Since 2015, the average price of new apartments has increased by 58% as of H1 2023 and amounted to EUR 2,219. In this overview, we’ll detail how the housing market dynamics have developed, what influenced them, and how Croatia compares to other European countries.

Starting off with the average price of new apartments in Croatia, the price per sqm has increased by 58% as compared to 2015 and amounted to EUR 2,219 in H1 2023. In Zagreb, the price growth is even higher, at 69%, and the average price per sqm for new apartments is EUR 2,623. Finally, in other settlements, the price growth during this period is 52%. During the same period, the number of apartments sold in Croatia increased by over 286%, with the number of apartments sold in Zagreb increasing by 212%, whilst in other settlements the increase amounted to 367%.

Average price of new apartments per sqm (EUR, left, 2015 – H1 2023), number of apartments sold (right, H1 2015 – H1 2023)

Source: DZS, InterCapital Research

New construction has been in focus in Croatia, especially in the last couple of years, for a couple of reasons. Firstly, two cultural traits have to be pointed out. The first one is the fact that home ownership is valued and sought after in Croatia. The second one is that real estate is seen as a form of savings and investment. The second reason, of course, is security. Since the earthquakes in Croatia that have happened in the last couple of years, as well as the natural disasters that have struck the region such as flooding, the demand for new real estate has gone up significantly. Unfortunately, due to limited supply, the demand for new housing tends to increase the overall housing prices in areas where the new construction takes place.

According to the latest EU-level comparable data released in Q1 2023, the housing price in Croatia has increased by 73.5% as compared to 2015 (the difference here is that this includes sales of existing housing as well). However, what’s interesting is that according to this data point, the price of new housing increased by 46.9%, and the price of existing housing grew by 78.8%. Of course, this is to be expected, as new construction had a higher base from where the price growth started, while the existing housing had to “catch up”. What’s even more worrying, however, is if we look at the city of Zagreb, where growth amounted to 93.3%, whilst on the Adriatic coast, it increased by 66.5%. The price growth in isolation, however, doesn’t tell us much. To better understand what’s going on, we took a look at several construction sector indicators, such as the building permits, volume of construction works, and building material producer prices.

Building permits issued in Croatia (January 2015 – July 2023)

Source: DZS, InterCapital Research

Despite the current macroeconomic situation, the demand for real estate and construction sector operations is still growing in Croatia. In fact, the total number of building permits issued in the 7M of 2023 (latest available data), amounted to 6,573, representing an increase of 3% YoY, 14% compared to the pre-pandemic 2019, and 92% compared to 2015. On average, about 83% of these building permits went to buildings, while the remaining 17% went to civil construction works.

Volume indices of construction works (gross series, 2015=100, January 2016 – June 2023)

Source: DZS, InterCapital Research

This is also present if we look at the volume of construction works, which compared to 2015, increased by 74.6% in June 2023, with 106% growth for buildings, and 40% growth for civil engineering works. This, of course, is the gross series which isn’t adjusted for working days or seasonality, but what we’re more interested in here is the growth trend. Combined with the issued building permits, this would mean that construction has been largely unaffected, at least in terms of volume by the macroeconomic environment. What about costs, however?

Building material producer prices, inflation growth (2015=100, January 2017 – August 2023)

Source: DZS, InterCapital Research

In line with the inflation trend, the building material producer prices grew by 26.3% in August 2023 as compared to 2015. On a like-for-like basis with other indicators presented above, they increased by 24.4% as of June 2023. Of course, this includes just one of the input items into construction and doesn’t include cost items such as building permits, employee expenses, as well as other types of documentation required, and other costs. As such, it could also be said that the costs for real estate developers have also increased during this period. Unfortunately, there isn’t an individual statistic that shows just how much this growth amounted to.

This was the supply side of the equation, and it could be summarized that even though a lot of construction is being done and will be done in the coming period, the costs have gone up as well, and combined with the strong demand, there is just not enough supply currently. On the other hand, the demand is driven by the described desire for home ownership, as well as seeing housing as a savings/investment opportunity. This has largely been supported through the last several years by subsidized loans from the government, but also in general by the low housing loan interest rates.

