As global equities are going through another goldilocks episode, fixed income is threading water in the expectation of signals from major central banks about the possible direction of interest rates. Meanwhile, Croatian investors are undergoing switching from local bonds into international ones because of considerable pickup. If you still haven’t done it, put March 20th on your calendar because it’s the first date of Croatian sovereign rating review (S&P). For the additional three dates worth remembering, go through this brief article.

On December 09th, 2019 JP Morgan issued its Equity Derivatives Outlook publication with a 3,400.00 point target for the S&P500 index (year-end 2020, assuming EPS @ 180 USD an P/E ~ 19.0x). At a time of publication, this was forecast was positioned at the higher part of the spectrum and it took a lot of guts to publish such a figure. Nevertheless, merely one month and two signatures on the US-China trade deal later, the S&P500 closed at 3,316.81, meaning that in the first two weeks of the year the index delivered more than half of the expected annual return. Dow Jones broke the magical 29,000 point threshold as well, so generally speaking US equity indices closed at record highs yesterday. Speaking about implied volatility indices, VIX index closed at 12.32 (the lowest value since end-November) and the spread between the first and the second futures is at its 97th percentile, looking within the three-year time span. This is not pointing in the direction of increased implied volatility going slightly forward since the front month futures contract will be expiring as soon as next week (January 22nd) so the price of the futures contract converged to the index value. On the other hand, the spread between the second futures and the index appears to be slightly elevated (15.14 – 12.32 = 2.82, 81st percentile in 2017-2020 time horizon), meaning that markets might be hedging themselves against realized volatility in the months ahead.

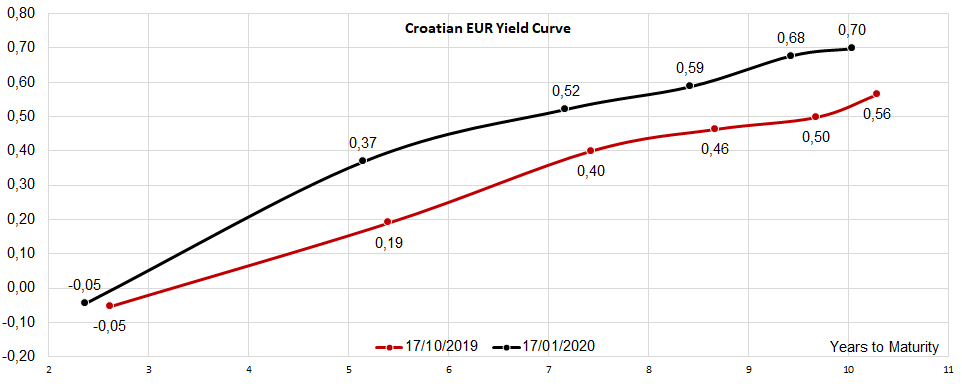

Speaking about the Croatian international bonds not much has been going on lately in terms of yields and prices. The long end (CROATIA 2029 EUR in particular) has reported a modest rise in prices amid heightened geopolitical risk, the top of it being the day that Iran retaliated by shelling US military positions in Iraq. Nevertheless, since then European bonds managed to report a price correction, meaning that the drop in yields was a pure risk off move that was short lived as usual. The chart submitted below shows that CROATIA 2029 EUR could now be purchased @ 104.25 clean price (0.66% YTM, 93.4bps above the German paper of corresponding maturity). Considering Croatian bonds, there are still some things worth considering: Standard&Poor’s Global Ratings is expected to review the Croatian sovereign rating on March 20th and on September 18th, while Fitch will the same on June 05th and December 04th. These dates are definitely worth putting on the calendar, although markets tend to anticipate the moves and trade the corresponding sovereign paper as the move had already happened.

