As global equities are going through another goldilocks episode, fixed income is threading water in the expectation of signals from major central banks about the possible direction of interest rates. Meanwhile, Croatian investors are undergoing switching from local bonds into international ones because of considerable pickup. If you still haven’t done it, put March 20th on your calendar because it’s the first date of Croatian sovereign rating review (S&P). For the additional three dates worth remembering, go through this brief article.

On December 09th, 2019 JP Morgan issued its Equity Derivatives Outlook publication with a 3,400.00 point target for the S&P500 index (year-end 2020, assuming EPS @ 180 USD an P/E ~ 19.0x). At a time of publication, this was forecast was positioned at the higher part of the spectrum and it took a lot of guts to publish such a figure. Nevertheless, merely one month and two signatures on the US-China trade deal later, the S&P500 closed at 3,316.81, meaning that in the first two weeks of the year the index delivered more than half of the expected annual return. Dow Jones broke the magical 29,000 point threshold as well, so generally speaking US equity indices closed at record highs yesterday. Speaking about implied volatility indices, VIX index closed at 12.32 (the lowest value since end-November) and the spread between the first and the second futures is at its 97th percentile, looking within the three-year time span. This is not pointing in the direction of increased implied volatility going slightly forward since the front month futures contract will be expiring as soon as next week (January 22nd) so the price of the futures contract converged to the index value. On the other hand, the spread between the second futures and the index appears to be slightly elevated (15.14 – 12.32 = 2.82, 81st percentile in 2017-2020 time horizon), meaning that markets might be hedging themselves against realized volatility in the months ahead.

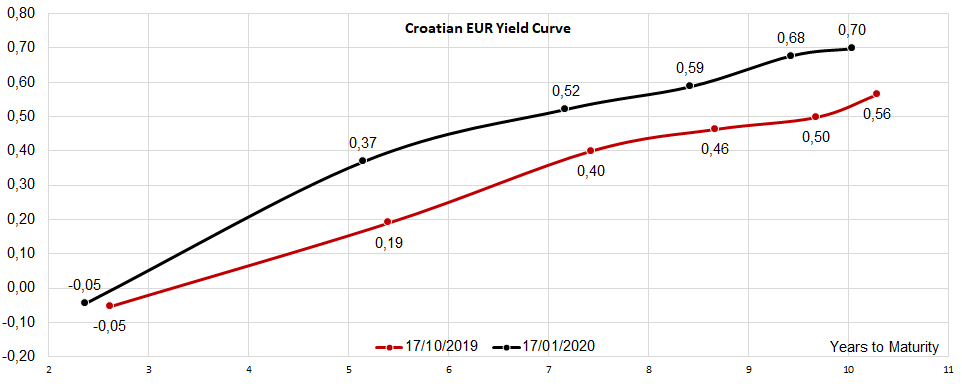

Speaking about the Croatian international bonds not much has been going on lately in terms of yields and prices. The long end (CROATIA 2029 EUR in particular) has reported a modest rise in prices amid heightened geopolitical risk, the top of it being the day that Iran retaliated by shelling US military positions in Iraq. Nevertheless, since then European bonds managed to report a price correction, meaning that the drop in yields was a pure risk off move that was short lived as usual. The chart submitted below shows that CROATIA 2029 EUR could now be purchased @ 104.25 clean price (0.66% YTM, 93.4bps above the German paper of corresponding maturity). Considering Croatian bonds, there are still some things worth considering: Standard&Poor’s Global Ratings is expected to review the Croatian sovereign rating on March 20th and on September 18th, while Fitch will the same on June 05th and December 04th. These dates are definitely worth putting on the calendar, although markets tend to anticipate the moves and trade the corresponding sovereign paper as the move had already happened.

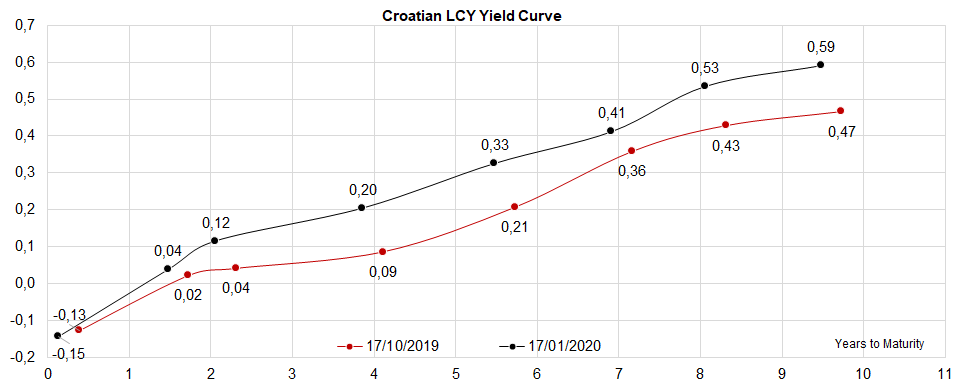

Looking at the local HRK curve, the yields did move slightly up compared to mid-October, a response to rising yields in the international markets. Currently, we’re seeing a bit of a selling pressure on CROATE 2.375 07/09/29 – at least part of it comes from switching from local bonds into Eurobonds since hedging FX exposure represents a carry positive trade. This switching trade might suddenly stop once the forward points on EURHRK turn negative and FX hedging starts to work the other way around, i.e. eating away all of the yield premium of international bonds.

For CEE investors looking at Romania, rating events are scheduled for 01st May (Fitch), June 05th (S&P), 30th October (Fitch) and December 04th (S&P). Two things are worth considering here: the two rating agencies converged to the same credit rating (BBB-), but they diverge in terms of outlook (S&P has a negative one, while Fitch keeps it at stable). The country is expected to place an international bond any time soon (i.e. in the coming months) and there is no rating reviews on the calendar before the placement actually happens. The size and the duration of the paper (or papers, if there is a multiple tranche) is still unknown, but it wouldn’t be surprising if the country decides to issue a paper with an extended maturity. In the midst of a complex political situation, the current Ministry of Finance looks determined to bring down the fiscal deficit to 3.0% GDP by 2023, although some form of fiscal largesse might be required if the ruling party seeks to secure a stable government.