Since 2015, the average price of new apartments has increased by 58% as of H1 2023 and amounted to EUR 2,219. In this overview, we’ll detail how the housing market dynamics have developed, what influenced them, and how Croatia compares to other European countries.

Starting off with the average price of new apartments in Croatia, the price per sqm has increased by 58% as compared to 2015 and amounted to EUR 2,219 in H1 2023. In Zagreb, the price growth is even higher, at 69%, and the average price per sqm for new apartments is EUR 2,623. Finally, in other settlements, the price growth during this period is 52%. During the same period, the number of apartments sold in Croatia increased by over 286%, with the number of apartments sold in Zagreb increasing by 212%, whilst in other settlements the increase amounted to 367%.

Average price of new apartments per sqm (EUR, left, 2015 – H1 2023), number of apartments sold (right, H1 2015 – H1 2023)

Source: DZS, InterCapital Research

New construction has been in focus in Croatia, especially in the last couple of years, for a couple of reasons. Firstly, two cultural traits have to be pointed out. The first one is the fact that home ownership is valued and sought after in Croatia. The second one is that real estate is seen as a form of savings and investment. The second reason, of course, is security. Since the earthquakes in Croatia that have happened in the last couple of years, as well as the natural disasters that have struck the region such as flooding, the demand for new real estate has gone up significantly. Unfortunately, due to limited supply, the demand for new housing tends to increase the overall housing prices in areas where the new construction takes place.

According to the latest EU-level comparable data released in Q1 2023, the housing price in Croatia has increased by 73.5% as compared to 2015 (the difference here is that this includes sales of existing housing as well). However, what’s interesting is that according to this data point, the price of new housing increased by 46.9%, and the price of existing housing grew by 78.8%. Of course, this is to be expected, as new construction had a higher base from where the price growth started, while the existing housing had to “catch up”. What’s even more worrying, however, is if we look at the city of Zagreb, where growth amounted to 93.3%, whilst on the Adriatic coast, it increased by 66.5%. The price growth in isolation, however, doesn’t tell us much. To better understand what’s going on, we took a look at several construction sector indicators, such as the building permits, volume of construction works, and building material producer prices.

Building permits issued in Croatia (January 2015 – July 2023)

Source: DZS, InterCapital Research

Despite the current macroeconomic situation, the demand for real estate and construction sector operations is still growing in Croatia. In fact, the total number of building permits issued in the 7M of 2023 (latest available data), amounted to 6,573, representing an increase of 3% YoY, 14% compared to the pre-pandemic 2019, and 92% compared to 2015. On average, about 83% of these building permits went to buildings, while the remaining 17% went to civil construction works.

Volume indices of construction works (gross series, 2015=100, January 2016 – June 2023)

Source: DZS, InterCapital Research

This is also present if we look at the volume of construction works, which compared to 2015, increased by 74.6% in June 2023, with 106% growth for buildings, and 40% growth for civil engineering works. This, of course, is the gross series which isn’t adjusted for working days or seasonality, but what we’re more interested in here is the growth trend. Combined with the issued building permits, this would mean that construction has been largely unaffected, at least in terms of volume by the macroeconomic environment. What about costs, however?

Building material producer prices, inflation growth (2015=100, January 2017 – August 2023)

Source: DZS, InterCapital Research

In line with the inflation trend, the building material producer prices grew by 26.3% in August 2023 as compared to 2015. On a like-for-like basis with other indicators presented above, they increased by 24.4% as of June 2023. Of course, this includes just one of the input items into construction and doesn’t include cost items such as building permits, employee expenses, as well as other types of documentation required, and other costs. As such, it could also be said that the costs for real estate developers have also increased during this period. Unfortunately, there isn’t an individual statistic that shows just how much this growth amounted to.

This was the supply side of the equation, and it could be summarized that even though a lot of construction is being done and will be done in the coming period, the costs have gone up as well, and combined with the strong demand, there is just not enough supply currently. On the other hand, the demand is driven by the described desire for home ownership, as well as seeing housing as a savings/investment opportunity. This has largely been supported through the last several years by subsidized loans from the government, but also in general by the low housing loan interest rates.

