Today, we decided to bring you an overview of the ROE and capital structure of the CROBEX10 constituents, as well as to compare how these factors changed on a yearly basis.

First of all, it should be noted that all are based on the latest available information, i.e. H1 2023 results of the CROBEX10 constituents. To provide an accurate picture, a trailing twelve-month period was used. A comparison was made to the same period last year (also using trailing twelve months).

ROE of CROBEX10 constituents (TTM H1 2023 vs. TTM H1 2022, %)

Source: Companies’ data, InterCapital Research

In terms of ROE, the largest one in H1 2023 was recorded by Ericsson NT, with an ROE of 30.42%, representing a decrease of 6.84 p.p. YoY. If we were to look at the causes of this, we can see that the Company recorded basically the same TTM net income as in the same period last year, a decline of 1.4%, whilst at the same time, it managed to increase its equity by 20.76%. Following them we have Span with a ROE of 17.9%, a decline of 1.69 p.p. YoY, driven by a slight increase in TTM net income (+2.1% YoY), but an even larger 11.7% growth in equity. The only other company with an ROE of over 10% is Podravka, at 12.27%, representing an increase of 4.11 p.p. (also the largest growth recorded), mainly driven by Podravka’s growth in TTM net profit, which grew by almost 65%, while the equity also increased by 9.7%. It is important to note that Podravka had tax incentives booked in Q2 for investment in its production line and employment of people in the amount of EUR 19.7m. This has significantly lifted its H1 net income for EUR 18.9m. Its normalized net income is up EUR 0.1m. On the other hand, Atlantska Plovidba recorded a negative ROE at -8.7%, representing a change of 54.12 p.p. YoY (H1 2022 TTM ROE: 45.4%), and this is tied to the decline in its TTM net profit, which turned negative at EUR 10.8m (TTM H1 2022: EUR 70.2m), while the Company’s equity also decreased by 19.4%. Of course, it should be noted that Atlantska Plovidba operates in the shipping industry which is extremely sensitive to macroeconomic developments. As such, in 2021 and part of 2022, the demand for shipping was still high, and with a limited no. ships available, the prices of shipping, and thus the Company’s profits skyrocketed. The reverse scenario was in the paly for the last 12 months, with the overall demand for shipping decreasing to some of the lowest levels in the last couple of years. As such, these results are a reflection of these changes. The 2nd company with the lowest ROE is Arena Hospitality Group, at 3.52%, representing a decrease of 4.82 p.p. YoY, and this came as a result of a 57% decrease in TTM net income. Delving into this further, even though Arena recorded solid top-line growth, its costs have also increased significantly, which especially impacted the bottom line. As such, with an almost unchanged equity amount (+1.47% YoY), the decrease in ROE happened. Other companies faired better, albeit most of them either managed to slightly improve their ROE, or experienced a decrease, and this is again due to the overall macroeconomic environment.

Capital structure of CROBEX10 constituents (H1 2022 left, H1 2023 right, % of the total)

Source: Companies’ data, InterCapital Research

Besides ROE, one other thing that’s worthwhile to look at is the capital structure of a company, i.e. how is its passive side of the balance sheet structured between debt and equity. As we can see in the chart above, HT has no financial debt, and as such it is 100% financed by equity. Following them we have Span at 98% equity financing, representing an increase of 3 p.p. YoY, and Ericsson NT, at 91%, representing an increase of 6.63 p.p. YoY. On the other hand, Arena Hospitality Group is primarily debt-financed, at 54%, representing a decrease of 3.26 p.p. YoY. The next company with the lowest amount of equity financing is Valamar Riviera, at 56%, with an increase of 3.6 p.p. YoY.

A pattern does emerge from both of these data points: most of the companies have their profitability under pressure. Rising costs, especially in terms of energy, material, and employee costs are putting most of the pressure on this, and when we see that for example, ROE has remained unchanged, increased, or decreased by a little, it has to be taken into account the size of these challenges, and how important efficient cost management is. With regards to the capital structure, most of the companies increased the levels of equity as opposed to debt in their balance sheet. This is to be expected, as higher interest rates make the interest burden a lot more expensive than in previous years. Two exceptions could be made, however. Firstly is the shipping industry, which as described above is under a lot of pressure, so additional leverage is required. Secondly is the tourism industry, especially in companies which were already quite indebted to begin with. Continued investments into accommodation and new projects usually come from debt. If we were to take the example of Arena, the Company invested significantly in the last couple of years into its accommodation portfolio, with fixing its interest which was a good thing to do during period of low interest rates. During the same time, profitability suffered, first because of COVID-19, and then later due to rising expenses across the board. As such, an increase in debt levels can be expected as equity decreased. As the Company noted recently on the ZSE Prime Plus Webcast (more on which you can read here), 94% of the financial debt has a fixed interest rate, and the remainder is hedged below 3%. Because of this, even this increase in the overall % of debt shouldn’t have a material impact on the Company.

