies (+4 companies overall), while 5 companies will enter the Frontier index (from a previous Small Cap Frontier).

Slovenia will have 8 investable companies (+1), while 4 companies will enter the Frontier index (Krka and NLB are already part of the Frontier index).

Romania will have 16 investable companies (+10!), while 6 companies will enter the Frontier index.

Source: MSCI, InterCapital Research

In conclusion, MSCI’s recognition of Croatia, Slovenia and Romania through more companies being included in MSCI’S Small Cap and Frontier index implies increasing economic prominence. We are eager to witness the unlocking of value that this deserved recognition of the region may bring!