Everybody is talking about the direction of global rates. Even the global equity players became aware that in a market like this, equities are effectively a short straddle on rates. What do we make of Stan Druckenmiller’s open ed in WSJ and why is CROATI 1.5 06/17/2031 such an ugly duckling of CROATI€ curve, find out in this brief research piece.

As the fixed income markets struggle to find direction, the focus of the investors starts to shift away from rate hikes and in the direction of taper talk. What’s the reason behind such a sudden shift? Partly it’s because FED officials are gradually starting to “talk about talking about tapering“, but the other major reason for concern came on May 10th when Stanley Druckenmiller, investment legend and George Soros’ prodigy, flagged concern over FED’s accommodative monetary policy in the wake of economic reopening. Druckenmiller didn’t really pick words to describe his concern: he said that FED is “playing with fire” and that “it’s time for a change”. His informational blueprint is rather simple: the American economy is back to pre-recession levels, unemployment has recovered by as much as 70% from it’s peak and still, FED continues to be buying 40bn USD of MBS a month. Druckenmiller is looking at the issue of accommodative monetary policy from different angles and he’s incorporating into his analysis the fact that US Department of Treasury had to add about 30% of GDP in extra public debt to bridge the demand slump stemming from the pandemic and he’s quite certain that neither taxes, nor GDP growth could make that go away in the coming years. The only way out of this is through monetization of debt and he’s certain that’s going to happen moving forward.

Stan Druckenmiller’s open ed in WSJ is definitely a vintage piece of his research – concise and comprehensive, it outlines hedge fund veteran’s outlook and concerns, as well as sketching a way forward. One particular sentence echoes minds of readers: “The pernicious deflationary episodes of the past century started not because inflation was too close to zero but because of the popping of asset bubbles.” In Stan’s economic mind it’s quite clear how the engine works: accommodative monetary policy unabated causes asset bubbles, which have to pop sooner or later and are followed by periods of deflation and disinflation; which are the treated by central banks by a new round of accommodative monetary policy that causes bubbles to pop which leads to… Well, you get the point.

So what happens next? Some would say Druckenmiller is just one in line of hedge fund veteran’s that took FED within the crosshairs of his critique. Ray Dalio and Larry Summers already took a swing in the same direction – Dalio’s comment raised a few eyebrows, while Summers’ harsh words aimed at the way FED is conducting monetary policy were partly explained by the fact that he was expecting to be included in Biden’s new administration, but was instead left out and marginalized by younger Democrats. Yannis Varoufakis described one talk he had with Larry Summers and said that Summers told him insiders never turn against other insiders; the moment you hear somebody is talking against financial insider, you can easily conclude that he has become an outsider. Ironically, this year Summers has become a victim of his own words said ten years ago. Him turning against FED officials means just one thing: that’s he might be becoming an outsider himself. Putting all of that aside, it’s still worth mentioning that comments about the state of the market coming from top brass of the financial industry were powerful enough to turn the tide of cash in any direction. Whoever doubts that, don’t forget that the tech bubble in late 1990s popped when Barron’s called it a bubble and that a major bond sell off in early 2015 came about after Jeffrey Gundlach (DoubleLine) said that German Schatz looks as grossly overvalued and called for a sell. The EGB yield curve caught fire which spread to all the durations and a few weeks later Bund yields moved from 0.04% (pre-Gundlach) to about 1.0% (post-Gundlach top). From that perspective, this year’s EGB sell off looks like a summer breeze.

Stan Druckenmiller hasn’t caused a Jeff Gundlach 2015-style bond sell off, but it did manage to put the focus on August 2021 (Jackson Hole meeting). The central bankers’ get together is a perfect opportunity to fine tune their actions and that’s precisely why Mario Draghi choose Jackson Hole to announce European QE back in 2014. Since August is three months away, the short term focus would be on FED officials’ comments in the coming weeks, looking for anything that might sound as tapering of asset purchases.