The price of the global benchmark for crude oil, Brent, has surged to more than $95/barrel in the last couple of days. In this article, we take a quick look at what has driven this increase.

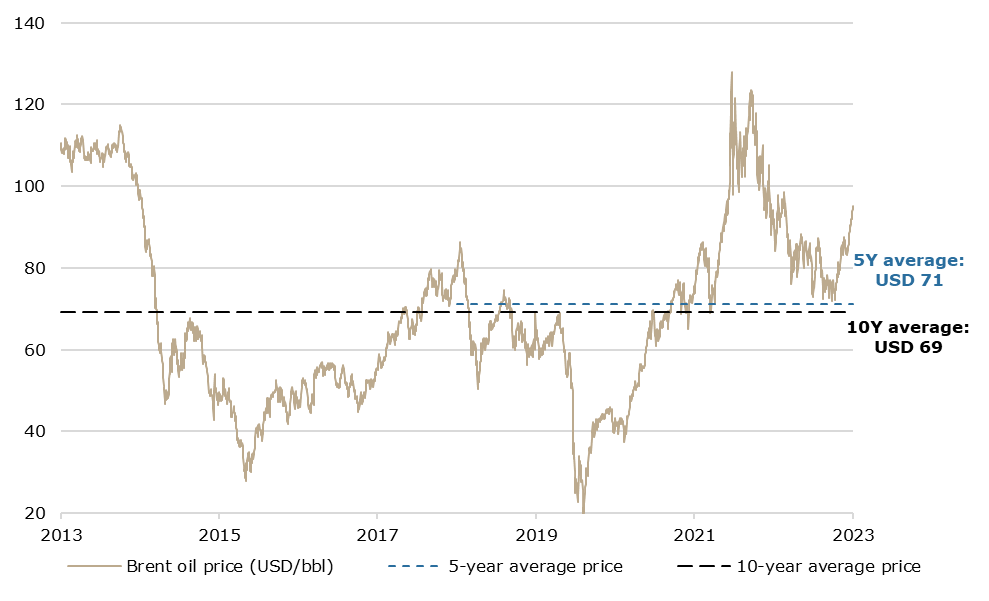

In the last couple of months, the oil price, represented by the Brent benchmark has surged, reaching a level of $95/bbl (barrel), which would also imply the highest level it has been at in the last 10 months. Furthermore, this represents a rally of app. 27% since June, and 11% on a YTD basis. Compared to its 5-year and 10-year averages, this represents an increase of 34%, and 37%, respectively.

Brent oil price (2013 – 2023 YTD, USD/bbl)

Source: Bloomberg, InterCapital Research

As with most commodities, oil is under the influence of many different factors. The war in Ukraine, high inflation rates, and the subsequent interest rate hikes by central banks across the world have all played a significant role. However, the latest rally happened not because of the lack of demand, but spurred by the decisions of OPEC members to reduce or maintain the levels of supply, as opposed to increasing them. The latest news regarding this matter is the decision by Russia and Saudi Arabia to keep their supply cuts (of a combined 1.3m barrels/day), until the end of 2023, instead of increasing production. Of course, the motives for these decisions are plentiful. Since the start of the war in Ukraine, and especially since the imposition of the price cap on Russian oil, a deflationary effect on the prices of oil has taken place, as Russia is one of the world’s largest producers. Furthermore, the general macroeconomic environment, and the latest data on growth across the world, are also having an influence. There are different estimates and expectations, some sources citing an improvement in the economic outlook, while others are projecting lower growth. One other development that happened recently is the start of to conflict in Nagorno-Karabakh between Azerbaijan and Armenia. As the region is one which both produces a lot of commodities, but also one where a lot of transportation takes place, this also had a destabilizing influence on the price.

There is also speculation that the price might reach an extent over $100/bbl. Taking all of this into account, however, the price might have rallied, but it is still a lot lower than the all-time high achieved in March 2022, right after the beginning of the Russian invasion of Ukraine. Back then, the price reached almost $128/bbl, meaning that 35% growth would still be required to breach that level. Even with all these developments, this is highly unlikely to happen, especially if the high inflation, and thus the higher possibility of recession persists.