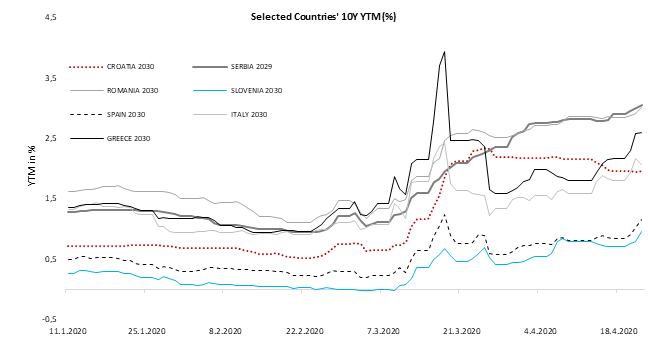

When sovereign yields in Europe exploded in mid – March, ECB came to the rescue with large PEPP programme and pushed yields south. Now, heads of EU countries cannot agree on stimulus package, forcing periphery spreads close to March levels once again. Today all eyes will be on European Council video meeting despite we do not expect to see final deal today, meaning that ECB could stay in this game alone for a bit more.

Before going to the main subject today, let us just say that yesterday Eurostat published debt and deficit data for EU countries in 2019 showing that in the end of last year, EU27 budget deficit stood at only 0.6% of GDP, meaning that debt as share of GDP fell to 77.8%. In euro area deficit also stood at 0.6% while debt to GDP ratio was at 84.1%, down from 85.8% year earlier. Croatia posted its third surplus in a row (0.4% of GDP), leading its debt to GDP to 73.2%, its lowest level since 2012. However, balanced budgets or even surpluses now look like a dream which leads us to our today’s theme.

President of European Council, Mr Charles Michel has invited all EU countries on its 4th videoconference that will take stage today on which EU leaders should discuss further help for the economy that is going to see dip which has not been seen since GFC. Last plan that fell short of expectations provided on April 9th stood at EUR 540bn out of which EUR 240bn was from ESM, 200bn was from EIB and EUR 100bn from EC. However, most of the periphery countries did not agree with the package saying that debt should be mutualized which would grant much larger package in amount of EUR 1.500bn (more than 10% of GDP). As Germany, Austria and Netherlands opposed, challenges with fiscal stimulus continues and there is not any homogenous proposal at the table, at least this morning.

With EU package still waiting to be finalized, fiscal packages on countries’ level rise calling for bigger and bigger need for funding, resulting in spreads in periphery widening significantly in the last few weeks. Yesterday we saw Italian 10Y paper reaching spread of 275bps versus bund before ECB announced it will ease its limits on collateral for funding as there is possibility of downgrade by credit rating agencies. Similar action was done by FED just a week ago when they decided to buy “fallen angels”. So, it was another ECB action that limited yield rise in periphery spreads, at least for the day. However, there were some countries which spread overjumped spread that we have seen a month ago when ECB announced PEPP.

Talking about PEPP, ECB did report that it had bought EUR 70bn until April 17th, meaning that it was buying more than EUR 3bn worth of bonds a day, as it started on March 26th. That was not enough to keep yields and spreads steady for a period longer than a month as investors became aware how big the wall of new debt is. Just in the first three days this week we have seen many EA countries issuing new debt, including Italy, Portugal, Slovakia, Spain and so on. Just to put things into perspective how big these issues are, Italy and Spain only issued EUR 25bn and this was just a chunk of funds that will be needed. But still, the most interesting thing about these auctions is enormous demand. Namely, on Italian syndicated auction, there was more than EUR 110bn for dual tranche while for Spanish 10Y paper there was bid of almost EUR 100bn (EUR 15bn issued). Most likely demand was way above supply due to new issue premium (new SPGB 2030 was issued at 17bps premium over current 10Y) but it is not clear why we did not see such a support on the secondary market. All in all, it seems like without strong signal from EU leaders that they will do whatever it takes, ECB will have to be the only player in that game meaning that they will have to increase its buying to hold yields not to fly to the sky.

Source: Bloomberg, InterCapital

For today we decided to look at EBITDA and net profit margins of Slovenian companies, for which we used 2019 figures.

Earlier this week we presented you with EBITDA and profit margins of Croatian companies, so for today we decided to present you with the same for Slovenian companies. Note that financials (NLB, Triglav and Sava Re) were excluded from the analysis.

It is important to note once again that comparing the margins across the selected companies is not necessarily the best way to do the comparison as many companies operate in different industries. Since both EBITDA and profit margin reflect to a great extent the industry in which the company operates in, we advise to compare it to the peer average or median. Nevertheless, it is still worth seeing which Slovenian companies are more profitable and therefore have more “room” to potentially reduce the prices of their goods or services if needed, while still remaining a higher level of profitability.

EBITDA margin (%)

Profit margin (%)

As visible from the graph, Telekom Slovenije operates with the highest EBITDA margin of 30.1%, which is expected given that Telecoms tend to have a relatively high EBITDA margin. Krka and Cinkarna Celje follow, with EBITDA margin of 25.8% and 21.2%, respectively. Petrol comes last with 4.5%.

