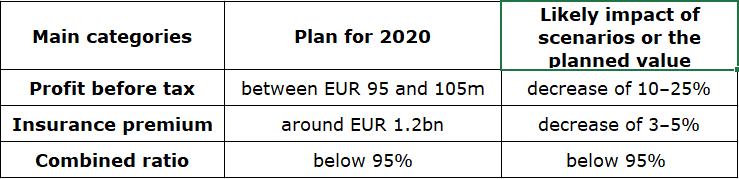

Triglav expects a 3-5% decrease of insurance premiums and 10-25% decrease in EBT (compared to initial 2020 plan).

The Triglav Group assesses that its insurance and investment portfolios are sufficiently resilient and that its capital position is appropriate to effectively cope with increased risks arising from the COVID-19 pandemic situation. The Group assessed impact on the main categories of the Triglav Group’s business plan for 2020 will be as follows:

Source: Triglav Group

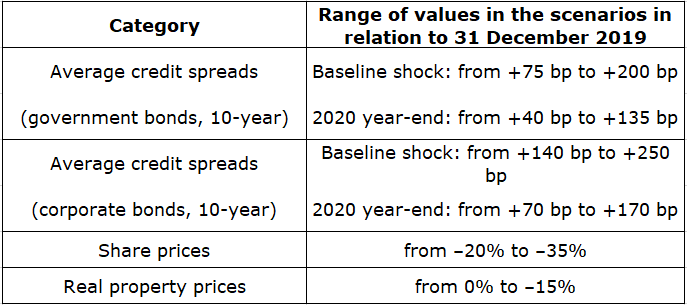

The scenarios account for shocks of varying intensity in the international financial markets, specifically the impact on credit spreads on government and corporate bonds, share prices and real property prices. The scenarios foresee higher baseline shocks, followed by a gradual easing of the situation by the end of 2020.

Source: Triglav Group

The projected deterioration of the economic situation and the suspended activity in the manufacturing and service sectors in both Slovenia and the region will impact the Triglav Group’s underwriting activities. It is estimated that primarily the written premium and claims result of the non-life insurance segment will be affected.

In relation to the plan, the volume of motor vehicle insurance premium (motor hull insurance and motor vehicle liability insurance) is expected to fall mainly as a result of lower sales of new vehicles, deregistration of existing vehicles and smaller coverage. Individual scenarios also accounted for lower sales due to obstacles to taking out such insurance policies. As a result of lower economic activity, a decrease in life insurance premium and premium written in real property insurance, credit insurance and general liability insurance is expected, in addition to lower demand for travel insurance.

Due to the impact of unearned premium, the expected decline in net premium income will be lower than the decrease in gross written premium. In parallel, lower net claims incurred are anticipated for some insurance classes due to reduced economic activity and movement restrictions. As a consequence of the pandemic, the life insurance segment accounted for the probability of somewhat increased payouts due to death and an increase in early termination of life insurance policies.

Shocks on the financial markets, particularly changes in credit spreads on government and corporate bonds, affect not only the return on investment but also the market value of assets and liabilities of the Triglav Group and thus the capital adequacy ratio. The decrease in the market value and thus the amount of financial assets under management is also reflected in lower income from the management of clients’ assets.

The impact assessment takes into account both lower investments and decreased operating expenses. In this regard, the Triglav Group expects a reduction in those expenses and investments that are not absolutely necessary for the implementation of strategic projects and other development activities outlined in the strategy. According to the scenarios, acquisition costs will be lower due to a decrease in the volume of written premium.

According to these scenarios, the assessed impact on the Triglav Group’s capital adequacy at the end of 2020 will be a decline of 15–30 p.p.. As part of the impact analysis of the pandemic on the Group’s performance in 2020, the effects of a significant negative shock on the financial markets was further examined, in which the fall in share and real property prices and credit spread growth would be comparable to the situation in the last financial crisis of 2008, while the risk-free interest rate term structure would further decrease. In the event of such a scenario, it is estimated that the Group’s capital adequacy would be further reduced, but still likely to remain above 175%.