In the last few weeks, it became more than obvious that world will see recession this year, but the biggest question is how big the slump will be. Will it be V-shape recovery, U-shape or even L, meaning low GDP levels for years. As no one can say how big the consequences will be with much confidence, governments and central banks brought their toughest weapons and are trying to cushion this crisis as much as possible. In this article read about all the measures and what we expect can be done further.

Let’s start this article with March PMI data that came out for some EU countries and Euro zone in aggregate this week. Namely, EA’s composite PMI fell from 51.6 in February to 31.4 which left the index at the lowest level on the record but one has to bear in mind that survey was taken in mid-March while lockdowns were stronger each day in certain countries in EU meaning that in case lockdown lasts longer, index could fell further. Going on, yesterday we saw German Ifo survey which showed the same picture, i.e. expectations index fell to the levels seen in 2009 and if we use correlation between mentioned indices and GDP it is clear that GDP could fall more than 10% in Q2. Situation is especially challenging in service sector which could fall by 30-40% in Q2 while manufacturing still holds some ground.

With lockdowns being stronger and economy being halted, governments and central banks were forced to react in the last couple of weeks. If we would list all of the measures, we could write a book so we will just list several most important fiscal and monetary actions.

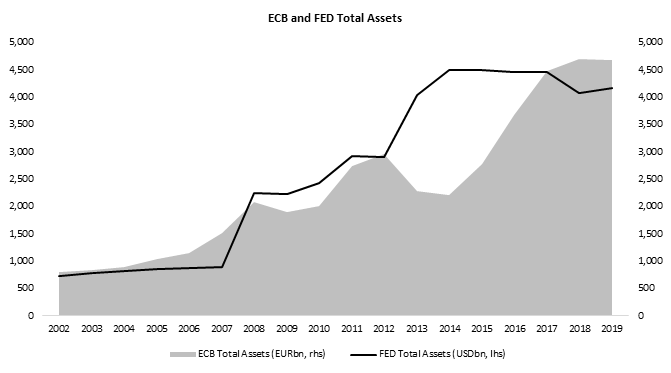

First, as we wrote last week, ECB announced it will buy up to EUR 750bn of sovereign bonds including Greece (non-IG) which halved yields on periphery. Furthermore, ECB will most likely ignore capital key and maybe adjust later to stop the pressure on some issuances while it could also start buying corporate bonds. Another step will be ESM (European Stability Mechanism fund that could provide additional EUR 400bn as 100bn is already in use for Greece. This additional support could be funded by so called corona bonds but there are still some details to agree as new debt should be issued by capital from all of the EA countries. As we mentioned above, ECB will most likely expand its asset purchases, increase its bazooka if needed while we think that buying equity is still bit too far to go but we wouldn’t exclude that in the next stage in case corona virus stays longer than expected. Considering bond markets, as flow became only one-way, central banks seem to be The buyer at the moment and their intentions to buy more and more assets could calm markets, at least in the short term.

Across the Atlantic, last week everyone thought that FED is out of ammunition as it slashed its rates to zero, increased its purchases and pumped enormous amounts through repo. However, on Monday morning they announced they will buy US treasuries and MBS as much as needed, i.e. without any limit. Just to put things in perspective, FED is now buying USD 75bn treasuries and USD 50bn of MBSs per day. Furthermore, there is also USD 300bn package that will buy corporate bonds rated BBB with maturity up to 5 years. With unlimited buying, FED is actually now at full speed and now it is all about fiscal measures and how much debt will be needed.

Another side of the coin are fiscal measures that will need central banks to monetize all this debt that will be needed to support economies. After political battle in the Congress, fiscal package in the US was agreed at level of US 2tr, i.e. 10% of GDP with half of the package that will be transferred to individuals and companies through cash payments and loans, unemployment insurance transfers and so on. In EA there are similar types of allowances except there aren’t any direct cash payments to households and package seems bit smaller in terms of GDP. Namely, Germany will open its budget up to 5.0% of GDP which is based on GDP decrease of 5.0% this year. This would leave German budget deficit at 4.7% of GDP after last year’s surplus.

Meanwhile, Croatian government introduced 64 measures such as tax postponement, support with wages and so on but the main point is that there will not be any permanent write-offs of tax debt, at least for now. According to Finance Minister Maric, this is just first package of measures and lot more will have to be done mostly depending on duration of the pandemic and at the moment revenue side of the government’s P&L should delay around HRK 14bn (EUR 2bn, 3.5% of GDP). On the other side, CNB seems to be more proactive as it maintained several FX auctions, repo auctions and even bought bonds on secondary market. Also, CNB decreased rate of mandatory reserve for banks which will result in increased liquidity of more than HRK 10bn.

Source: FRED, ECB, InterCapital