On Thursday, October 17, the European Central Bank delivered another 25bps cut, the first back-to-back this cycle, and signalled that more is coming from where that came. Although the cut itself was widely anticipated, given the recent September HICP and PMI prints, the press conference turned out to be more dovish (suggesting a looser monetary policy) compared to market expectations. We will further explain the crux of what was said at the presser and what lies ahead for the ECB.

This was not one of those so-called projection meetings on which the ECB’s staff produces freshly minted economic projections that help the Governing Council steer monetary policy in the appropriate direction, but we still received a hint that there are going to be some modifications at the upcoming meeting, namely the inflation projections. This insight stems from the difference in the wording of the press conference statement, which now states that HICP inflation is expected to decline to target in the course of 2025, giving a greater likelihood of such a thing happening in the first half of the year.

The decision at the meeting was unanimous, and there was no pushback on the market’s expectations of the terminal rate and the velocity with which we will get there. The financial conditions are still considered to be in restrictive territory. They explained the need for that with the rise in inflation expected over the coming months because of base effects before losing momentum and retreating to target next year. While the risks to the inflation outlook remain two-sided, pressures arising from the resilient labour market and unabating wage cost pickups are slowly moving out of the spotlight, leaving the centre stage to the risk of the inflation undershooting rather than overshooting, especially now when the jeopardy of oil prices surging have eased, and oil has found itself in a new comfort zone around 70$ per barrel of WTI blend.

The meeting-by-meeting approach based on the totality of the data, not specific data points, is still the mantra for President Lagarde. When talking about a possible recession, she was adamant, saying that it was not going to happen, but this was conditioned on the data currently available. The market has some other ideas and will get another round of cues that will give more perspective, with PMI numbers coming in this Thursday, followed by a preliminary flash GDP estimate for 3Q24 on October 30, and closing the month are flash inflation prints for October the day after.

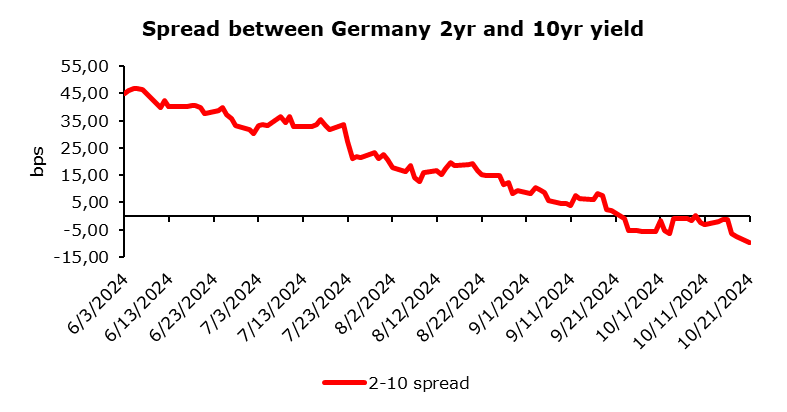

To paraphrase The Doors’ aptly titled song “Summer’s Almost Gone”, the question is now where will be in terms of terminal rate when the ECB finishes the cutting cycle. The market is now pricing in that to be on the lower end of the 2.00-2.50% range. It even sees a solid possibility of a 50bps cut in December, i.e. a much swifter pace of dialling back to the neutral stance. Bund yield remains at the same levels as before the ECB’s meeting, and the curves have steepened by several basis points from the short end. Euro area steepeners are back in play, and this might be the last train to catch for initiating them if you have missed recent opportunities. Further impetus might come from depressing PMIs and risks from tariffs and geopolitical risks dampening growth.

Source: Bloomberg, InterCapital