CEE finally got interesting on Wednesday when Poland and Romania placed brand new international bonds. So far we didn’t manage to find any decent analysis on the placements and received the explanation from one investment bank that a lot of their fixed income research staff is on a study break for this week’s CFA exams. Luckily, our team finished the CFA journey and is fully able to deliver a substantiated analysis of last week’s bond placements. Enjoy your reading.

At first glance the Wednesday’s ROMANI$ syndicate looks relatively bad from the owner’s perspective (the issuer would subscribe to the opposite view).

Romanian Ministry of Finance decided to place a dual USD tranche and went to the markets with IPTs at T+250bps/T+320bps for 5.5Y/12.0Y maturities. These IPTs raised a couple of eyebrows since it indicated 60bps-80bps NIP, depending upon whom you ask to price the curve. In our view, calculating the NIP (new issuance premium) was a pointless task indeed since ROMANI$ cash prices were marked quite low and it was difficult to find a buyer for the existing bonds. The risk off environment was getting worse by the day and asset managers were asking themselves how much juice would Romania have to give in order to make the deal float.

It’s worth bearing in mind that Romanian Ministry of Finance planned to raise as much as 10bn EUR this year on international markets and with Wednesday’s syndicate they managed to get close to 6.75bn USD in existing deals. This was third Romanian syndicate this year, following a 2.4bn USD 5Y/17Y USD placement and 2.5bn EUR dual tranche, both transactions happening in January. In a nutshell, close to half Romanian funding needs were closed in January and the situation looked quite good for the sovereign. Then the environment got a bit colder.

First of all, the IPTs contracted by some 10bps and some of the asset managers were seeing the ROMANI 6 05/25/2034$ at NIPs as wide as 70bps! Wow! On the other hand, some of the asset owners claimed it was irresponsible to place 1.75bn USD of new paper on a 3.00bn USD orderbook (implying a 1.7x bid-to-cover). To make things worse, SPX went down from 4.100 to 3.900 on the day of the bond placement. According to one of the bondholders: “It was like the Supreme Court upheld Murphy’s Law – you had an outsized print, by a twin deficit SEE country, in the midst of the risk off environment!” Truth be told, on the following day both bonds were marked lower and we did see some sellers, but the clips were measured in hundreds of thousands. The bond flipping aristocracy sat through this time, possibly learning a lesson on previous CEE/SEE syndicates that without the central banks as marginal bond buyers all of this is a losing game. A bit less smart money was attracted to cheap valuations and was cut in the process – luckily there was a handful of UK HF’s shorting it on the syndication day and closing the deals on the following morning. This at least gave the FM accounts some source of bids. Finally, ROMANI 5.25 11/25/2027$ was placed at 5.3% YTM (ref 99.764, T+240bps), while ROMANI 6 05/25/2034$ was placed at 6.02% YTM (ref 99.839, T+310bps).

There are some silver linings as well in the CEE space. Poland placed a EUR syndicate on Wednesday as well, 2bn EUR worth of 10Y paper on a 4.1bn EUR book (implying a 2.05x bid-to-cover). IPTs came early at MS+125bps and managed to close at MS+110bps, putting the end yield to maturity at 2.85%.