Total housing loans (EURbn) and newly issued housing loans interest rates (%) (2020 – July 2023)

Source: HNB, InterCapital Research

In fact, the situation has largely remained unchanged in Croatia in this regard, even after all the interest rate hikes. The total housing loan amount increased by 9.3% YoY in July 2023, and 32% compared to January 2020. On the interest rate side, the average interest rate on newly issued housing loans amounted to 3.25% in July 2023, an increase of 0.76 p.p. YoY, and 0.28 p.p. compared to January 2020. Compared to other European countries, the relative growth hasn’t been that large. In fact, the current interest rates on deposits offered by the ECB for banks are above the ones offered for these loans, so further loan interest rate growth could be expected. If we combine the loan interest rate growth and the future expectation of housing price growth, then it isn’t too hard to imagine that demand could be higher now, as it is “relatively” cheaper to purchase now than later. However, if we were to look at the rest of Europe, we can see that the situation isn’t ideal either.

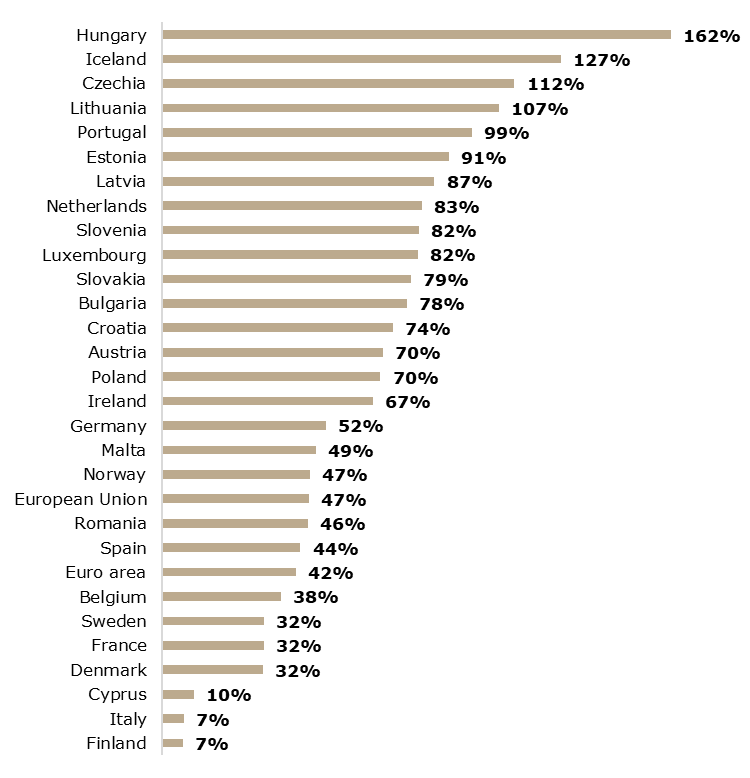

Housing price index in EU, select European countries (2015=0, Q1 2023 vs. 2015, %)

Source: Eurostat, InterCapital Research

As of Q1 2023 and compared to 2015, EU housing prices grew by 46.8%, whilst in the Euro area by 42%. Looking at the other observed countries, we can see that Croatia is somewhere in the middle. There are countries such as Hungary, Iceland, Czechia, and Lithuania where prices have increased by over 2x in this period. On the other hand, there are countries such as Finland, Italy, Cyprus, Denmark, France, and Sweden, where the price growth ranged between 6% and 40%. Of course, the reasons for these differences are many, and specific to each country. Factors such as size, wealth, population density, and population growth, etc., all play a role here. As such, maybe the best thing to do would be to look at the countries that were relatively “successful” in containing the housing price growth and try to learn and apply the policies that would lead to similar outcomes in Croatia. As the lack of affordable housing is one of the main issues facing people in Croatia, especially young people, such policies would also help fight the demographic decline that is also present.

Standard & Poor’s Global Ratings revised Croatia’s outlook as positive on the back of improving wealth with economic convergence with the eurozone over the past decade. The positive outlook indicates that S&P could raise the ratings if Croatia achieves faster integration into the wealthier eurozone economy.

