It was getting really hot in the fixed income dealing desks these last two days because it became obvious two hard currency central banks were fighting different battles. FED is trying to slay the beast of inflation, while the ECB is trying to keep the currency block together. What are the implications of this divergence? Find out in this brief article.

Desperate times call for desperate measures so on Wednesday FOMC raised rates by 75bps in the first such move since 1994. This move came against the backdrop of CPI report released last week showing no meaningful signs of inflation slowing down, but also against the backdrop of a report that US households are raising their inflation expectations. Before we proceed to central bank actions, a word about the current inflation prospects.

Most of the aggressive price rise we have observed in the past months is a result of a supply shock, although inflation academics sometimes like to connect CPI rises with monetary expansion (the prosaic money printing). We would like to push forward a rather simple question: QE (an emblematic feature of money printing) has been around since 2008 (USA) or 2014 (EA) and hasn’t been able to move CPI up by a full percentage point. With this in mind, don’t forget that the driver of the current CPI figures is more likely to be sitting on the supply side and that abundant funding opportunities (i.e. cheap money) served merely as a catalyst. The former is more important for understanding the current inflation narrative than the latter.

So, if the current CPI is more about the supply, rather than demand, why are central banks hiking so aggressively? The key in understanding this lies with inflation expectations – the purpose of raising interest rates is to take the edge off household expectations about future inflation and hence mitigating the vicious circle of self-fulfilling prophecies. We have yet to see how successful the central banks will be in reaching this goal, but for now this appears to be rather distant. In other words, more interest rate hikes are needed before we will be able to say that inflation expectations are now well anchored.

This is probably the reason why FOMC median dot rests at 3.4% in December 2022, implying at least one more 75bps rate hike by the end of the year. FED is not losing time and it could be that the next meeting (27th July) will bring one more 75bps rate hike, bringing the FED fund target rate from the current 1.50%-1.75% to 2.25%-2.50%. If this happens, the target FED fund rate spread would move higher than in the previous tightening cycles, something that hasn’t happened in at least 40 years. With Wednesday’s three-quarter point hike we are exactly where we were in beginning March 2020 when FED started to give relief to battered financial markets through expansive monetary policy.

What’s even more interesting is that at least in Europe the focus of attention was rather on ECB, than on the FED. The reason was the ad hoc ECB GC meeting taking place on June 15th that brought about two important decisions:

- ECB is going to put through flexible PEPP reinvestments in order to put a lid on spread widening

- Internal committees are instructed to accelerate the completion of new anti-fragmentation tool

It’s clear that Christine Lagarde is having her own whatever it takes moment. However, the situation in 2022 is much different than a decade ago because Lagarde’s predecessor Mario Draghi had inflation prints around 2.00% YoY while he was saving the integrity of euro area. On the other hand, he also had poorly capitalized European banks burdened with periphery bonds. This time is different, but we would argue not much easier: euro area banks are well capitalized, at least compared to 2012, but inflation is elevated and not showing signs of abating. Lagarde will obviously not have a banking crisis, but the trick is to get periphery spreads under control without worsening the inflation picture and angering European local legislative bodies. Do you remember how much commotion PEPP created with German constitutional court (Bundesverfassungsgericht) back in 2020? We are certain that Frankfurt is looking for ways to avoid conflict with Brussels and especially Berlin.