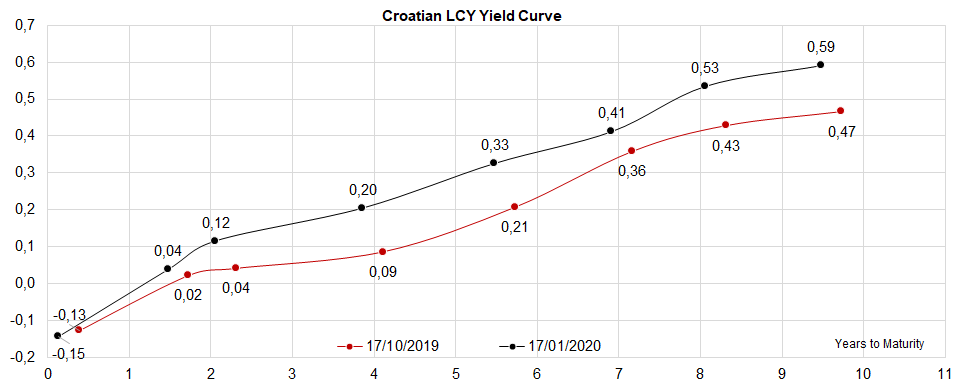

Looking at the local HRK curve, the yields did move slightly up compared to mid-October, a response to rising yields in the international markets. Currently, we’re seeing a bit of a selling pressure on CROATE 2.375 07/09/29 – at least part of it comes from switching from local bonds into Eurobonds since hedging FX exposure represents a carry positive trade. This switching trade might suddenly stop once the forward points on EURHRK turn negative and FX hedging starts to work the other way around, i.e. eating away all of the yield premium of international bonds.

For CEE investors looking at Romania, rating events are scheduled for 01st May (Fitch), June 05th (S&P), 30th October (Fitch) and December 04th (S&P). Two things are worth considering here: the two rating agencies converged to the same credit rating (BBB-), but they diverge in terms of outlook (S&P has a negative one, while Fitch keeps it at stable). The country is expected to place an international bond any time soon (i.e. in the coming months) and there is no rating reviews on the calendar before the placement actually happens. The size and the duration of the paper (or papers, if there is a multiple tranche) is still unknown, but it wouldn’t be surprising if the country decides to issue a paper with an extended maturity. In the midst of a complex political situation, the current Ministry of Finance looks determined to bring down the fiscal deficit to 3.0% GDP by 2023, although some form of fiscal largesse might be required if the ruling party seeks to secure a stable government.

Such allegations were reflected in yesterday’s trading, as Krka’s share price decreased by 4.42%, closing at EUR 73.6 per share.

According to unconfirmed media reports, Krka is under investigation by the Romanian health ministry after confidential documents detailing controversial payments to doctors were leaked to the local media. Romanian media released certain documents and testimonials from employees claiming that Krka also bribed doctors for prescribing Biobil.

Such allegations were reflected in yesterday’s trading, as Krka’s share price decreased by 4.42%, closing at EUR 73.6 per share. Excluding ex-dividend dates, this is the highest daily share price decrease since January 2013. It is worth noting that Romanian market accounts for roughly EUR 53m of Krka’s sales (roughly 4% of FY 2018 sales).

Earlier today, Krka published an official statement regarding the mentioned issue. To read more about their statement click here.

The agreement represents our 5th market making mandate in the Slovenian market. As the only provider of market making services in Slovenia, we remain dedicated to making investments into the region more attractive by supporting transparency and liquidity, and we thank our partners for supporting us in achieving this goal.

We are proud to announce that InterCapital has concluded a contract with Telekom Slovenije regarding market making services. Being a market maker means that InterCapital will continuously put both bid (buy) and ask (sell) orders on TLSG shares at a pre-defined spread. The idea is to enable investors to buy or sell the shares (up to a certain size) at any time within a reasonable volatility range.

In 2019, InterCapital reignited market making in Slovenia after 10 years, and currently provides the mentioned services to 5 Slovenian blue chips: Telekom Slovenije, Krka, Triglav, Petrol and Sava Re.