Standard & Poor’s Global Ratings revised Croatia’s outlook as positive on the back of improving wealth with economic convergence with the eurozone over the past decade. Revision is supported by steady expansion in tourism, increasingly complemented by investments in the economy’s productive capacity & GDP per capita strengthening to 73% of the EU average in 2022 from 60% in 2013. The positive outlook indicates that S&P could raise the ratings if Croatia achieves faster integration into the wealthier eurozone economy.

The agency said that Croatia’s forecasted economic growth is expected to continue in 2023. According to the agency, strong wage growth owing to a tight labor market has kept gross real wage growth in positive territory this year, boosting private consumption beyond the agency’s previous expectations. The agency now forecasts real GDP growth at 2.5% for 2023, up from the initial 1.7% that was anticipated in March, supported by private consumption, especially as inflations decelerate; investments; and dynamic tourism activity. They believe Croatia’s recent eurozone entry and accession to the Schengen Area will support the economy’s long-term growth by fostering investments and facilitating tourists’ entry. Also, the agency expects Croatia to maintain a solid growth trajectory over the medium term, with real growth averaging 2.6% yearly through 2026.

The agency also commented on expected investments. Backed by EU financing, investments should anchor Croatia’s growth in 2024-2026 and cushion any potential volatility stemming from year-on-year variations in tourism flows. In addition, the agency considers opportunities for strengthening the economy’s resilience and productive capacity that could result from the successful implementation of Croatia’s National Recovery and Resilience Program. Institutional progress could facilitate improvements in productivity, the business environment, and the efficiency of the public sector and judiciary and further amplify income convergence with the EU average.

The government is expected to remain committed to its reform program, receive significant EU financing, and maintain fiscal prudence to gradually rebuild the fiscal space it lost as a result of the pandemic. Gross general government debt is expected to be reduced to lower than 60% of GDP by 2026, with net government debt settling below 55% of GDP throughout 2023-2026.

Further, the agency also provided upside & downside scenarios. In the upside scenario, the agency could raise the ratings over the next 12 months if Croatia’s economic resilience is sustained, supported by the country’s deepening integration with Europe, and facilitated institutional improvements, for example within the judiciary, education, and broader business environment. The downside scenario is based on Croatia’s outlook if economic performance does not improve as expected. Such weakening could come about if the Russia-Ukraine conflict led to increasingly severe economic consequences across Europe or if inflationary conditions significantly worsened. Net emigration trends and an aging population also represent a long-term risk to Croatia’s growth and public finances. Near-term risks would result from worsening consumer sentiment in continental Europe. Croatia directs about 25% of its goods exports to Germany and Italy, making it vulnerable to the economic developments of these key EU trading partners.

External and fiscal deleveraging should continue through 2025

The agency expects Croatia to post a modest budget deficit of 0.7% of GDP in 2023, despite cost-of-living pressures and increased costs due to the indexation of current spending items, notably pensions and social transfers.

Moreover, it is anticipated that fiscal consolidation will be spurred by Croatia’s alignment with the Maastricht criteria from 2023 onward. Net general government debt is expected to gradually reduce and approach 54% of GDP by 2026 from 60% in 2022, thanks to stringent fiscal management and the nominal growth of the economy.

Regarding the inflation development, Croatia’s inflation rate of 7.8% in August was the second highest in the eurozone that month, when it averaged 5.3%. Inflation is set to fuel price increases after shifting from commodities to the labor market as nominal wage growth is a brisk 12% for 2023. Croatia’s tourism sector will also act as a key driver of overall price hikes, in particular, because it is pivoting toward more affluent tourists. This resulted in a services inflation rate of 11% in August, which is notably above headline inflation. Croatia’s inflation is expected to be moderate over 2023-2024 but remain higher than the eurozone average over the medium term, reflecting the economy’s convergence as prices and wages catch up with the more mature eurozone economies. Finally, the impact of monetary policy tightening has been reduced by Croatia’s adoption of the euro.

Today, AM Best affirmed the Financial Strength Rating of “A” (Excellent) and the Long-term Issuer Credit Ratings of “a” (Excellent) of Zavarovalnica Triglav and Pozavarovalnica Triglav Re, with a stable medium-term outlook.