When looking at the profit margins, Krka operates with the highest margin (16.4%). On the flip, side Telekom Slovenije recorded the lowest profit margin in 2019, of only 0.2%. However it is important to note that such a low margin could be considered as a one off for Telekom Slovenije given that in 2019 the Group recorded a net financial loss of EUR -28.14, compared to EUR 15.97m. Such a result could be attributed to two key reasons. The first one is that in 2018, finance income from the equity holdings was higher due to the sale of Blicnet, while the second one is that in 2019 other finance expenses include a loss of EUR 17.6m on the acquisition of a 34% minority interest in Planet TV (former Antenna TV SL), claimed on the basis of an arbitration award in the proceedings between Telekom Slovenije and Antenna TV SL Slovenia B.V.

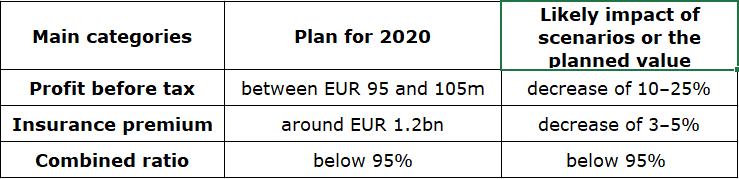

Triglav expects a 3-5% decrease of insurance premiums and 10-25% decrease in EBT (compared to initial 2020 plan).

The Triglav Group assesses that its insurance and investment portfolios are sufficiently resilient and that its capital position is appropriate to effectively cope with increased risks arising from the COVID-19 pandemic situation. The Group assessed impact on the main categories of the Triglav Group’s business plan for 2020 will be as follows:

Source: Triglav Group

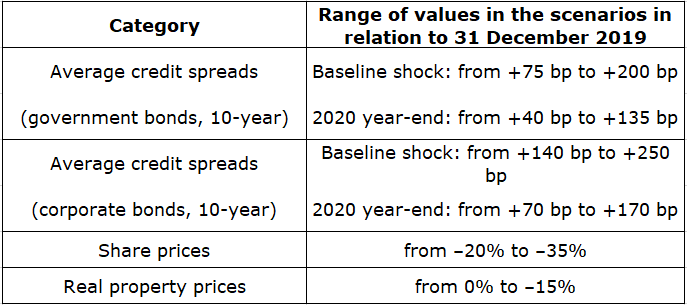

The scenarios account for shocks of varying intensity in the international financial markets, specifically the impact on credit spreads on government and corporate bonds, share prices and real property prices. The scenarios foresee higher baseline shocks, followed by a gradual easing of the situation by the end of 2020.

Source: Triglav Group

The projected deterioration of the economic situation and the suspended activity in the manufacturing and service sectors in both Slovenia and the region will impact the Triglav Group’s underwriting activities. It is estimated that primarily the written premium and claims result of the non-life insurance segment will be affected.

In relation to the plan, the volume of motor vehicle insurance premium (motor hull insurance and motor vehicle liability insurance) is expected to fall mainly as a result of lower sales of new vehicles, deregistration of existing vehicles and smaller coverage. Individual scenarios also accounted for lower sales due to obstacles to taking out such insurance policies. As a result of lower economic activity, a decrease in life insurance premium and premium written in real property insurance, credit insurance and general liability insurance is expected, in addition to lower demand for travel insurance.

Due to the impact of unearned premium, the expected decline in net premium income will be lower than the decrease in gross written premium. In parallel, lower net claims incurred are anticipated for some insurance classes due to reduced economic activity and movement restrictions. As a consequence of the pandemic, the life insurance segment accounted for the probability of somewhat increased payouts due to death and an increase in early termination of life insurance policies.

Shocks on the financial markets, particularly changes in credit spreads on government and corporate bonds, affect not only the return on investment but also the market value of assets and liabilities of the Triglav Group and thus the capital adequacy ratio. The decrease in the market value and thus the amount of financial assets under management is also reflected in lower income from the management of clients’ assets.

The impact assessment takes into account both lower investments and decreased operating expenses. In this regard, the Triglav Group expects a reduction in those expenses and investments that are not absolutely necessary for the implementation of strategic projects and other development activities outlined in the strategy. According to the scenarios, acquisition costs will be lower due to a decrease in the volume of written premium.

According to these scenarios, the assessed impact on the Triglav Group’s capital adequacy at the end of 2020 will be a decline of 15–30 p.p.. As part of the impact analysis of the pandemic on the Group’s performance in 2020, the effects of a significant negative shock on the financial markets was further examined, in which the fall in share and real property prices and credit spread growth would be comparable to the situation in the last financial crisis of 2008, while the risk-free interest rate term structure would further decrease. In the event of such a scenario, it is estimated that the Group’s capital adequacy would be further reduced, but still likely to remain above 175%.

Dividend yield is 5.8%, while ex-date is 2 July 2020.

Romgaz published the Resolution of the GSM which was held on 22 April in which the shareholders approved a dividend payment of RON 1.61 per share. The dividend will be distributed from 2019 net profit and partially from retained earnings. Such a dividend payment is 61% lower than the one paid in 2019 (for the year 2018). Dividend yield is 5.8%, while the ex-date is 2 July 2020.

Note that the payment date is 24 July 2020.

In the graphs below, we are bringing you a historic overview of the company’s historic dividend per share and dividend yield.

Dividend Per Share (2015 – 2020) (RON)

Dividend Yield (2015 – 2020) (%)