It was getting really hot in the fixed income dealing desks these last two days because it became obvious two hard currency central banks were fighting different battles. FED is trying to slay the beast of inflation, while the ECB is trying to keep the currency block together. What are the implications of this divergence? Find out in this brief article.

Desperate times call for desperate measures so on Wednesday FOMC raised rates by 75bps in the first such move since 1994. This move came against the backdrop of CPI report released last week showing no meaningful signs of inflation slowing down, but also against the backdrop of a report that US households are raising their inflation expectations. Before we proceed to central bank actions, a word about the current inflation prospects.

Most of the aggressive price rise we have observed in the past months is a result of a supply shock, although inflation academics sometimes like to connect CPI rises with monetary expansion (the prosaic money printing). We would like to push forward a rather simple question: QE (an emblematic feature of money printing) has been around since 2008 (USA) or 2014 (EA) and hasn’t been able to move CPI up by a full percentage point. With this in mind, don’t forget that the driver of the current CPI figures is more likely to be sitting on the supply side and that abundant funding opportunities (i.e. cheap money) served merely as a catalyst. The former is more important for understanding the current inflation narrative than the latter.

So, if the current CPI is more about the supply, rather than demand, why are central banks hiking so aggressively? The key in understanding this lies with inflation expectations – the purpose of raising interest rates is to take the edge off household expectations about future inflation and hence mitigating the vicious circle of self-fulfilling prophecies. We have yet to see how successful the central banks will be in reaching this goal, but for now this appears to be rather distant. In other words, more interest rate hikes are needed before we will be able to say that inflation expectations are now well anchored.

This is probably the reason why FOMC median dot rests at 3.4% in December 2022, implying at least one more 75bps rate hike by the end of the year. FED is not losing time and it could be that the next meeting (27th July) will bring one more 75bps rate hike, bringing the FED fund target rate from the current 1.50%-1.75% to 2.25%-2.50%. If this happens, the target FED fund rate spread would move higher than in the previous tightening cycles, something that hasn’t happened in at least 40 years. With Wednesday’s three-quarter point hike we are exactly where we were in beginning March 2020 when FED started to give relief to battered financial markets through expansive monetary policy.

What’s even more interesting is that at least in Europe the focus of attention was rather on ECB, than on the FED. The reason was the ad hoc ECB GC meeting taking place on June 15th that brought about two important decisions:

- ECB is going to put through flexible PEPP reinvestments in order to put a lid on spread widening

- Internal committees are instructed to accelerate the completion of new anti-fragmentation tool

It’s clear that Christine Lagarde is having her own whatever it takes moment. However, the situation in 2022 is much different than a decade ago because Lagarde’s predecessor Mario Draghi had inflation prints around 2.00% YoY while he was saving the integrity of euro area. On the other hand, he also had poorly capitalized European banks burdened with periphery bonds. This time is different, but we would argue not much easier: euro area banks are well capitalized, at least compared to 2012, but inflation is elevated and not showing signs of abating. Lagarde will obviously not have a banking crisis, but the trick is to get periphery spreads under control without worsening the inflation picture and angering European local legislative bodies. Do you remember how much commotion PEPP created with German constitutional court (Bundesverfassungsgericht) back in 2020? We are certain that Frankfurt is looking for ways to avoid conflict with Brussels and especially Berlin.

