In the last few weeks, it became more than obvious that world will see recession this year, but the biggest question is how big the slump will be. Will it be V-shape recovery, U-shape or even L, meaning low GDP levels for years. As no one can say how big the consequences will be with much confidence, governments and central banks brought their toughest weapons and are trying to cushion this crisis as much as possible. In this article read about all the measures and what we expect can be done further.

Let’s start this article with March PMI data that came out for some EU countries and Euro zone in aggregate this week. Namely, EA’s composite PMI fell from 51.6 in February to 31.4 which left the index at the lowest level on the record but one has to bear in mind that survey was taken in mid-March while lockdowns were stronger each day in certain countries in EU meaning that in case lockdown lasts longer, index could fell further. Going on, yesterday we saw German Ifo survey which showed the same picture, i.e. expectations index fell to the levels seen in 2009 and if we use correlation between mentioned indices and GDP it is clear that GDP could fall more than 10% in Q2. Situation is especially challenging in service sector which could fall by 30-40% in Q2 while manufacturing still holds some ground.

With lockdowns being stronger and economy being halted, governments and central banks were forced to react in the last couple of weeks. If we would list all of the measures, we could write a book so we will just list several most important fiscal and monetary actions.

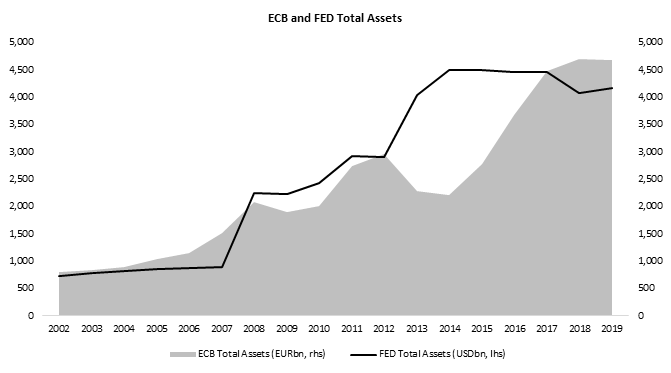

First, as we wrote last week, ECB announced it will buy up to EUR 750bn of sovereign bonds including Greece (non-IG) which halved yields on periphery. Furthermore, ECB will most likely ignore capital key and maybe adjust later to stop the pressure on some issuances while it could also start buying corporate bonds. Another step will be ESM (European Stability Mechanism fund that could provide additional EUR 400bn as 100bn is already in use for Greece. This additional support could be funded by so called corona bonds but there are still some details to agree as new debt should be issued by capital from all of the EA countries. As we mentioned above, ECB will most likely expand its asset purchases, increase its bazooka if needed while we think that buying equity is still bit too far to go but we wouldn’t exclude that in the next stage in case corona virus stays longer than expected. Considering bond markets, as flow became only one-way, central banks seem to be The buyer at the moment and their intentions to buy more and more assets could calm markets, at least in the short term.

Across the Atlantic, last week everyone thought that FED is out of ammunition as it slashed its rates to zero, increased its purchases and pumped enormous amounts through repo. However, on Monday morning they announced they will buy US treasuries and MBS as much as needed, i.e. without any limit. Just to put things in perspective, FED is now buying USD 75bn treasuries and USD 50bn of MBSs per day. Furthermore, there is also USD 300bn package that will buy corporate bonds rated BBB with maturity up to 5 years. With unlimited buying, FED is actually now at full speed and now it is all about fiscal measures and how much debt will be needed.

Another side of the coin are fiscal measures that will need central banks to monetize all this debt that will be needed to support economies. After political battle in the Congress, fiscal package in the US was agreed at level of US 2tr, i.e. 10% of GDP with half of the package that will be transferred to individuals and companies through cash payments and loans, unemployment insurance transfers and so on. In EA there are similar types of allowances except there aren’t any direct cash payments to households and package seems bit smaller in terms of GDP. Namely, Germany will open its budget up to 5.0% of GDP which is based on GDP decrease of 5.0% this year. This would leave German budget deficit at 4.7% of GDP after last year’s surplus.

Meanwhile, Croatian government introduced 64 measures such as tax postponement, support with wages and so on but the main point is that there will not be any permanent write-offs of tax debt, at least for now. According to Finance Minister Maric, this is just first package of measures and lot more will have to be done mostly depending on duration of the pandemic and at the moment revenue side of the government’s P&L should delay around HRK 14bn (EUR 2bn, 3.5% of GDP). On the other side, CNB seems to be more proactive as it maintained several FX auctions, repo auctions and even bought bonds on secondary market. Also, CNB decreased rate of mandatory reserve for banks which will result in increased liquidity of more than HRK 10bn.

Source: FRED, ECB, InterCapital

Valamar decided not to propose a dividend payment for the year 2019. Besides that the company issued another statement regarding the implications of Covid-19 on their operations.

Valamar published a document on the Zagreb Stock Exchange announcing that the Management Board has decided to cancel their GSM and withdraw their dividend proposal.

As a reminder, the Management Board and Supervisory Board initially proposed a dividend of HRK 1.2 per share, implying a payout ratio of 52%. Such a dividend was by HRK 0.2 per share higher compared to the one paid in 2019.

In the graph below, we are bringing you historical overview of the company’s dividends.

Dividend per Share (HRK) & Dividend Yield (%) (2015 – 2020)

Statement Regarding Covid-19

The occurrence of exceptional circumstances and the introduction of extraordinary measures to prohibit the gatherings, movement, hospitality venues, led to a consequential and immediate disruption of the Company’s business, cancellation of accommodation of other contracted services by partner agencies and guests during the pre-season period, so far with an uncertain impact on the months of the main season.