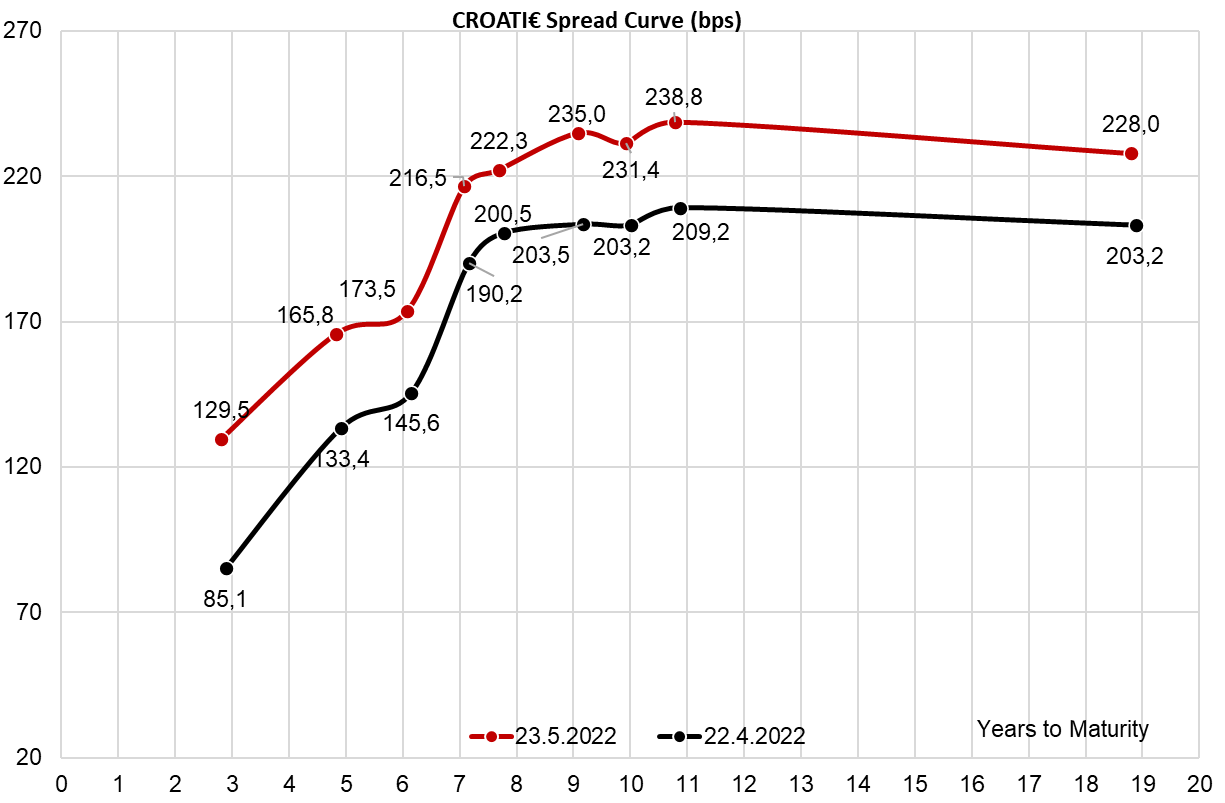

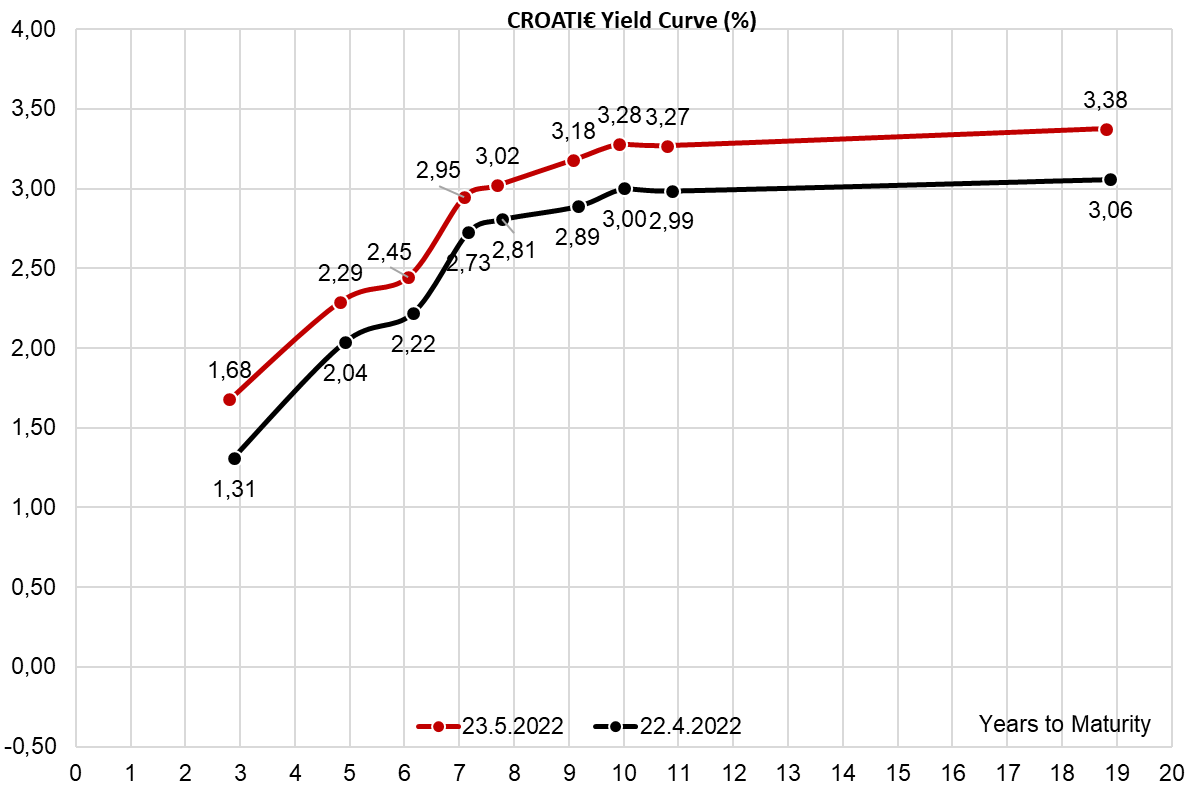

A bit of a context is needed here. Remember when Croatia placed 10Y paper exactly a month ago and the paper was quoted at B+205bps/B+203bps (bid/ask) on the following day? How could you not remember our research piece on the following day titled “The Eagle Has Hatched, but When Will It Fly?“. Well, this morning POLAND 2.75 05/25/2032€ is quoted at B+178bps/B+175bps (bid/ask). Oh and don’t forget that Poland is A2/A-/A-, compared to Croatia’s Ba1/BBB-/BBB. This morning CROATI 2.875 04/22/2032€ is priced at B+232.5bps/B+230.0bps, which is some 50bps wider than Poland. We would argue that it’s more likely that CROATI€ is rich instead of POLAND€ being cheap, but on a market like this nobody can guarantee anything.