“Oh boy, what an August” is the phrase that could have been rightfully coined based on events that happened solely on the 5th of August – the stock market crash, the VIX Index at 65, and OIS (Overnight Index Swap) suggesting that it was more likely than not that the Fed will slash their interest rates with an emergency cut in the following week. Three weeks later, the VIX is back below 16, arriving there in a record fashion, where it took only seven days for it to close below its long-term median of 17.6. The S&P 500 Index is on an all-out offense at its all-time high, with the chatter locomoting from emergency rate cuts to whether it is appropriate for the first cut to be 25bps or 50bps. Stay with us while we delve deeper into the details that shaped August and its impact on policy outlook, enriched by the Fed’s Chairman’s appearance at the Jackson Hole Economic Symposium, once again symbolizing the turning point for the Fed policy.

After receiving the downbeat ISM Manufacturing Employment print on the 1st of August, the Nonfarm Payrolls (114k vs 176k exp) print the day after, along with the Unemployment Rate (4.3% vs 4.1%), provided fresh impetus for the market to switch its focus on the labour market being cautioned by the Fed’s attention to its dual mandate goal. It sparked a recessionary narrative that, helped by Bank of Japan’s unforeseen rate hike on the 31st of July hike, which pushed the Nikkei and the Topix indices in freefall, led to a stock market crash in the US and fuelled concerns that the appropriate time for cutting rates was already behind us. The market’s jitteriness was amplified by the low liquidity characteristic for this time of the summer, but it proved to be short-lasting. A week later, the PPI and the CPI prints showed that the Fed should not be in a hurry to make an emergency cut based on the inflation side of its dual mandate, and the Retails Sales print on Thursday, the 15th, provided the S&P Index a push it needed to return where it was two weeks ago when the NFP print wroke havoc on the market. On Wednesday, the 21st, The Bureau for Labor Statistics announced its preliminary estimate of the upcoming annual benchmark revision to the employment data, which showed that its non-farm payroll estimates exaggerated the levels shown by the tax records by 800k. The reaction was feeble as the whisper on the street meant such a revision was in the cards.

After that, all the eyes were directed at Jerome Powell’s written speech set for Friday 23rd, where he was to review the economic conditions and give a near-term policy outlook. After a couple of introductory remarks, he adumbrated by saying that the time has come for policy to adjust while staying noncommittal on the size of the first cut, stressing their attentiveness to the labour market and making it clear that further cooling in the labour market is not wanted or welcome. He also noted that the current level of their policy rate gives them ample room to respond to any risks they may face, including the risk of unwelcome further weakening in labour market conditions, switching the attention to the next NFP print on the 6th of September.

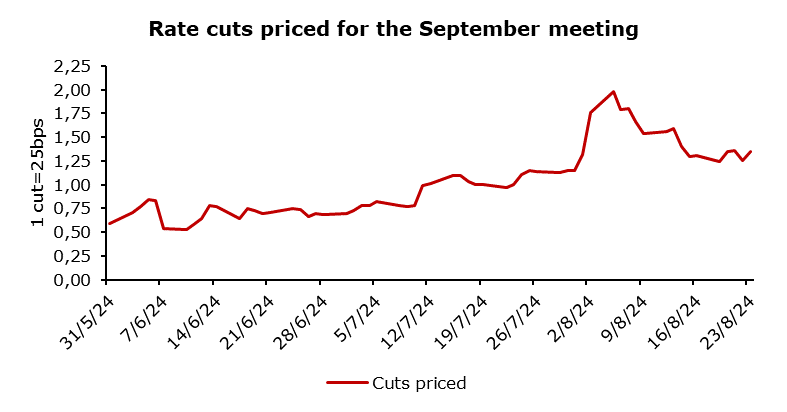

It appears that the Fed favours starting with a 25bps cut to keep market pricing anchored, along with the risk that a heftier cut, in the beginning, might look like a policy mistake ex-post, and election commentary during which they prefer to stay on the sidelines. The case for starting with 50bps is the symmetry with the tightening cycle, where they moved more aggressively when the policy rate was further from neutral and the passive tightening that has been ongoing with the inflation risks subsiding as shown by the real Fed Funds Rate. With no significant impact on the first rate cut size expected from the CPI print on the 11th, the subsequent employment report will be crucial in tipping the scales in favor of either the 25bps cut or the 50bps one.