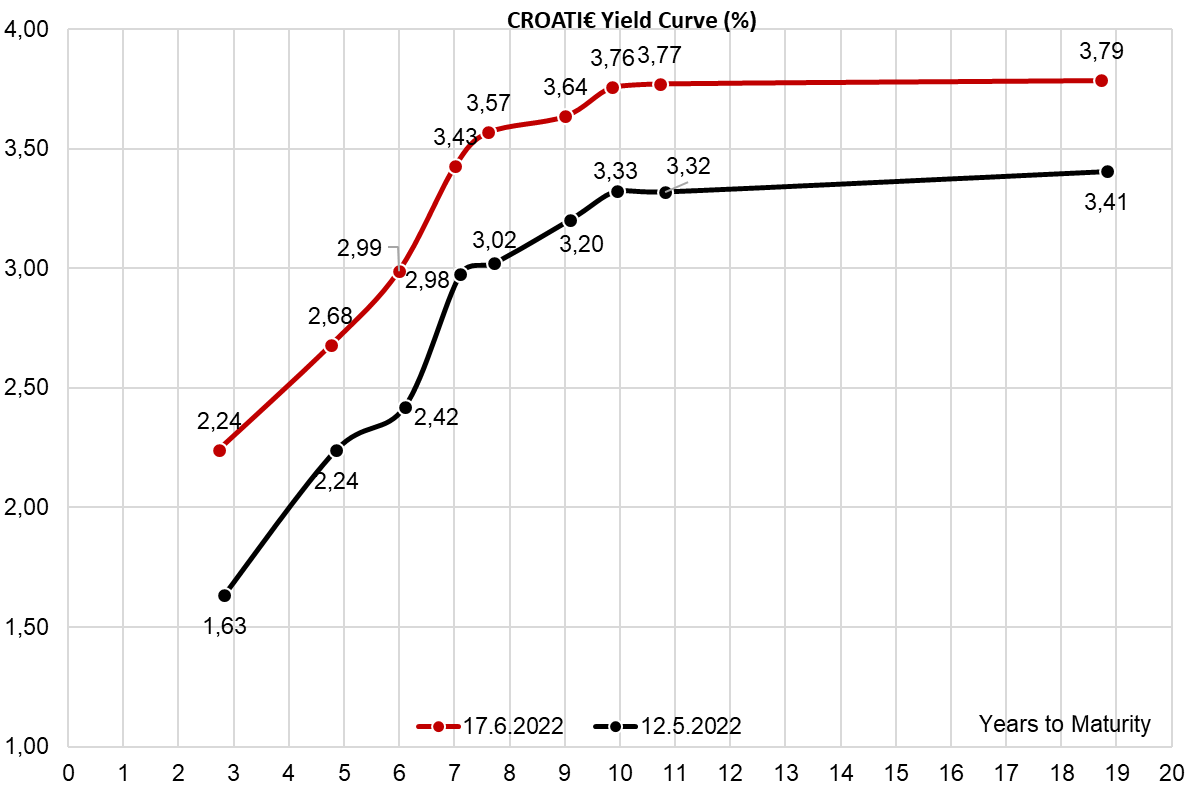

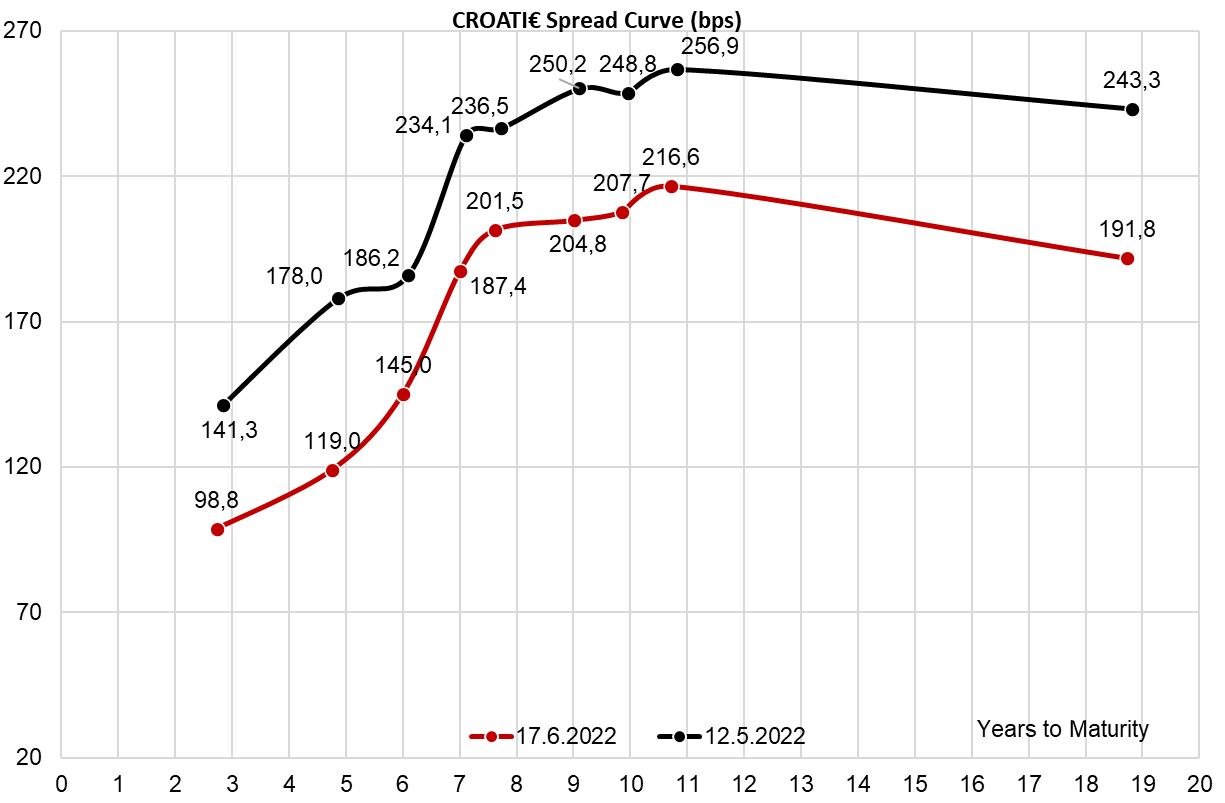

Finally, how are Croatian international bonds drifting through the storm? The new CROATI 2.875 04/22/2032€ was definitely the widowmaker of the curve – in the past two weeks it went from being priced 98.50-99.00 (3.05%-3.00%) to today’s 92.00-93.00 (3.87-3.74%). The spread to Germany widened from some 170bps to the current value of 207.7bps. At first it seems that Lagarde’s put isn’t working on this particular paper, but don’t forget that CROATI€ entered this sell off on the wrong foot, in other words it was spread-wise expensive from the very beginning. BTPS-GDBR spread went from 200bps (beginning June) to 240bps (Wednesday) before Lagarde’s put brought it back down to some 200bps (today). Croatia is again traded wider then Italy, something that we warned in our previous research pieces is still a a natural thing.

What happens next? The focus of domestic client now switches to the local bond auction that should take place in the coming weeks. So stay tuned, because it’s never boring on the bond desk!