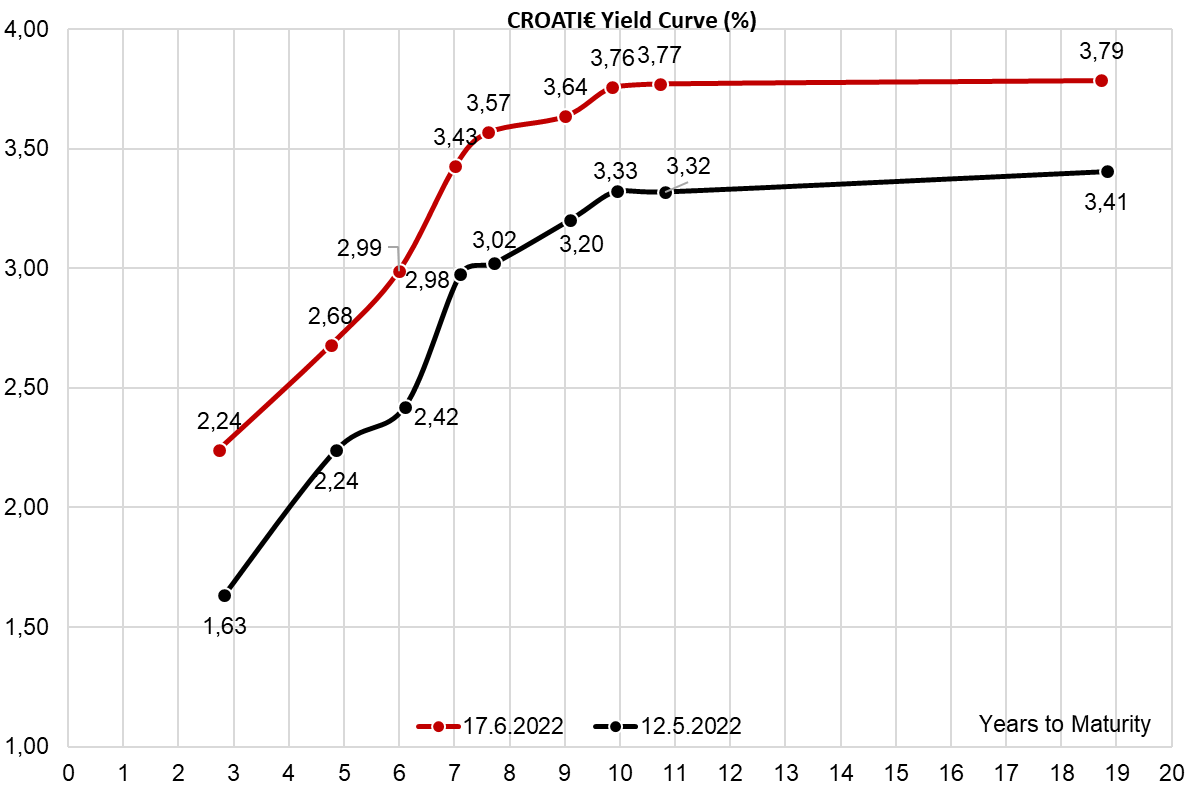

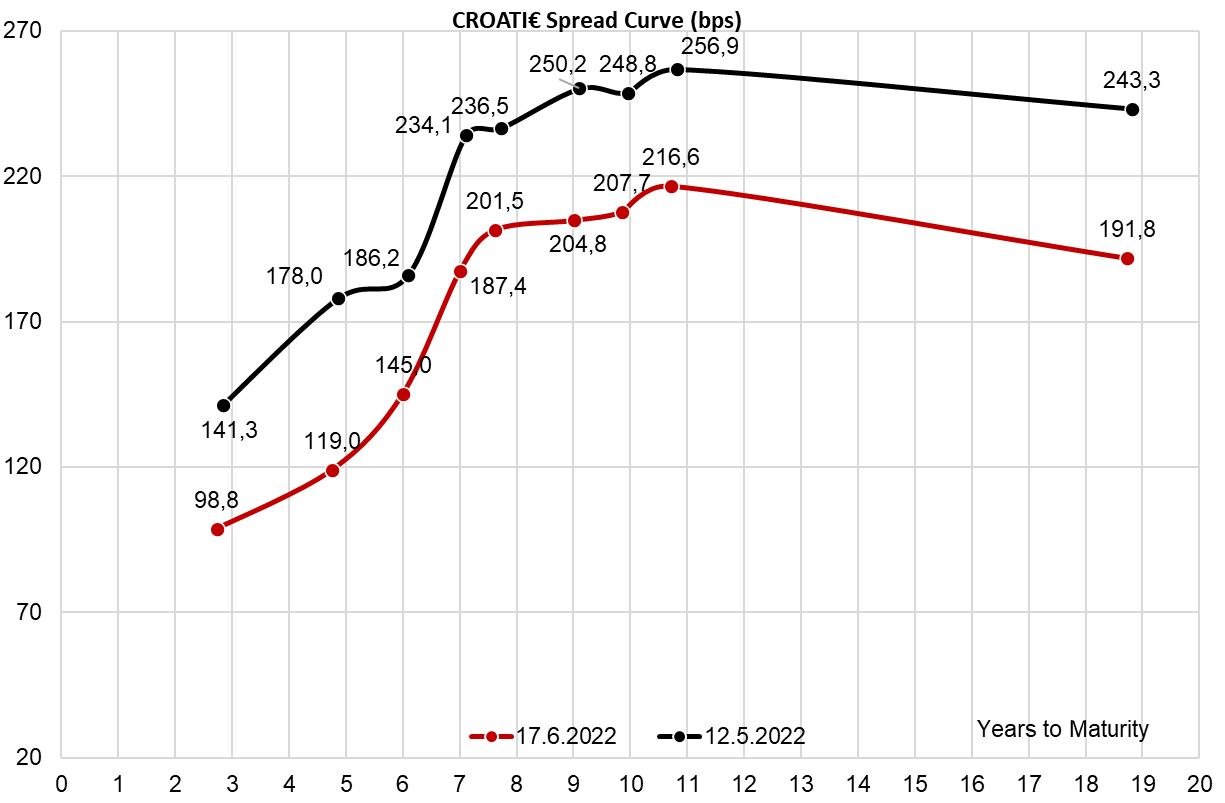

Finally, how are Croatian international bonds drifting through the storm? The new CROATI 2.875 04/22/2032€ was definitely the widowmaker of the curve – in the past two weeks it went from being priced 98.50-99.00 (3.05%-3.00%) to today’s 92.00-93.00 (3.87-3.74%). The spread to Germany widened from some 170bps to the current value of 207.7bps. At first it seems that Lagarde’s put isn’t working on this particular paper, but don’t forget that CROATI€ entered this sell off on the wrong foot, in other words it was spread-wise expensive from the very beginning. BTPS-GDBR spread went from 200bps (beginning June) to 240bps (Wednesday) before Lagarde’s put brought it back down to some 200bps (today). Croatia is again traded wider then Italy, something that we warned in our previous research pieces is still a a natural thing.

What happens next? The focus of domestic client now switches to the local bond auction that should take place in the coming weeks. So stay tuned, because it’s never boring on the bond desk!

Cinkarna Celje held the GSM yesterday in which the shareholders approved a dividend payment of EUR 24.9m. This translates into EUR 31.89 per share and is by EUR 10.9 per share higher compared to the initially proposed dividend. Also, a 10-to-1 share split was approved.

We note that the dividend yield is 11.1%, while ex-date is 22 June 2022.

Company operated stably and above its plan while having a surplus of cash at the end of Q1 amounting to EUR 57.1m, 6% higher than at the end of 2021. The eventual payment of dividends that would be paid in accordance with this proposal does not endanger the company’s capital stability in any way due to the cash surplus.

In the graph below, we are bringing you a historical overview of the company’s dividend per share and dividend yield.

Dividend per Share (EUR) and Dividend Yield (%) (2012 – 2022)

The program will start on 21 June 2022, will last until 20 June 2023, and will include a buyback of a maximum of 944,607 shares, with a maximum value of HRK 450m.

As Adris’ previous share buyback program is going to end on 20 June 2022, the Company has published a document stating that they are launching a new share buyback program on 21 June 2022. The program will include a buyback of a maximum of 944,607 shares with a total value of HRK 450m, while like the previous program, the Company is entitled to acquire up to 10% of its share capital.

