The price of the global benchmark for crude oil, Brent, has surged to more than $95/barrel in the last couple of days. In this article, we take a quick look at what has driven this increase.

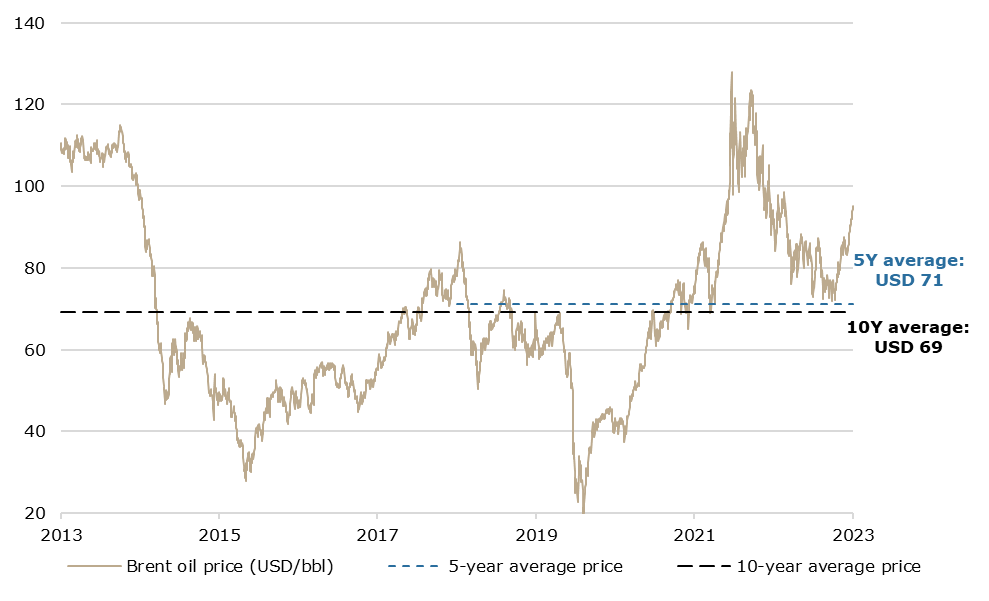

In the last couple of months, the oil price, represented by the Brent benchmark has surged, reaching a level of $95/bbl (barrel), which would also imply the highest level it has been at in the last 10 months. Furthermore, this represents a rally of app. 27% since June, and 11% on a YTD basis. Compared to its 5-year and 10-year averages, this represents an increase of 34%, and 37%, respectively.

Brent oil price (2013 – 2023 YTD, USD/bbl)

Source: Bloomberg, InterCapital Research

As with most commodities, oil is under the influence of many different factors. The war in Ukraine, high inflation rates, and the subsequent interest rate hikes by central banks across the world have all played a significant role. However, the latest rally happened not because of the lack of demand, but spurred by the decisions of OPEC members to reduce or maintain the levels of supply, as opposed to increasing them. The latest news regarding this matter is the decision by Russia and Saudi Arabia to keep their supply cuts (of a combined 1.3m barrels/day), until the end of 2023, instead of increasing production. Of course, the motives for these decisions are plentiful. Since the start of the war in Ukraine, and especially since the imposition of the price cap on Russian oil, a deflationary effect on the prices of oil has taken place, as Russia is one of the world’s largest producers. Furthermore, the general macroeconomic environment, and the latest data on growth across the world, are also having an influence. There are different estimates and expectations, some sources citing an improvement in the economic outlook, while others are projecting lower growth. One other development that happened recently is the start of to conflict in Nagorno-Karabakh between Azerbaijan and Armenia. As the region is one which both produces a lot of commodities, but also one where a lot of transportation takes place, this also had a destabilizing influence on the price.

There is also speculation that the price might reach an extent over $100/bbl. Taking all of this into account, however, the price might have rallied, but it is still a lot lower than the all-time high achieved in March 2022, right after the beginning of the Russian invasion of Ukraine. Back then, the price reached almost $128/bbl, meaning that 35% growth would still be required to breach that level. Even with all these developments, this is highly unlikely to happen, especially if the high inflation, and thus the higher possibility of recession persists.