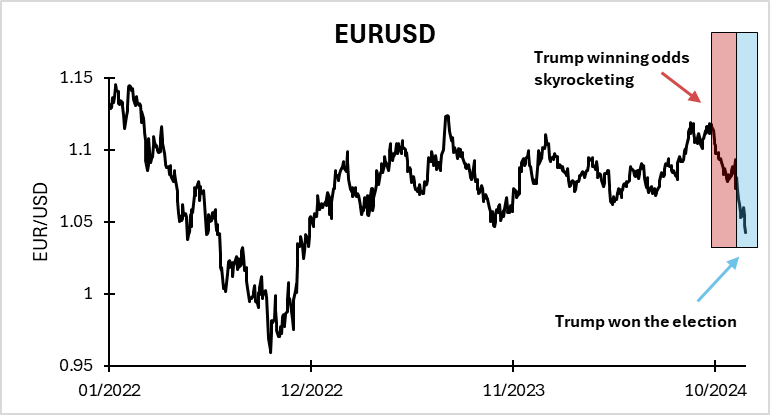

The re-election of Donald Trump reopened the discussion about a significant depreciation of the Euro. The positive trade balance of the European Union towards the US will be significantly pressured if Trump keeps his promise to introduce an all-across-the-board tariff of 10 to 20%.

European auto industry already faces significant pressure from lower sales in China, and tariffs are probably the game-changer for European manufacturing. Since the pre-election period, when markets started to forecast Donald Trump winning the election, the EURUSD has struggled. Markets are giving a high probability of more cuts by the European Central Bank due to a weak economy and lower long-term growth expectations. Low or even negative interest rates are not far-fetched anymore as they were in a post-COVID period of 2022, 2023, and most of 2024. Even though the 10-year yield in the US skyrocketed as the expectations of an even higher deficit and inflationary policy could raise medium-term inflation in the US, German yields cannot keep up with it due to higher long-term growth fear. EURUSD shows the exact problem that the EU is facing – lower long-term growth in combination with strong US growth prospects that sent the US 10-year yield vs Bund yield spread to 214bps. More precisely, markets believe the US will be the powerhouse, and the European outlook will not improve in the near term. Translated into monetary policy, the Federal Reserve is going to delay rate cuts further into the future or even stop much earlier than previously expected as the neutral rate is probably higher than before, and inflationary tariffs are going to spike up prices as low-technology imports from China are going to be much more expensive in the US than before. Expectations of EURUSD reaching parity are growing, and unfortunately, there are no signs of a quick reversal. A trade agreement with the US to leave the EU outside the US tariff world is the last resort for the EU. Does the EU have negotiating power to achieve that? After the start of the war in Ukraine and the cut-off of Russian energy, the answer is – probably not, as the United States became a significant exporter of energy products to Europe. Europe does not have another counterparty to quickly diversify the energy imports from the US, and the retaliatory import tariffs of the EU should exclude energy products as its demand is mostly inelastic. Also, the AI revolution is happening mostly in the US through Nvidia, Microsoft, Google, Meta, etc., a new technology that would be more expensive for Europe in case of retaliatory tariffs aimed at the US, so retaliatory tariffs are probably a no-go for EU. Unfortunately, Europe seems to be lost in the fast-changing trade relations without any real ally. US and EU decided to penalize China through various sanctions and tariffs (e.g. on electric vehicles), so China is not an ally at this point in combination with a weak Chinese economy. Russia is not an ally at this point and probably won’t be until the war in Ukraine finishes. And the US is going to penalize everyone, including the EU, with tariffs. Consequently, if the mentioned trade agreement is just fiction, the EU is going to get a raw deal. Lower rates in the EU are the probable future. However, the EU depends on Trump’s goodwill. That might be a good lesson for Europe to start reconsidering dependence upon everyone else and build independent policy (at least energy policy through nuclear energy). Trump’s goodwill decides whether the Euro goes below parity or stays above parity in the short term. However, medium and long-term prospects of growth are upon us to build.

The EURUSD nearing parity underscores the EU’s struggle with slower long-term growth, tariff pressures, and limited negotiation leverage. Trump’s potential trade tariffs and Europe’s energy dependency on the US create a precarious situation, exacerbated by weak demand from China and strained global alliances. With lower rates and sluggish economic prospects, the EU risks further depreciation of the Euro unless strategic independence is prioritized, particularly in energy and trade policies. The situation highlights the urgency for Europe to reduce reliance on external powers and foster resilience, as its medium and long-term growth depends on proactive policy shifts and self-reliance.

Source: Bloomberg, InterCapital