Besides that, InterCapital is already an established market maker in Croatia, covering 8 blue-chip companies, all part of the CROBEX index. According to our experience, the service accounts for a significant portion of the shares’ total turnover. We are proud of having earned the companies’ trust and will do our best to continue providing the best service possible. We remain dedicated to making investments into the region more attractive by supporting transparency and liquidity, and we thank our partners for supporting us in achieving this goal.

The mentioned guarantee amounts to HRK 300m, which represents 100% of the approved credit and/or financial framework.

The Government of the Republic of Croatia held a session in which they issued a decision granting a State guarantee in favor Croatian Bank for Reconstruction and Development (HBOR) and/or other commercial banks at home and/or abroad for credit indebtedness and/or financial framework for liquidity to companies of Đuro Đaković Grupa.

The mentioned guarantee amounts to HRK 300m, which represents 100% of the approved credit and/or financial framework. Of that amount, HRK 150m will be used, after the adoption of this decision, to create preconditions for unfreezing accounts, starting production and completing started contracts with customers, and paying obligations to customers financial institutions, as well as obligations towards the Republic of Croatia.

The other HRK 150m is intended for working capital for production in the facilities of the company Đuro Đaković Specijalna vozila, mainly for payment to suppliers, credit obligations, guarantees for good performance of work, advances received. The mentioned amount will be used upon receiving the consent of the European Commission in accordance with the guidelines of the European Commission on State aid for rescuing and restructuring non-financial undertakings in difficulty.

In December 2019, GWPs rose by 7.1% compared to last year. GWPs in non-life insurances grew 11.4% YoY, while life insurance decreased -2.1% YoY.

In December 2019, GWP’s rose by 7.1% compared to the same period last year. The total amount of GWPs collected reached HRK 10.73bn (includes insurers located in Croatia and insurers operating in Croatia but based in another EU country).

Total Croatian T12 GWP and Croatia Osiguranje T12 GWP (HRK bn)

The amount of GWPs in non-life insurances, which traditionally account for the biggest portion, grew 11.4% YoY, amounting to HRK 7.61bn. Meanwhile, life insurance continued with a trend where more maturities than premiums contracted were observed so segment has realized a decrease of -2.1% YoY, reaching HRK 3.11bn.

Croatia Osiguranje accounted for 25.3% of the market, as the company’s market share decreased by 2.2 p.p. which, represents a mild slowdown of the decreasing trend as in market share has decreased. When observing their GWPs in December, they amounted to HRK 2.71bn, which represents a decrease of 1.6% YoY.

Croatia Osiguranje T12 Market Share (%)

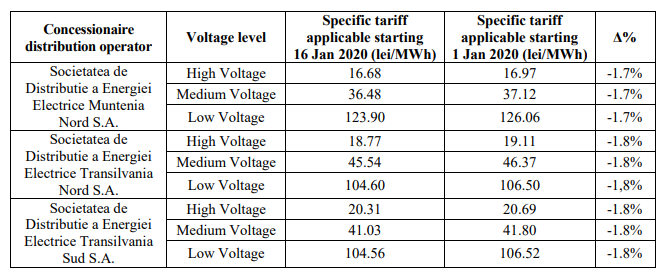

According to the ANRE Orders, the specific tariffs relate to the electricity distribution service for the three concessionaire distribution operators of Electrica Group and are applicable starting with 16 January 2020.

Electrica published an announcement on the Bucharest Stock Exchange regarding a change in distribution tarrifs. The specific tariffs for the electricity distribution service for the distribution subsidiaries of Electrica Group and the regulated electricity tariffs applied by Electrica Group’s supplier of last resort to the final customers.

Following the approval of the Government Emergency Ordinance no. 1/2020 by which the contribution to ANRE is reduced from 2% to 0.2% of turnover, the specific tariffs for the electricity distribution service applicable starting with 16 January 2020.

According to the ANRE Orders, the specific tariffs for the electricity distribution service for the three concessionaire distribution operators of Electrica Group applicable starting with 16 January 2020, compared to those applicable starting with 1 January 2020, are the following:

Source: Societatea Energetica Electrica, Bucharest Stock Exchange