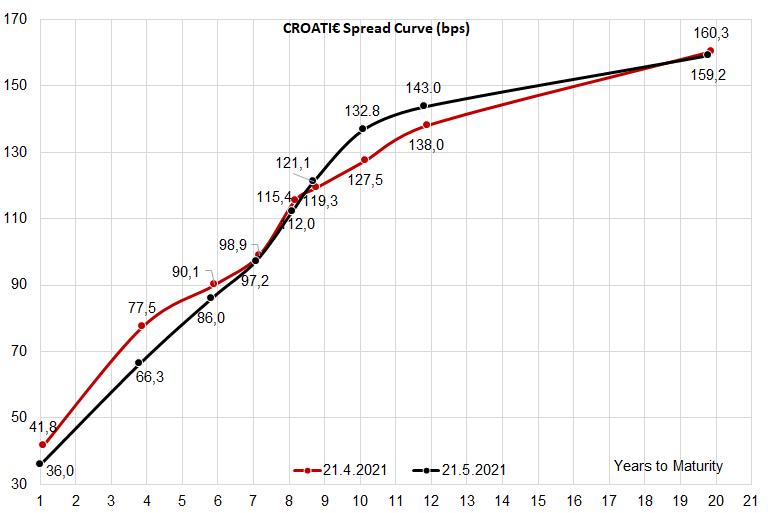

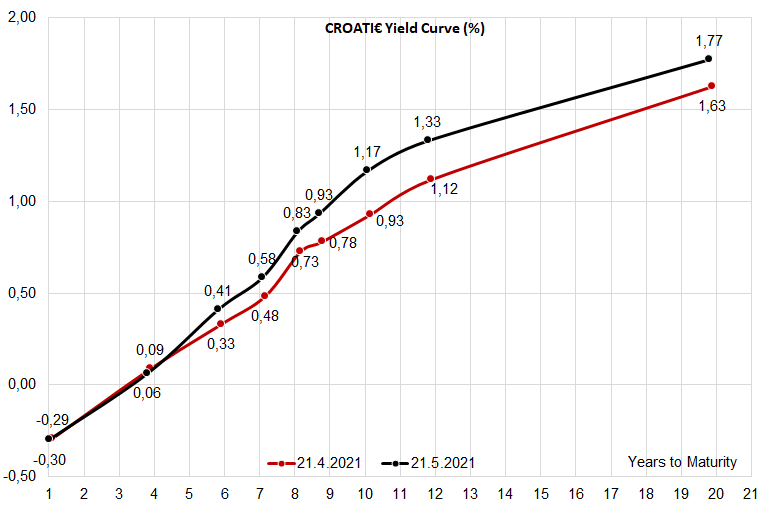

And now let’s get down to earth and see what’s going on with Croatian international bonds. On a one month time horizon Croatian yields followed the benchmark and moved north, but looking at the spreads the story is not so straightforward. The shape of the spread curve has changed in a way that short term spreads (namely CROATI 3 03/11/2025) have tightened while long term spreads have moved in the opposite direction and widened. This means that CROATI 1.5 06/17/2031 looks like an ugly duckling since it widened from B+127.5bps (April 21st) to B+132.8bps (May 21st). We have received a couple of inquiries from clients asking for clarity on the flow and all we can say regarding CROATI 1.5 06/17/2031 is that we see sell flow coming from foreigners, while domestic clients feel reluctant to add duration. But why has CROATI 1.6 06/17/2031 widened more that CROATI 1.125 03/04/2033, albeit by a small margin? If foreigners are cutting duration, shouldn’t they be selling longer paper instead? Well, you have to remember one thing – the two longest Croatian Eurobonds, CROATI 1.125 03/04/2033 and CROATI 1.75 03/04/2041, were placed at end-February when bond scare was running really deep so foreigners reduced their bids. Consequently, unusually high allocations of the two duration heavy bonds ended up on the accounts of Croatian domestic clients. What did local guys do with them? One part was reduced through selling, the other one went into HTC/HTM, so it can’t hurt anyone. CROATI 1.125 06/17/2031, well that’s a different story. Since this paper became a darling of UCITS funds, both domestic and foreign, it’s quite likely it’s mark-to-market, so it hurts quite a bit if the curve moves up and the bond is carried unhedged. It’s our interpretation that these market sensitive accounts came to cut their exposure and found themselves without somebody to dance with. We are certain that at some point local clients would start adding exposure to CROATI up again, but it won’t be before the path of global rates is more certain than it is today.