Croatia got a nod from S&P Global Ratings that everything is going OK with the credit rating. One more review is scheduled by Fitch on December 04th. How is rating news being absorbed by international fixed income markets? Find out in this brief research piece.

S&P Global Ratings affirmed i’s BBB-/A-3 long- and short-term credit rating for Croatia, stating that the Covid-19 related impact would be substantial, but transitory. There are several silver linings in the latest rating review, namely that the rating agency now expects a milder 8.0% YoY contraction in 2020, followed by a 5.6% YoY and 3.5% YoY recovery in 2021 and 2022, respectively. The cornerstone of this expectation upgrade is far better tourist season than previously expected – S&P cites visitor numbers reaching 50% of last year in July-August, which has a particularly strong weighting once we account for seasonality of Croatian tourism. Tourism is actually a bit of a wild card in the years ahead because on one hand, the whole economic sector might go through a permanent change in travelling and spending patterns; on the other hand, Croatia did perform better compared to regional touristic countries, partly because of the geographic proximity to principal emitting markets (which means that recovery in tourist demand might also be swifter compared to peers). The rating agency also praised government efforts in recent few years to reduce the macroeconomic imbalances, which allowed fiscal support to be expanded in order to weather out the storm. Once the economy is back on track to recovery, fiscal measures would be allowed to be rolled back and the fiscal parameters such as public deficit and debt would be back on a downward trajectory. S&P also praised efforts of Croatian government to put SOE spending in check and stop the expansion of public debt through the channels of state guarantees.

Rating agency reminded that after the Eurobond auction Croatian FX reserves have been restored to pre-Covid levels. This can be confirmed by taking a look at H8 table compiled by the central bank, indicating that indeed the official FX reserves reached 18.0bn EUR in July (compared to 18.6bn EUR in December 2020). These refurbished levels of FX reserves are coupled with 2.0bn EUR swap line with the ECB, which has been extended until June 30th, 2021.

The rating agency doesn’t expect much of CA deterioration in years ahead, stating that a fall in tourist revenues would be in larger part counterbalanced by lower imports. S&P hence expects -0.9% GDP to be repeated in 2021-24 and the EU funds would definitely cushion the deterioration of current account. Croatia would receive 10.0bn EUR from Next Generation EU (two third in grants), coupled with 12.0bn EUR in Multiannual Financial Framework.

Among other things the rating agency highlighted were political stability (i.e. strong mandate to HDZ in July parliamentary elections) and euro adoption in the next few years.

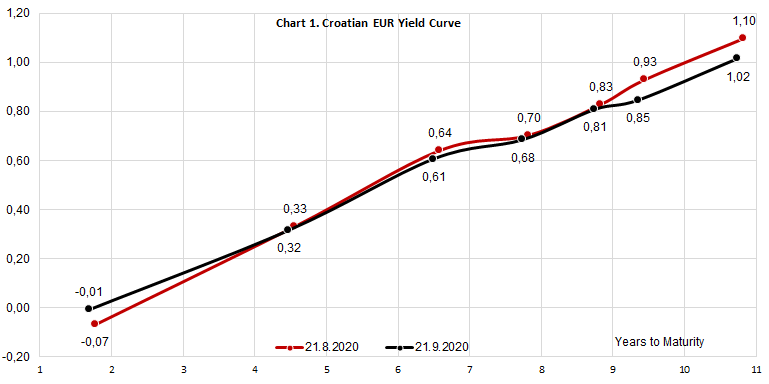

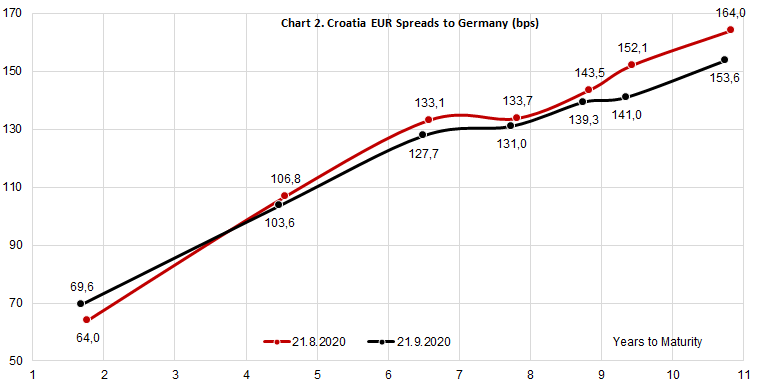

But what does it all mean for Croatian Eurobonds? Well, not much since everything the agency said was already discounted by the financial markets. However, it’s worth mentioning the declining risk premium in longer-dated Croatian EUR-denominated international bonds that took place since end-August. As Chart 1. would suggest, CROATI 2.75 01/27/2030 and CROATI 1.5 06/17/2031 both recorded lower yields, most of it coming from tighter spreads. Yield contraction for both amounted to some 8bps, which is significant once we translate it to clean price gains. This came on the back of 10bps-11bps of spread contraction and by looking at either of the curves (yield or spread) one can conclude that CROATI 1.125 06/19/2029 now looks a bit cheap compared to the rest of the curve. This is because this particular maturity is rather illiquid and it’s highly unlikely that a big source of selling pressure might suddenly pop up.

In the end, it’s worth remembering that this was the last S&P’s review of Croatian rating this year and no further reviews would happen before 2021. Fitch has scheduled one more Croatian rating review before the turn of the year (on December 04th, 2020). However, Romanian credit rating would be reviewed on October 30th (Fitch) and December 04th (S&P), so watch our for those dates.