Following its regular annual revision, AM Best, the credit rating agency (the Agency) re-affirmed the Financial Strength Rating of “A” (Excellent) and the Long-term Issuer Credit Ratings of “a” (Excellent) for Zavarovalnica Triglav and Pozavarovalnica Triglav Re. The Agency noted that all individual elements of the ratings are at the same level as last year. Both of these ratings have a stable medium-term outlook.

Starting off with the balance sheet, the Agency assessed Triglav’s balance sheet as very strong and its operating performance as strong. The impact of both the business profile and the state’s majority holding on the Company’s credit rating was assessed as neutral. The Agency considers Triglav’s enterprise risk management to be developed and appropriate for the Company’s risk profile and operational scope. Furthermore, in once again affirming the high rating of Pozavarovalnica Tiglav Re, AM Best factored in its strategic importance to the Triglav Group, combined with its strong integration into the Group.

Furthermore, Triglav’s strong balance sheet is underpinned by its risk-adjusted capitalization at the strongest level. The assessment also considers the Group’s prudent reserving and good financial flexibility, with access to equity and debt markets. AM Best further notes that Triglav has steadily reduced its exposure to products with guarantees in its life insurance portfolio in recent years and that their impact has also been mitigated by increased investment yield, supported by the increase in interest rates.

In terms of the Group’s operating performance, it has been strong in the last couple of years, driven by excellent non-life technical earnings in the domestic market and by a healthy investment income. With Triglav being the market leader in Slovenia and the wider region, it can effectively leverage the benefits of economies of scale and a well-diversified product portfolio. The Agency expects that Triglav’s full-year results will be impacted by the loss in the health insurance segment driven by a price cap on the supplemental health insurance in Slovenia and natural catastrophe events, particularly the floods in Slovenia. However, these losses are expected to be within the Group’s risk tolerances.

AM Best affirmed the Financial Strength rating of A (Excellent), and the Long-Term Issuer Credit Rating of “a” (Excellent) of Sava Re, with a stable outlook for these ratings.

Following its regular annual rating review, the rating agency AM Best (“the Agency”) issued its ratings on Sava Re on Friday. According to the review, AM Best affirmed the Financial Strength Rating of A (Excellent) and the Long-Term Issuer Credit Rating of “a” (Excellent) of Pozavarovanica Sava d.d., i.e. Sava Re, the operating holding company of Sava Insurance Group. The outlook for these Credit Ratings is stable.

According to AM Best, these ratings reflect Sava Re’s balance sheet strength, which the Agency assesses as very strong, combined with the strong operating performance, neutral business profile, and appropriate enterprise risk management (ERM).

Taking a closer look at the assessment, the balance sheet was deemed very strong. This was due to the following reasons: Sava Re’s strongest level of risk-adjusted capitalization, as measured by Best’s Capital Adequacy Ratio (BCAR), liquid investment portfolio, prudent reserving, and good internal capital generation. Moreover, the Company has a low reliance on reinsurance and sound financial flexibility, with access to both equity and debt markets.

In terms of the operating results, Sava Re has a track record of generating strong and stable op. results, indicated by the 5-year (2018-2022) weighted average ROE of 14.3% (based on the Agency’s calculation). Furthermore, consistent reporting of op. profits over the past 5 years have been driven by solid life and non-life underwriting performance, supplemented by healthy investment income. By the end of 2022, Sava Re reported a combined ratio of 90.4%, with a 5Y average of 91.6%. In H1 2023, Sava Re reported a strong net profit of EUR 40m and a combined ratio of 89.9%. Full-year results, however, will be impacted by the third-quarter floods, particularly in Slovenia. However, AM Best expects these losses to be within Sava Re’s risk tolerances. The Group has app. 70% of its GWPs in Slovenia, where its leading competitive position and prudent underwriting help generate strong and relatively stable earnings.

Finally, Sava Re benefits from its strong position in its core domestic market of Slovenia, where it’s the 2nd largest insurance company with app. 28% market share (excl. supplementary health insurance business), in terms of GWPs. The Group’s insurance business is largely focused on premiums written in Slovenia. However, the company continues to expand in the West Balkan markets. The Agency expects to see further geographic diversification in the medium term in both the direct and reinsurance segments, as the Group continues to develop its position prudently in the international reinsurance market. Taking all of this into account, AM Best considers Sava Re’s ERM to be developed, and appropriate for the company’s risk profile and operational scope.