The share price at which Adris will be acquiring the shares in this buyback should not exceed or be lower than 10% of the average market price of the previous day. The buyback program will last until 20 June 2023.

We are also proud to announce that once again, Adris’ share buyback program will be conducted by InterCapital Securities.

It should also be noted that currently, Adris holds 125,831 regular shares (or 1.3% of the total), and 569,562 preferred shares (or 8.39% of the total). Combined, this would mean the Company currently owns 695,393 treasury shares, which represent 4.24% of the total share capital.

Dividend yield is 3.14%, while ex-date is 23 June 2022.

Atlantic held the GSM in which the shareholders approved a dividend payment of HRK 50 per share as well as the share split, in which 1 current share will be split into 4 new shares. According to the report, a dividend of HRK 50 DPS shall be paid in 2022, out of the retained earnings the Company realized in the 2020 business year.

Note that dividend yield is 3.14%, while ex-dividend date is 23 June 2022. Payment date is 5 July 2022.

In the graph below, we are bringing you the company’s historical dividend per share and dividend yield.

Atlantic Grupa Dividend per Share (HRK) and Dividend Yields (%) (2013 – 2022)

At the closing price before the announcement, this would amount to a DY of 2.98%. Ex-date is set for 20 June 2022.

Ina has published the resolutions of its GSM held on 15 June 2022. Among the resolutions, the most interesting one is the approval of the 2022 dividend payment. According to the report, out of the net profit of HRK 1.27bn achieved in 2021, HRK 241.2m will be used to cover losses from the previous year, HRK 51.6m will be transferred into legal reserves, HRK 513.9k will be transferred into retained earnings, while HRK 980m will be used for dividend payment.

This implies a payout ratio of 77%, which would translate into a dividend of HRK 98 DPS. At the closing price before the announcement, this would amount to a DY of 2.98%. The ex-date is set for 20 June 2022, while the payment date is set for 14 July 2022.

Below we provide you with the Company’s historical dividend per share and dividend yields.

INA dividend per share (HRK) and dividend yield (%) (2015 – 2022)

Dividend yield is 7.5%, while ex-date is 2 August 2022.

Telekom Slovenije held the GSM in which the shareholders approved a dividend payment of EUR 29.2m. This translates into a dividend payment of EUR 4.5 per share, which was (counter)proposed by the largest shareholder of the Group.

Dividend yield is 7.5%, while ex-date is 29 July 2022. The dividends shall be paid on 2 August 2021.

In the graph below, we are bringing you a historical overview of the company’s dividends.

Telekom Slovenije Dividend per Share (EUR) and Dividend Yield (%) (2010 – 2022)

At the price before the announcement, this would amount to a DY of 9.94%. The ex-date is yet to be announced.

The Executive Board of OMV Petrom announced a special dividend proposal to be paid out in 2022. As the Company outlined in its 20230 Strategy, the Dividend Guidance allows the possibility of a distribution of a special dividend, if the investment plans are funded.

As the Company has a strong financial position in terms of net cash and profitability, the Executive Board decided to propose the payment of a special dividend in the amount of RON 0.0450 DPS. This would mean that the total value of the special dividends is RON 2.55bn, which would also mean that the dividend yield at the price before the announcement would amount to 9.94%.

The special dividend proposal is subject to approval by the Supervisory Board (which will meet on 21 June 2022), but also the GSM. The ex-date and Payment date will be announced through a convening notice of the GSM, which is estimated to be disclosed on 21 June 2022.

As a reminder, OMV Petrom already paid out a dividend of RON 0.0341 DPS (DY 7.4%) on 6 June 2022. Below we provide you with a historical overview of the Company’s dividends per share and dividend yields.

OMV Petrom dividend per share (RON) and dividend yield (%), (2013 – 2022)