With the IPO of Hidroelectrica successfully done after a strong book building, a new question naturally arises: will Romania become an Emerging market? You can find this topic pretty easily, however, we saw no actual specifics around it. Therefore, in this blog, you can find exactly how did IPO of Hidroelectrica contribute to the Romanian market.

Probably the hottest topic in the regional equity market – Hidroelectrica. At the outset of this article, we will provide just a brief overview of this topic. However, even though everyone is currently talking about it, we found no specific implications of Hidroelectrica’s IPO impact on the Romanian stock market. Therefore, we decided to dive into the specific MSCI criteria and demystify how exactly will Hidroelectrica contribute to Romania’s improvement into the Emerging market (from its current Frontier status).

We emphasize that the sale of the aforementioned share of Hidroelectrica is one of the conditions of the Romanian recovery plan! After the listing, Hidroelectrica immediately became the largest company listed on the Bucharest Stock Exchange with a market cap of >EUR 10bn. Let us just briefly remind you that this kind of strategy for development has still not been developed and implemented in Croatia, while Slovenia implemented it recently. Back to the topic – Hidroelectrica is the 7th Romanian company included in the FTSE Global All-World Index, FTSE Global Large Cap Index, and FTSE Emerging Index. However, let’s dive into its impact on the Romanian equity market on a country level as the listing of the company is over.

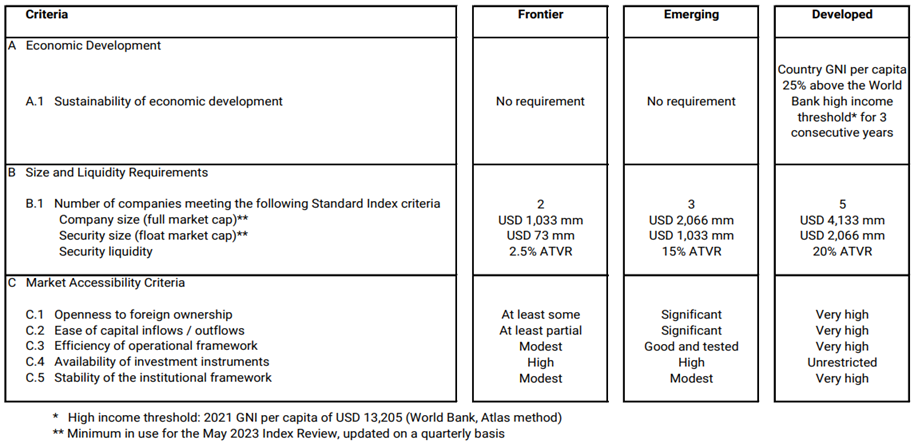

MSCI Market Classification Framework

Source: MSCI Global Market Accessibility Review

In the MSCI criteria above, one can notice that for MSCI to classify a company as „Emerging“, a country needs at least 3 companies that fulfill size & liquidity requirements. For companies to be considered „big enough“, it has to have a market capitalization of >USD 2,066m. However, looking at its free float market cap, it still needs to be >USD 1,033m. This somehow complicates the situation. Further, looking at liquidity criteria – those companies need their ATVR to be at least 15%. But what ATVR stands for? ATVR is Annual Traded Value Ratio, which is calculated as TTM equity turnover compared (read: divided) to its free float-adjusted market cap. Basically, ATVR reflects the proportion of the company’s free float market capitalization traded annually. However, we note that equity turnover does not include block trades so that turnover is potentially not under one-off effects. Now that this is out of the way, where does Romania stand?

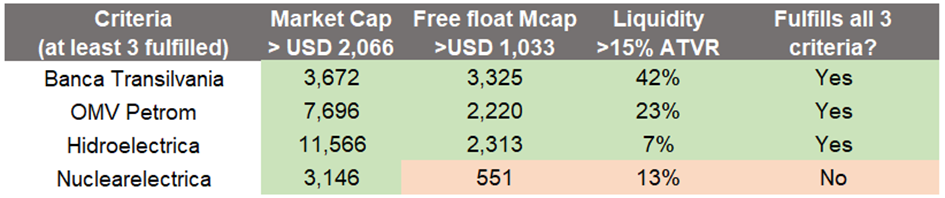

Source: Bloomberg, InterCapital Research

Upon analyzing the Romanian market with respect to MSCI’s criteria, it becomes evident that Hidroelectrica serves as the final catalyst for Romania’s improvement. Scanning through the first criteria, Romania already has „at least 3“ companies big enough. However, Nuclearelectrica does not fulfill the second screening: free float-adjusted market cap. And to be fair, it is far away from being considered „big enough“. Here, Hidroelectrica comes shining as that third company!

Also, looking at liquidity criteria, prior to H2O’s listing, Romania had „only“ two companies fulfilling MSCI criteria with Nuclearelectrica not being liquid enough. However, we emphasize that given ATVR in this calculation includes block trades due to simplification of the data derived from Bloomberg. In other words, real ATVR is slightly lower. However, we can see that both Banca Transilvania & OMV Petrom fulfill the criteria well enough, while Nuclearelectrica, again, fails to meet the criteria. Zooming our focus on Hidroelectrica, we can see it fairly above size criteria for both market cap and free float-adjusted one. Finally, H20 already stands at 7% of ATVR with only a few days of trading on the stock exchange. It is safe enough to say that the company with an IPO of this interest will definitely fulfill the criteria when 12 months of data will be available.

With this, we would like to conclude this brief analysis with a simple statement – Hidroelectrica actually is that final momentum and tipping point for Romania to be classified as „Emerging“ by MSCI. The third company is both big & liquid enough (yet to be confirmed, but safe enough to assume). From now on, MSCI could raise its status from a frontier market to an emerging one. The anticipated upgrade of Romania’s market status marks a pivotal turning point in the country’s financial landscape, resulting in well-deserved improvement in liquidity from new inflows. With this, the whole story of Romania should be wrapped up for now.