Following the tightening of general prevention measures by the authorities, on 15 March 2020 all previously opened catering establishments were closed and until further notice their reopening is delayed. In addition, a decision was made to suspend investment work at all construction sites due to restrictive measures and increased risk to the health of all participants.

Given the global reach of problems caused by the unpredictable spread of the COVID-19 virus, closed border crossings of surrounding countries, a number of obstacles to the free transfer of passengers, goods and services to many important markets for Valamars, at this point it is still too early to give quantitative estimates regarding the negative impact of COVID-19 on business of Valamar in the coming period.

In order to achieve business continuity with a primary focus on escalation plans for the Company’s liquidity and solvency measures, starting on 1 April 2020. The program “break, restart of the business” will be launched for 30 to 90 days.

Given that the tourist facilities have been temporarily suspended, in accordance with the current decisions of the Croatian authorities, Valamar will close its facilities until 30 April 2020.

The temporary pause program will include all employees of the Company, by which the company will ensure that jobs are maintained without layoffs. All workers who, due to extraordinary circumstances, will not be able to carry on business activities will be put on hold with at least 60% of regular pay secured, but not less than HRK 4,250 (net).

Ad Plastik is adjusting its capacities in response to the disruption in the economy brought by the pandemic.

The Company has announced on the ZSE about the existence of new events affecting its business operations. The outbreak of coronavirus has forced many businesses around the globe to temporarily cease their operations to stop the spread of the disease. Ad Plastik’s factory in Hungary supplies the products to the Bentley Motors, their important customer that has temporarily shut down all plants in the UK. Also, the Company’s factory in Russia is adjusting its capacities since Volkswagen Group has temporarily closed factories, while other Russian clients continue to operate at the moment.

Yesterday, the management board of the NLB Group held a conference call in which they discussed the implications of the Covid-19 situation on the Group’s operations.

The CEO, Blaž Brodnjak, opened the call stating that the bank is so far maintaining normal operations and critical functions are running smoothly. The bank is providing all services, where majority of business is in transaction, while volume of asset management business and lending is reduced at the moment, due to the pandemic. Roughly half of the branches of the bank are open, while the management is taking a sequence of steps in insuring stable operations of the company.

When looking at the banks portfolio, on the corporate side, the most impacted industries (such as hotels, restaurants, transportation) account for less than 10% of the exposures. Meanwhile, roughly 20% of the entire portfolio could be considered to be medium impacted (industries like wholesale, retail, automotive). The management notes that on the corporate side a rising usage of revolvers and overdrafts are being witnessed, while the clients are requesting restructuring. Almost all countries in which the bank operates, are allowing for moratoriums, so the bank will for smaller ones use frame now foreseen by the regulator.

The management also notes that in high risk industries, they might observe increased cost of risk and potential higher default rates, especially on the corporate side. But at the moment it is still too early to quantify the effect, however they add that it seems manageable from the bank’s perspective.

On the retail side, the company is not witnessing any imminent bigger problems yet. They note that they expect a considerably reduced demand for new loans, which would come from potential job uncertainty of retail clients. They add that retail clients are also using less credit cards as a result of people staying at home and a decrease in usage of revolving credit.

Slovenian Government has introduced Intervention Act which allows Slovenian borrowers, who suffer liquidity problems caused by COVID-19 epidemic, both corporate and retail, to apply for grace period for loans with Slovenian banks. A deferral is granted for at least twelve (12) months, whereas the bank and the borrower can agree on terms which are more favorable for the borrower. As regulators see this crisis as systemic risk and they have imposed grace period for stressed borrowers, the bank does not see strong impact on their profitability anytime soon. According to management, moratoriums will apply so higher impact will come in the following period, when the bank will be able to assess how their clients’ businesses are impacted. Therefore, then will be the time when they will have to record potential provisions. As this measure is deferring payments for borrowers, the management sees this rather as a liquidity burden, not at interest income burden as interest is accrued during the period. This measure will also somewhat increase workload in operations, as monthly reporting of borrowers in distress about their financial situation to banks is introduced.

Capital and Capital measures

The bank operates with a strong balance sheet and has completed most of its capital agenda prior to the Covid-19 situation, issuing in excess of EUR 200m of Tier 2 capital, which is now necessary to absorb both the market situation and the acquisition of Komercijalna Banka.

The management notes that they would be interested in issuing Tier 1 capital, however this is mostly subject to market condition, so as of now we can expect that NLB will hold back on Tier 1 issuance.

Dividend policy

NLB is currently faced with a challenge of absorbing both the acquisition of Komercijalna Banka and the current market situation posed by Covid 19 crisis. The fact that issuance of Tier 1 capital seems to be closed due to market conditions is not accommodating. The company does not plan on revising their medium-term dividend policy and is comfortable with fulfilling the 70% payout ratio for the coming years, however dividend for 2019 will be synchronized with absorbance of Komercijalna Banka. Consequently it is challenging to predict the dividend for the year 2019. Unlike in Croatia, where the Central Bank required banks to retain 100% of their 2019 earnings, no such move is currently in sight in Slovenia.

Acquisition of Komercijalna Banka

In February NLB announced that they have entered into a share purchase agreement with the Republic of Serbia for the acquisition of an 83.23% ordinary shareholding in Komercijalna Banka.

NLB acquired the 83.23% shareholding for the amount of EUR 387m, which will be payable in cash on completion. Such a price puts the transaction multiple at P/B 0.77 and P/E 6, while it implies a valuation of EUR 465m for the 100% stake in Komercijalna Banka. Since the SPA, the market conditions have changed and the remaining shares of Komercijalna Banka are traded at quite lower multiples on the Belgrade Stock Exchange. The management pointed out that the fundamental prospects for Komercijalna Banka have not changed. Value created potential and the merits of the transaction as well as the economic prospects of the region have not necessarily changed, according to the management.