Total housing loans (EURbn) and newly issued housing loans interest rates (%) (2020 – July 2023)

Source: HNB, InterCapital Research

In fact, the situation has largely remained unchanged in Croatia in this regard, even after all the interest rate hikes. The total housing loan amount increased by 9.3% YoY in July 2023, and 32% compared to January 2020. On the interest rate side, the average interest rate on newly issued housing loans amounted to 3.25% in July 2023, an increase of 0.76 p.p. YoY, and 0.28 p.p. compared to January 2020. Compared to other European countries, the relative growth hasn’t been that large. In fact, the current interest rates on deposits offered by the ECB for banks are above the ones offered for these loans, so further loan interest rate growth could be expected. If we combine the loan interest rate growth and the future expectation of housing price growth, then it isn’t too hard to imagine that demand could be higher now, as it is “relatively” cheaper to purchase now than later. However, if we were to look at the rest of Europe, we can see that the situation isn’t ideal either.

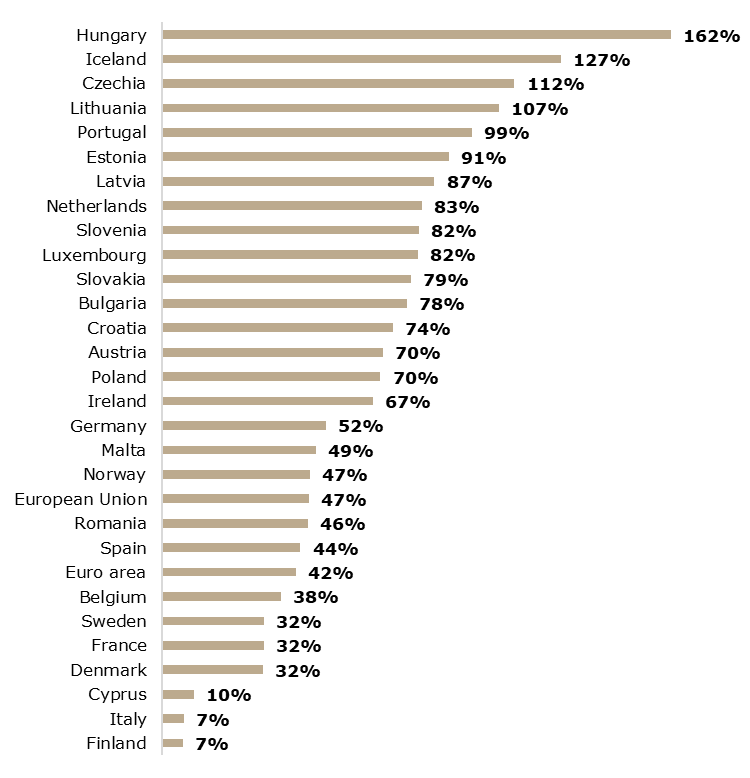

Housing price index in EU, select European countries (2015=0, Q1 2023 vs. 2015, %)

Source: Eurostat, InterCapital Research

As of Q1 2023 and compared to 2015, EU housing prices grew by 46.8%, whilst in the Euro area by 42%. Looking at the other observed countries, we can see that Croatia is somewhere in the middle. There are countries such as Hungary, Iceland, Czechia, and Lithuania where prices have increased by over 2x in this period. On the other hand, there are countries such as Finland, Italy, Cyprus, Denmark, France, and Sweden, where the price growth ranged between 6% and 40%. Of course, the reasons for these differences are many, and specific to each country. Factors such as size, wealth, population density, and population growth, etc., all play a role here. As such, maybe the best thing to do would be to look at the countries that were relatively “successful” in containing the housing price growth and try to learn and apply the policies that would lead to similar outcomes in Croatia. As the lack of affordable housing is one of the main issues facing people in Croatia, especially young people, such policies would also help fight the demographic decline that is also present.